The impact of valuation on REIT performance

Real estate investment trusts (REITs) have transformed the property sector by providing investors with a unique opportunity to benefit from its growth. By pooling capital from a broad base of investors, REITs create large scale investment vehicles that own, manage, and develop income-generating properties.

Access to diversified portfolio

First established in the United States in 1960, REITs were designed to give investors access to diversified portfolios of income-producing real estate. Their success in the US paved the way for global adoption, with countries like Canada, the United Kingdom, Japan, and Singapore integrating this model into their markets.

The REIT concept has also taken root in the Philippines, emerging as a game-changer in the local real estate landscape. Gaining momentum in the early 2000s amid rapid urban development, REITs gained a formal legal framework with the passage of the REIT Act in 2009.

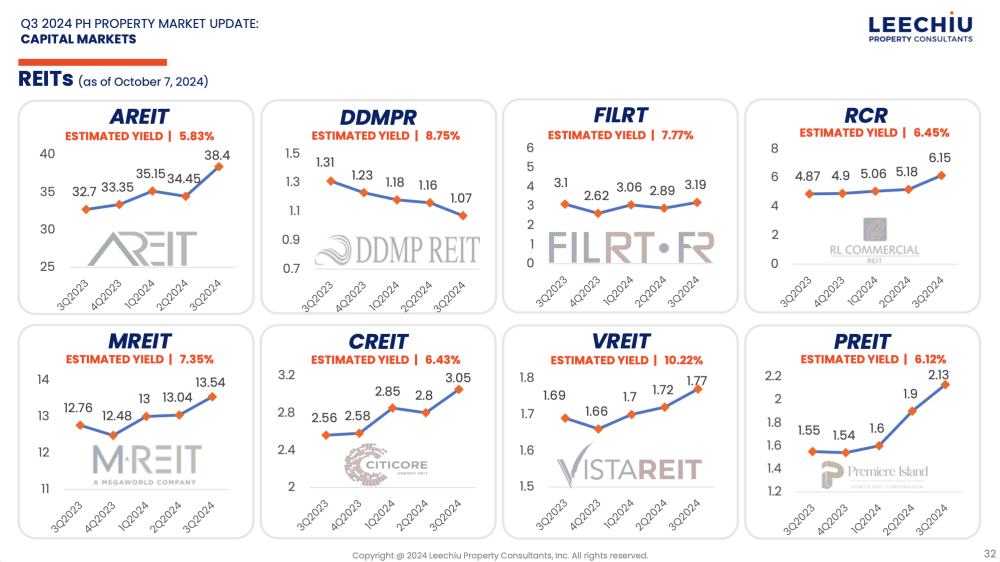

A significant milestone was achieved in 2020 when Ayala REIT Inc. launched as the first REIT to be listed on the Philippine Stock Exchange (PSE). Its success attracted other key players, such as DoubleDragon Properties and MREIT Inc.

In the Philippines, REITs have introduced a transparent and liquid avenue for both local and foreign investors to engage in the real estate market. Their presence has also driven the expansion of commercial, residential, and industrial properties.

Central to this progress is the critical role of real estate valuation, which underpins the performance and long term sustainability of REITs. Accurate valuations are essential, ensuring informed decisions, investor confidence, and compliance with regulatory standards, as REITs continue to shape the dynamic Philippine real estate market.

Real estate valuation

Real estate valuation is a cornerstone for REITs, shaping financial reporting, investment strategies, and market dynamics.

Ensuring accurate financial reporting. Transparency and accuracy in financial reporting are paramount for publicly listed REITs. Accurate property valuations directly impact financial statements, net asset values (NAV), and investor confidence. Overvaluation or undervaluation can mislead stakeholders, distort stock prices, and lead to regulatory penalties.

Guiding investment decisions. Proper valuations help REIT managers optimize investment decisions when acquiring, selling, or holding properties. This ensures portfolios are strategically structured, maximizing returns while avoiding risks like overpaying or undervaluing assets.

Measuring performance and managing risks. Property valuations provide a clear picture of a REIT’s financial health. Analyzing trends in asset values enables REITs to assess investment success and identify potential risks or opportunities, adapting to fluctuations in market or economic conditions.

Building investor confidence and market liquidity. Accurate valuations underpin investor trust, crucial for the liquidity and stability of REIT stocks. Transparent valuation practices strengthen relationships with stakeholders, attract new investments, and stabilize stock prices, ensuring long-term growth.

Adapting to market dynamics. As the Philippine real estate market evolves—driven by urbanization, infrastructure projects, and shifting consumer preferences—valuations help REITs stay agile. Whether repositioning assets or redeveloping properties, reliable data empowers REITs to seize opportunities and mitigate risks.

Ensuring regulatory compliance. REITs must adhere to regulatory standards set by the Securities and Exchange Commission (SEC), including periodic property valuations by independent appraisers. Non-compliance can lead to legal repercussions and damage to reputation. Accurate valuations safeguard adherence to both local and international standards.

Safeguarding investor interests

To ensure the integrity of the REIT market and safeguard investor interests, it is crucial that property valuations are conducted by independent and qualified appraisers. These valuations play a critical role in financial reporting, investment decision-making, risk management, and regulatory compliance.

By adhering to rigorous valuation standards and best practices, REITs can maintain transparency, accountability, and market confidence.

Reputable valuation firms are equipped to provide high quality, accurate property valuations. A valuation company must be accredited with the Securities and Exchange Commission (SEC), PSE, and the Bangko Sentral ng Pilipinas (BSP), with PRC licensed real estate appraisers to meet the minimum requirement.

Leechiu Property Consultants is among the few firms who have these qualifications.

The author is the senior manager for Property Valuation at Leechiu Property Consultants Inc., the country’s premier real estate advisory firm.