Consunjis cue cement-core biz combo

The Consunji Group has come a step closer toward the integration of the country’s fourth-largest cement maker with the conglomerate’s engineering and construction businesses, having completed its $272-million takeover of Cemex Holdings Philippines Inc. (CHP).

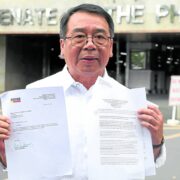

In a stock exchange filing on Tuesday, DMCI Holdings Inc. said its chair, Isidro Consunji, was appointed chair of CHP. Also, as a result of the deal, DMCI chief finance officer Herbert Consunji was elected president and CEO of the cement manufacturer.

DMCI and its subsidiaries, Semirara Mining and Power Corp. and Dacon Corp., on Monday finalized their acquisition of Cemex Asian South East Corp., which holds an 89.86-percent stake in CHP.

DMCI now has a 51 percent interest in CHP, while Semirara and Dacon account for 10 percent and 29 percent, respectively.

Core business

“This acquisition aligns with our core expertise in engineering and construction and dedication to contributing to the infrastructure development of the Philippines,” Isidro Consunji said in a statement.

Last month, Dacon, the unlisted affiliate of the Consunji Group, completed its tender offer to buy P18.29 million worth of shares in CHP.

The public now owns 1.35 billion shares in CHP, representing a 10.01 percent ownership, or just above the bourse’s 10 percent minimum requirement. This allows CHP to remain listed on the Philippine Stock Exchange.

CHP’s current annual production capacity stands at 5.7 million tons, although this is expected to grow to 7.2 million tons by early next year upon the completion of the expansion plant of Solid Cement Corp.

Turnaround

The company is still grappling with a challenging environment for cement makers in the country, with its net loss in the first nine months of the year ballooning by 131 percent to P2.87 billion.

DMCI hopes to turn this around by 2025 with the help of the Solid Cement manufacturing plant and the integration of the group’s businesses with CHP.

“Our priorities are to enhance the logistics network, optimize the product mix, manage production and operating costs, and leverage on potential operating synergies within the DMCI ecosystem,” Herbert Consunji said.

In July, CHP subsidiary APO Cement Corp. signed a retail supply agreement with Semirara’s SEM Calaca RES Corp., which will provide 44 megawatts of electricity to two cement facilities located in Naga, Cebu.

Meanwhile, DMCI and its property development arm, DMCI Homes, eye sourcing around 400,000 metric tons of cement from CHP.