Top 5 ways to save for your first home

For many Filipinos, owning a home is a major life goal—a symbol of security, stability, and success.

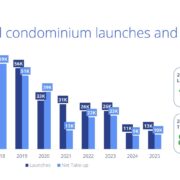

However, purchasing your first home can seem overwhelming due to rising property prices and the financial commitment involved.

But with proper planning, discipline, and focus, homeownership is attainable. Whether you’re eyeing a property in Metro Manila or in the provinces, saving up for your first home requires a combination of budgeting, financial discipline, and long-term planning.

Here are five key ways to save for your first home and make your dream a reality.

Set clear savings goals and create a budget

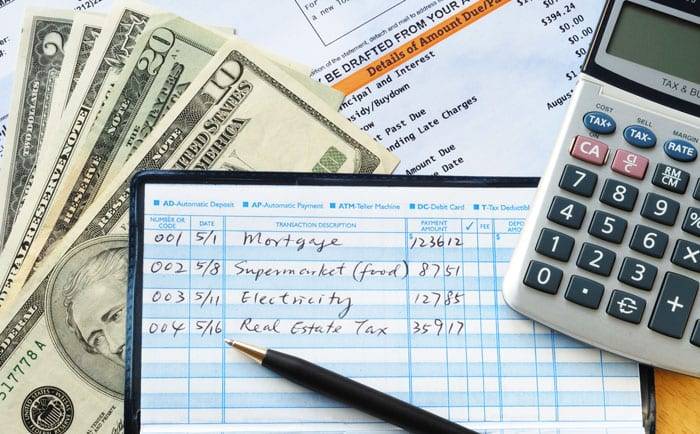

The first step is to set a clear and realistic savings goal. This means determining how much you need for the down payment and other costs, such as taxes, insurance, and moving expenses.

In the Philippines, most banks require a down payment of around 10 percent to 20 percent of the property’s value. If you’re planning to buy a house worth P3 million, you’ll need at least P300,000 to P600,000 for the down payment. You also need to consider other costs such as closing fees, transfer taxes, and mortgage insurance, which can add another 5 to 7 percent to the purchase price.

In setting your goal, determine the type of home you want and research property prices in your desired area, then calculate the required down payment and closing costs.

Establish a savings timeline. If you want to buy your home in five years, divide the total amount by the number of months to understand how much you need to save monthly.

Once you have a goal, create a budget that allows you to allocate a portion of your income toward savings. Track your expenses and identify areas where you can cut back. Prioritize home savings, ensuring it becomes a non-negotiable monthly commitment.

Open a separate home savings account

To avoid mixing your home savings with your day-to-day expenses, it’s essential to open a separate bank account for your home fund. This will help you keep track of your progress and resist the temptation to dip into your savings for other purposes.

You can set up an automatic transfer from your salary account to your home savings every month. Some banks offer high-interest savings accounts or time deposit accounts that provide higher rates. These will allow you to grow your savings faster while keeping your money safe.

Cut unnecessary expenses and adjust your lifestyle

Saving for a home requires sacrifices, especially when it comes to your lifestyle. Many of these sacrifices, however, are temporary and can significantly speed up your path to homeownership.

Start by identifying areas where you can reduce your spending such as dining out, entertainment subscriptions, and impulsive shopping. Instead, opt for budget-friendly activities such as home-cooked meals, movie nights at home, and thrift shopping.

Consider using public transport or going for carpool to reduce fuel and maintenance costs. Walking or biking to nearby destinations can save you money while keeping you healthy.

Be mindful also of your energy consumption at home by unplugging appliances when not in use, using energy-efficient lighting, and reducing water usage. Consider adopting a more frugal lifestyle, at least temporarily, to accelerate your savings. You can opt for budget-conscious vacations.

Remember, these changes are investments in your future home.

Increase your income

Increasing your income can provide a significant boost to your savings.

If you have skills in writing, graphic design, web development, or other in-demand fields, consider taking on freelance gigs to earn extra money. Start a small business or engage in side hustles like selling products online, offering tutoring services, among others. With platforms like Lazada, Shopee, and social media, starting a side business has never been easier.

Take advantage of Pag-IBIG and affordable housing loans

Filipinos are fortunate to have access to the Pag-IBIG Fund, which offers affordable housing loans to its members. Pag-IBIG provides competitive interest rates and longer loan terms compared to traditional banks, making it easier for first-time homebuyers to finance their dream homes.

To maximize your savings, consider the Pag-IBIG Regular Savings. As a member, you can make voluntary top-ups to your regular contributions. This will not only increase your future loanable amount but also boost your savings through dividends.

Pag-IBIG housing loans offer competitive interest rates and longer repayment terms of up to 30 years. If you’re eligible, you can borrow up to P6 million to finance your home purchase. The loan terms are flexible, and monthly amortizations can be adjusted based on your capacity to pay.

Eye on the goal

Saving for your first home may seem like a daunting task, but it is entirely possible with the right strategies. The journey may require discipline, sacrifices, and a shift in your spending habits, but the reward—a home to call your own—is well worth the effort.

Keep your eye on the goal, and with consistent saving, your dream of owning your first home will become a reality.