Gov’t raises P30B from T-bond offer

The Marcos administration was able to borrow more than initially planned during Tuesday’s sale of Treasury bonds (T-bonds) as local rates tracked a decline in US Treasury yields.

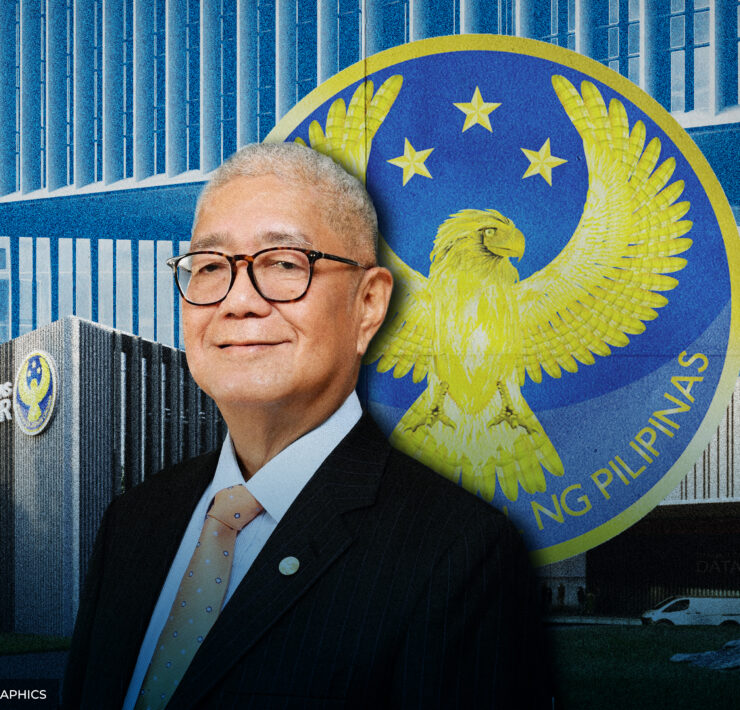

Auction results showed that the Bureau of the Treasury (BTr) had raised its target amount of P30 billion via reissued T-bonds, which have a remaining life of seven years and seven months.

The offering attracted P67.6 billion in total tenders, exceeding the original size of the issuance by 2.3 times. That prompted the BTr to open its tap facility window to accept an additional P5 billion in excess demand.

Lower yields sought by local creditors also gave the government room to accept the bids. According to the BTr, the seven-year T-bonds fetched an average rate of 5.973 percent, much cheaper than the 6.249 percent seen during the previous auction of the same tenor last Jan. 14.

The rate was also lower than the 5.994 percent quoted for the comparable tenor in the secondary market yesterday.

Michael Ricafort, chief economist at Rizal Commercial Banking Corp., said domestic rates followed the movement of bond yields in the US.

“The Treasury bond average auction yield is slightly lower after the comparable seven-year U.S. Treasury yield eased to one-month lows recently after the Trump administration signaled that it would prioritize policies that would help reduce the benchmark 10-year US Treasury yield instead of questioning Fed (US Federal Reserve) rate decisions,” Ricafort said.

For this year, the Marcos administration is targeting to borrow P2.55 trillion from creditors at home and abroad to plug a projected budget hole amounting to P1.54 trillion, or equivalent to 5.3 percent of the country’s gross domestic product.