BSP to regulate digital financial shops

The Bangko Sentral ng Pilipinas (BSP) wants banks and electronic money (e-money) issuers to follow a set of regulations when creating a one-stop digital marketplace for financial products and services, in a bid to ensure consumer protection and risk management.

The BSP is collecting feedback from stakeholders on a draft circular that would set the guidelines on the adoption of a digital marketplace model. The central bank will wait for the comments until March 7.

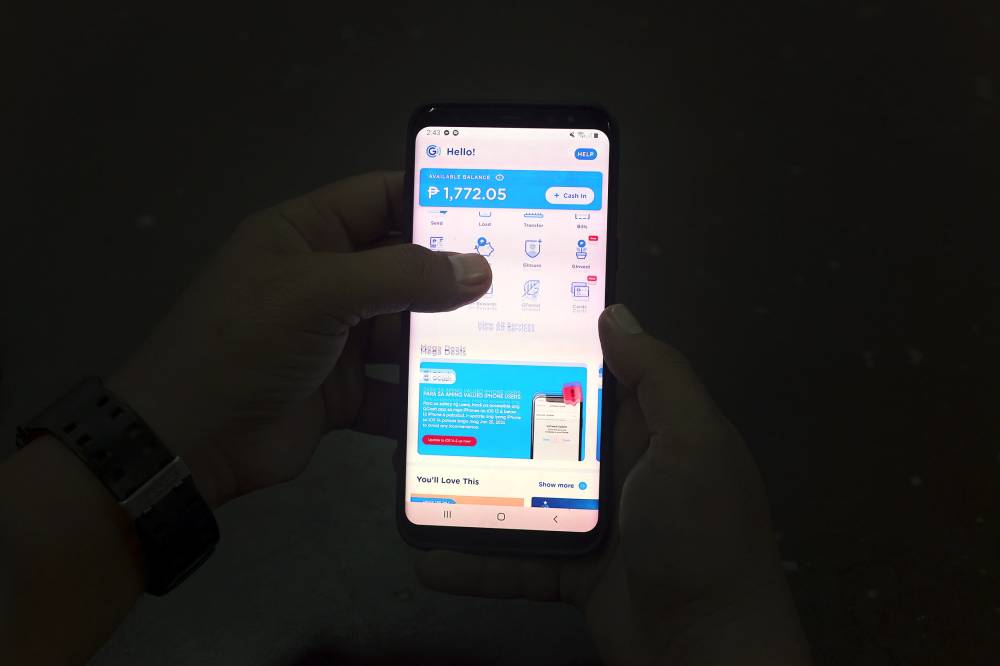

A digital marketplace model allows banks and other financial institutions to collaborate and build a single virtual platform where consumers can browse and compare financial products—an online marketplace for offerings, loans, deposit accounts and insurance, among others.

The BSP said such an “ecosystem partnership” would promote competition among banks and e-money issuers, while providing customers with a broad selection of financial products and services.

But the regulator stressed that “sound governance, risk management and consumer protection systems” would underpin the adoption of the digital marketplace model.

This includes an “effective, consent-driven” information-sharing arrangement to ensure that attendant risks are adequately managed and consumer interests are protected.”

That said, the draft circular provided that banks and e-money issuers may become an operator of a digital marketplace subject to the approval of the regulator, which will collect processing and licensing fees.

Those interested to become a marketplace operator must have a combined capital of at least P1 billion, as well as an “adequate and reliable” IT infrastructure and solutions that can fully support its digital marketplace operations. An operator must also have no major supervisory concerns or recurring issues in terms of compliance with regulations.

The marketplace operator may perform ancillary functions to enhance user experience, operations and risk assessment. This may include preliminary screening or underwriting, pre-assessment of borrowers’ creditworthiness, customer identification or verification and client suitability assessment, among others.

At the same time, the draft rules prohibit products and services that are associated with gambling or any activities that could “undermine the reputation” of sellers from being offered in the marketplace.