SPECIAL REPORT: ‘Sustained GDP growth in the next four years can reduce debt’

- (Second of three parts)

Senate President Francis Escudero shares the view of economic managers that pegging the ballooning national debt to the size of the economy is a better way of evaluating the country’s debt stock.

The goal of the economic team of President Ferdinand Marcos Jr. is to maintain and even lower the debt stock, which stands at around 60 percent of the gross domestic product (GDP), Escudero disclosed in an exclusive interview with the INQUIRER.

“According to the estimates of the economic team, they will be able to maintain it at this number and, in fact, before the end of the President’s term in 2028, it will be at 58 percent. Well, that’s according to their projections. Of course, their projections would be very positive of our economic growth, GDP growth, and their projections about debt increase is very conservative. We should expect that,” he said.

The Philippine Congress does not set a debt ceiling for government borrowing, unlike the United States Congress, which can limit the executive department’s borrowing autonomy.

“The ceiling is a moving target,” said Escudero. “Actually, the amount is not as relevant as it is a factor of a percentage of the GDP,” he stressed, explaining that the debt stock went up by P6 trillion during the time of President Rodrigo Duterte.

“It’s going up at the rate of P1.5 to P2 trillion per year during the first two years of President Marcos. So, if it continues at this rate, our debt will be equivalent to our GDP right now. That’s why we have to sustain the increase in GDP for the next four years in order to maintain the debt-to-GDP ratio at manageable levels. I think the international standard is 70-75 percent, (but) we’re at 60 percent.”

The government’s economic team is not concerned about the consequences of using more borrowing to fund government expenses because while the total debt today stands at P15.48 trillion, the size of the economy is P26.5 trillion.

“Is it sustainable? Yes, if—there’s a big if—if we will be able to sustain this rate of increase in our GDP at, at least, 6 percent, if not even higher,” said Escudero, explaining that because of a strong economy, the Marcos administration has the capacity to pay back its maturing debts as they fall due.

The Senate chief also pointed out that the debt levels of some Southeast Asian neighbors “are by far bigger than ours … So, we’re actually in good shape compared to our neighbors.”

Revenue gaps

The national debt, which stands at P15.48 trillion, is .2 percent lower than last year’s level—60.6 percent to 60.4 percent of the GDP. But in the first half of 2024, the debt to GDP ratio reached 60.9 percent (as of June 30).

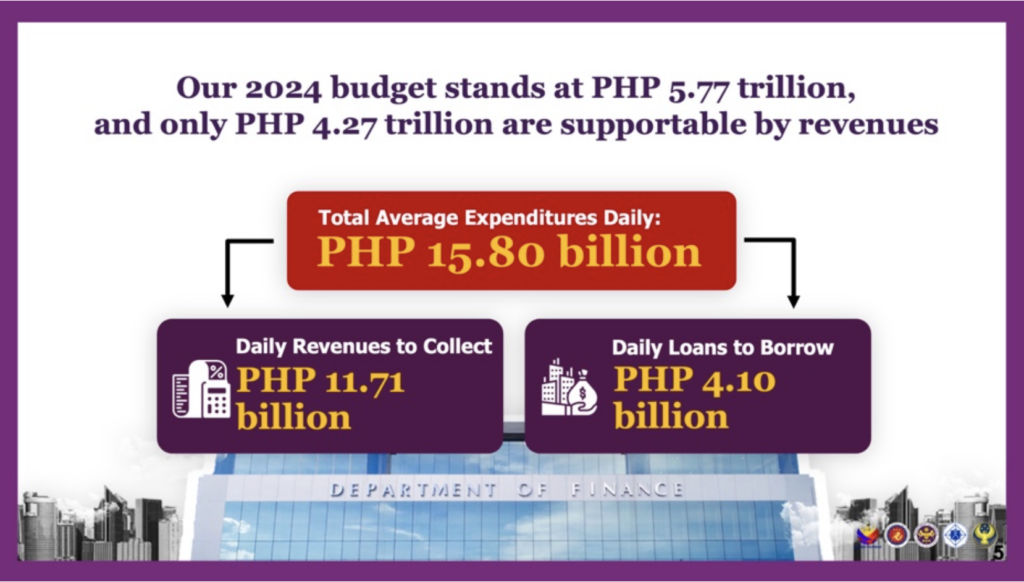

Finance Secretary Ralph Recto gave the Senate context of the growing national debt at the Development Budget Coordination Committee (DBCC) budget briefing two weeks ago. “To put it into perspective, our 2024 budget, as per the GAA (General Appropriations Act of 2024), stands at 5.77 trillion pesos, of which, only 4.27 trillion pesos are supported by revenues,” he said.

The government’s daily expenditures amount to P15.80 billion, of which P11.71 billion will be financed by revenue collections, and the rest, P4.10 billion, by loans, he said.

“So, against the Herculean task of funding a gargantuan budget, we needed to scout for more resources without inflicting new taxes on the present—considering the period of high inflation in the last two years—or bequeathing debts to be paid by future generations,” said Recto.

Since he assumed the finance portfolio last January 12, the former senator has made it a policy not to push for new taxes, which are unpopular with the public. But this puts Recto in a bind due to the revenue shortfall vis-à-vis the increased government spending needed to grow the economy.

To solve the conundrum, the Department of Finance (DOF) under Recto’s stewardship increased the dividend rates for Government-Owned and Controlled Corporations to 75 percent from 50 percent, becoming a significant source of non-tax revenue for the government.

The Bureau of Internal Revenue (BIR) and Bureau of Customs (BOC) have also stepped up with higher collection performance through digitalization, strict enforcement, and plugging leakages in the tax system, especially from e-commerce, Recto said.

The finance chief disclosed the following fiscal and expenditure figures as of mid-year:

- Total revenues grew by 15.6 percent to P2.15 trillion, of which tax collections from the BIR and BOC totaled P1.84 trillion pesos, 10 higher than last year.

- Non-tax revenues recorded a 63.3 percent growth, totaling P314.2 billion.

- Expenditures also grew by 14.6 percent to P2.76 trillion, equivalent to 21.9 percent of GDP.

“This robust revenue performance placed us among Asia’s top revenue-to-GDP ratios at 17.1 percent for the first half of the year. And this is above our full-year target of 16.1 percent,” Recto said.

Fiscal deficit vs. projections

But the fiscal deficit for the first half of 2024 stood at P613.90 billion. “As a percentage of GDP, our deficit remains very manageable at 4.9 percent in the first semester, below the 5.6 percent full-year target. Over the medium term, we anticipate a 10.3 percent average annual growth in total revenues to support our people’s growing needs,” he disclosed.

But he predicted a slight increase in revenues, as a percentage of GDP, from 2024 to the end of Mr. Marcos’ term: 16.1 percent in 2024 to 17.0 percent in 2028. For this to happen, tax collections should rise by 11.8 percent annually, driven by projected double-digit collection growths of the BIR and BOC. “This will outpace the roughly 8.7 percent average increase of our nominal GDP every year from 2024 to 2028,” he said.

By 2028, the tax effort should rise to 16.3 percent from 14.4 percent in 2024. If that happens, the fiscal deficit can drop from 5.6 percent in 2024 to 3.7 percent by 2028. “Spending, of course, will continue to prioritize education, infrastructure, food security, social protection, and national security to support our growth momentum,” Recto said.

Redomination of debt to peso

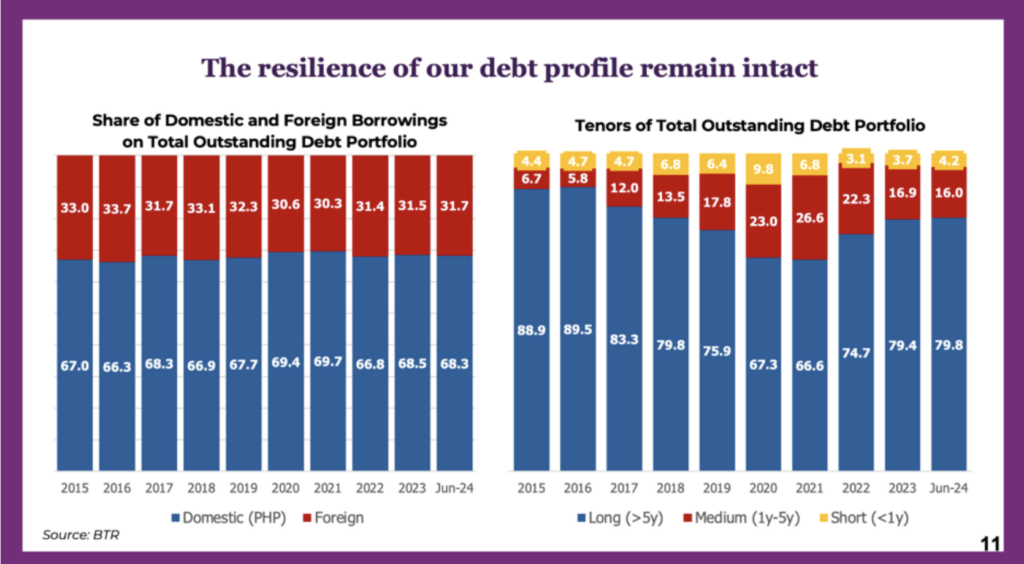

To manage debt, the government has prioritized domestic financing, which has facilitated the continued redenomination of the debt into local currency, now representing 68.3 percent of the country’s total borrowings.

“We also strategically favor long-term obligations to reduce our reliance on short-term debt and minimize rollover risks. Currently, long-term debts constitute 79.8 percent of our total portfolio,” Recto said, and added: “But while interest rates have gone up, the cost of our borrowings remains manageable and much lower than our GDP growth. In fact, our effective interest rate for next year is only 5.3 percent, which is very cheap considering that the average term of our debt is 7.5 years.”

For Escudero, managing debt responsibly does not only mean efficiently collecting taxes, selling government assets, and lowering expenses to reduce debt, but to “make sure that every peso spent by the government contributes to the expansion of our GDP because while the debt balloons, for as long as the GDP growth is larger, we can maintain the debt level at 60 percent every year.”

Thus, the government should continue to invest in both capital resources (roads, bridges and airports) and human capital (education). “So, we’re headed in the right direction, investing in both our capital and in infrastructure which are the two drivers of our GDP,” said Escudero.

Lowering taxes on fuel, electricity

But the Philippine economy is always at risk of experiencing GDP contraction or negative growth due to global economic shocks, such as the COVID-19 pandemic, wars, and the risk of a U.S. recession.

If such a scenario arises, the government has no other recourse but to reduce its expenses. “We need to lessen our borrowing because once we’ve breached that 70-75 percent debt-to-GDP ratio, interest rates will be higher, it would be difficult to look for money, and we will be hard pressed to fund needed expenditures,” he said.

Since the amount of the proposed budget cannot be reduced by Congress, Escudero is considering the wisdom of reducing taxes if it can help grow the economy, such as lowering excise taxes on fuel and taxes on electricity.

“What is the of effect of lowering taxes on fuel use for electricity vis-à-vis GDP growth?” he asked, pointing out that the country’s electricity prices are among the highest in Southeast Asia, which is a major issue for foreign investors.

He has already asked the National Economic Development Authority to study if lowering these taxes could lead to cheaper oil prices and electricity rates, and ultimately boost the GDP.

“This puts money in the pockets of our people and believe me, they know better how to spend their money than the government.” If money is spent locally, it will circulate in the local economy and generate new jobs and businesses, resulting in a higher GDP, he said.

(To be concluded)

Take a look at the first part of this special report here.

SPECIAL REPORT: Can the Philippine economy outgrow debt by 2028?