PSEi plunges into bear territory

The local bourse crashed into bear territory on Friday as disappointing macroeconomic data and a major index rebalancing rocked investors still looking for a catalyst to jolt life into the market.

By the end of the session, the benchmark Philippine Stock Exchange Index (PSEi) plunged by 4.01 percent, or a whopping 245.07 points, to 5,862.59, its lowest closing value in 27 months.

Likewise, the broader All Shares Index shed 2.19 percent, or 79 points, to 3,520.32.

A total of 1.76 billion shares worth P21.61 billion changed hands as foreigners made net purchases worth P594.22 million, stock exchange data showed.

The PSEi is now officially in bear territory, as it has declined by 22.4 percent from its recent high of 7,554 in October.

The market’s crash was due to a number of macroeconomic factors, highlighting “the impact of our slowing economy,” according to Jonathan Ravelas, senior adviser at Reyes Tacandong & Co.

“We were affected by sticky inflation, the impact of the storms and there appears to be no clear positive support for growth in 2025, except for the infrastructure spending of the government,” Ravelas said in a phone interview.

Below target

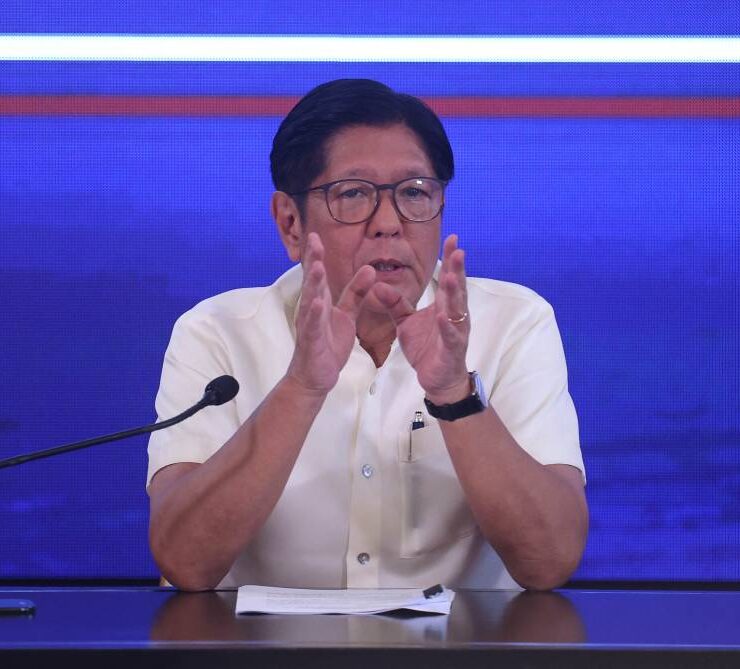

The country’s gross domestic product (GDP) grew at an average of 5.6 percent in 2024. While this is slightly faster than the 5.5-percent growth in 2023, it is still below the Marcos administration’s target of 6 to 6.5 percent.

“The GDP numbers confirm that the consumer sector has not yet recovered from sticky inflation,” Ravelas said.

Meanwhile, AP Securities Inc. research head Alfred Benjamin Garcia pointed out that the PSEi’s fall was “an extraordinary circumstance” because it was also partly due to the index rebalancing effective on Saturday, Feb. 1.

The Philippine Stock Exchange Inc. recently announced the entry of China Banking Corp. (Chinabank) and AREIT Inc. into the 30-member PSEi, booting out Nickel Asia Corp. (NAC) and Wilcon Depot Inc.

Garcia explained that Chinabank and AREIT’s combined free-float weighted market capitalization of P157.8 billion was way bigger than NAC and Wilcon’s P30.2 billion.

As a result, “all index names had to be down weighted to make room for the inclusion of AREIT and [Chinabank].”

While the PSEi is at its lowest level in more than two years, Garcia noted that the impact of the index rebalancing should taper down soon, “so I’m optimistic that we should bounce back next week.”

At the same time, Ravelas said now was a good opportunity to accumulate specific stocks.

“This is like a three-day sale in SM [malls] to buy dividend-yielding [stocks] and REITs,” he added, referring to real estate investment trusts such as AREIT.

Both types of stocks promise dividends and higher yields to traders, making them attractive investments, especially when the market is down.

Chinabank, considered dividend-yielding, was the most actively traded stock as it soared by 38.91 percent to P93 each.