RCBC expands offshore borrowing program to $4B

Rizal Commercial Banking Corp. (RCBC) is set to tap the offshore bond market to raise $4 billion as investors slowly favor fixed-income securities amid falling interest rates.

The Yuchengco-led bank on Tuesday said its board of directors had approved to increase the size of its medium-term note program (MTN) from $3 billion originally.

Japan-based SMBC Nikko will be appointed the program arranger to issue the foreign currency-denominated senior notes.

RCBC has yet to disclose the details of the bond issuance, including the maturity date and yield.

Generally, an MTN program allows companies to raise capital over a period of up to 10 years. This also lets companies tailor the issuance to their specific funding needs.

This comes after the Bangko Sentral ng Pilipinas slashed the benchmark interest rate of big banks by a total of 50 basis points to 6 percent. Interest rate cuts usually make bonds attractive to investors, as these signal better economic conditions, thus boosting confidence. Prices of previously issued bonds also appreciate as investors lock in better yield.

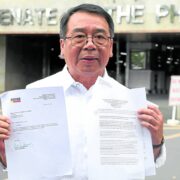

Earlier, RCBC president and CEO Eugene Acevedo said they expected earnings to finally climb this year after four consecutive quarters of drops, due mainly to monetary policy easing.

As interest rate cuts result in lower borrowing costs, RCBC is projecting an expansion of its loan portfolio.

Acevedo explained that they were focusing their resources on growing the consumer loan and credit card segments, seeing that these core businesses were registering “very strong growth.”

In the first half of the year, the country’s fifth largest private bank saw consumer loans surge by 38 percent on higher auto and housing loans. This caused the 29-percent uptick in net interest income to P19.75 billion.

However, this growth failed to pull up the bank’s bottom line, which fell by 28.5 percent to P4.45 billion.

RCBC previously announced plans to boost its loan portfolio by 27 percent to P160 billion by the end of the year.

At the same time, RCBC announced plans to expand its Telemoney remittance service to other countries in the Asia Pacific, Europe and North America.

Demand for remittance services in these continents was steadily expanding due to an increasing number of overseas Filipino workers, according to RCBC head of transaction banking Martin Tirol.

“As RCBC enters these new markets, the competitive landscape has shifted with the entrance of fintech companies and traditional banks,” Tirol said.