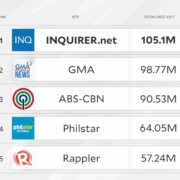

Soon, Filipino investors can trade foreign stocks through PSE

Stocks of foreign companies listed on overseas exchanges may soon be traded locally as the Philippine Stock Exchange Inc. (PSE) prepares for the launch of Global Philippine Depositary Receipts (GPDRs), which are expected to allow investors in the Philippines to diversify their portfolios and increase exposure to the global market.

In a memorandum posted on its website last week, the bourse sought the public’s comments on its proposed rules for GPDRs.

GPDRs are peso-denominated instruments issued by a depositary bank. These represent an investor’s ownership in a foreign company’s shares listed on an overseas exchange. When GPDRs are traded, market participants essentially buy and sell the rights to own the foreign shares.

Juan Paolo Colet, managing director at investment bank China Bank Capital Corp., explained GPDRs were “an indirect way for local investors to buy or sell stocks and other securities listed in foreign markets.”

“It also helps investors diversify their investment portfolios by having exposure to foreign companies so they are not entirely dependent on domestic economic conditions,” Colet said in a message to the Inquirer.

A holder of a GPDR, however, does not have voting rights in the foreign company.

Under the proposed guidelines, a GPDR will be “freely tradable” in the PSE on a sponsored or unsponsored basis.

A GPDR is sponsored when a foreign company enters into an agreement with a Philippine-based GPDR issuer to sell these instruments. Transactions without formal agreements with the overseas firm qualify as unsponsored.

GPDR requirements

Before these can be listed on the PSE, there must be at least 50 holders of the same kind of GPDRs, with a total minimum subscription amount of P30 million.

An issuer of a GPDR also needs to hire a Philippine-based custodian of the securities.

To qualify as a GPDR issuer, a company needs to have a minimum paid-up capital of P100 million.

Apart from a chosen custodian, issuers also need to have a securities broker and a transfer agent.

The PSE also noted that securities listed on the local stock market may be traded in overseas exchanges through depositary receipts, albeit subject to the rules of the exchanges.

While this is good news for local investors, Colet pointed out that for GDPRs to fully “take off,” the PSE “must ensure it is easy to structure, offer and trade this product in the local market.”

“They (PSE) also need to clarify the taxation of such instrument,” he said.