SEC shuts down 2 more firms for running illegal Ponzi, loan scheme

The Securities and Exchange Commission (SEC) has revoked the corporate registrations of Procap International and Ray International Philippines Corp. for allegedly soliciting investments from the public without the required prior registration.

In a statement on Tuesday, the corporate watchdog said it had also slapped Procap with a P1-million penalty for running a Ponzi scheme whereby the earnings of other investors are being used to fund new investments.

The SEC found out that Procap was selling securities in the form of policy plans that promise investors 0.2 percent to 1.14 percent of guaranteed daily income. These were not registered with the SEC, making the investment contracts illegal.

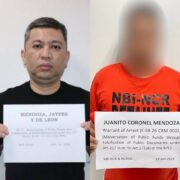

The regulator and other law enforcement agencies arrested 20 Procap representatives—including directors, incorporators and employees—in October last year during an entrapment operation in Makati City.

A cease-and-desist order (CDO) was issued against the company in February.

Meanwhile, the SEC noted that Ray International were operating under the name and styles of Ray Education Directions Consultancy Services, Be Unrivaled Productions and Sine Cordillera.

“The company was found to be offering programs for becoming a real estate agent, and a property saver or buyer-investor with a promise of guaranteed income of up to P61,000 for 24 months, depending on the investment,” the regulator explained.

“It also promotes becoming a passive investor as a partner-financier for an investment ranging from P300,000 to P10 million, with a total income of P108,000 up to P3.6 million in 12 months,” it added.

Prior to the cancellation of its corporate registration, the SEC issued a CDO against Ray International and other companies where its incorporation also holds controlling positions. These were Casa Infini Builders and Realty Co. Ltd., Casa Infini Realty Management Co., Ltd., and Casa Infini Properties and Development Corp.

Earlier this month, the regulator advised against transacting with MicPhil Lending Corp., an unregistered company operating a loan scam.

The entity, according to SEC, asks its borrowers to make a deposit in advance to prove their repayment capability. However, no loans are being disbursed afterwards.

The regulator said the victims may reach out to the Philippine National Police and the National Bureau of Investigation in filing complaints.