BIZ BUZZ: CIMB expands

With the volume of digital payments in the Philippines “skyrocketing”—as Fitch Solutions subsidiary BMI Country Risk & Industry Research describes it, noting a 27-percent growth rate based on data from 2022 to 2023—many companies that have not yet forayed into this market are moving in.

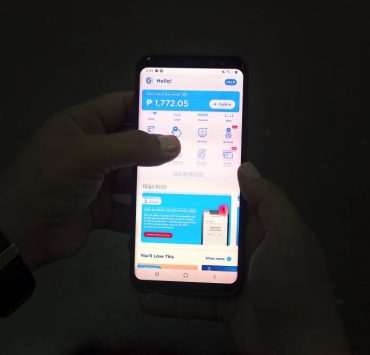

One such player is CIMB Bank Philippines, which has just launched its own digital payments system through its mobile app. This is somewhat an inward looking move for a fintech firm that has amassed 9 million customers since it launched in 2018 through a strategy of “embedded banking.”

CEO Vijay Manoharan explains this as “bringing the bank to the customer instead of the customer going to the bank.” In practice, this means being present where consumers are making their transactions.

“We like to think of ourselves as a platform bank. Our products and services are available to our customers at different platforms, for ease of access and convenience,” he says.

Thus, for example, CIMB Bank Philippines had powered retail platform Shopee’s “buy now pay later” operations by directly financing buyers’ purchases.

More recently, the digital bank has partnered with another e-commerce giant, providing the engine for Lazada’s own BNPL offering.

Also, CIMB Bank Philippines has been engaging savers through Lazada’s LazSave feature, a savings account within the e-retail platform.

The digital bank has also been offering not only savings accounts, but credit lines through e-wallet platform GCash.

Now, it has launched its own CIMB Pay, through which users can transfer funds, pay merchants and pay bills using QR PH codes.

By supporting the government’s drive for cashless transactions, CIMB Bank Philippines has set a goal of signing up 500,000 users over the next 18 months.

Meanwhile, with customer acquisition averaging at more than a million each year, Manoharan says they are looking at reaching the 10-million milestone by the end of this year.

No surprise then, that CIMB Bank Philippines ranked best among local players in The Asian Bankers’ 2025 list of “World’s Top 100 Digital Banks.”

The subsidiary of Malaysia-based CIMB Group placed 41st, ahead of only two out of four competitors—UnionDigital Bank (47th) and MayaBank (65th), both of which launched in 2022.

“We have not only changed the way how banking is delivered in the Philippines, we have also opened doors for other banks to follow our business model and bring digitization of financial services to all Filipinos, following the lead of CIMB in the Philippines,” Manoharan says.