Oversupply: A prime opportunity for smart buyers, investors

The Philippine real estate sector continues to offer significant opportunities for both end-users and investors. For those with a long-term vision, this period offers a unique chance to enter the market under favorable conditions.

Market cleansing

It should be noted though that the current oversupply should not be viewed as a crisis but as a natural phase in a maturing industry. It serves as a market filter, weeding out speculative and short-term players while allowing serious, long-term developers to thrive. This period of market correction benefits institutional developers who maintain strong fundamentals and long-term planning.

While some areas in Metro Manila are indeed experiencing excess inventory, other locations remain resilient. Key central business districts (CBDs) such as Bonifacio Global City (BGC), Makati, Ortigas, and Iloilo Business Park, for example, remain prime locations for investment and homeownership.

Stabilizing through fundamental demand

Despite the exit of Philippine offshore gaming operators, the real estate market is stabilizing, with less speculation and more genuine demand from local buyers.

The luxury and affordable housing segments remain largely unscathed, underscoring the resilience of the market. The shift toward local end-user purchases signifies a healthier and more sustainable real estate environment.

Lessons from global markets

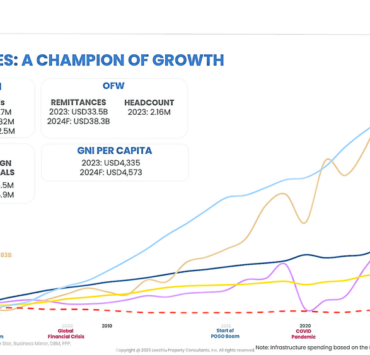

The pattern of investing early in an oversupply market is not new.

In cities like Dubai, periods of high inventory have historically been the best times for savvy investors and homebuyers to enter the market. During Dubai’s oversupply phase in the early 2010s, properties were available at lower prices, attracting long-term investors who benefited from price rebounds and rental income as the market stabilized.

Similarly, Dubai’s postpandemic recovery was driven by a surge in demand from end-users and international investors who capitalized on attractive valuations.

This is also happening in other mature markets like Singapore and Hong Kong, where cycles of high supply have historically been followed by price appreciation as the market stabilizes.

A similar trend is evident in Metro Manila today. With the right approach, buyers can leverage their hard-earned savings to secure properties at competitive prices, positioning themselves for future capital appreciation.

Why now is a strategic time to invest

For end-users still renting, the current market presents a golden opportunity to transition into homeownership.

Millions of Filipinos are still renting, longing for a place they can call their own. With competitive pricing in select areas, flexible payment terms, and a shift toward long-term occupancy, now is an ideal time to invest in a home.

Despite concerns over inventory levels, the market still faces a fundamental housing gap. With the return-to-office trend gaining momentum, demand for properties near business districts is rising again.

For buyers and investors with long-term vision, an oversupply market provides several advantages. These include better pricing and flexible payment terms from developers seeking to move inventory; wider selection of RFOs and pre-selling units in prime locations; higher negotiating power for end-users and investors purchasing in bulk; and future capital appreciation, as supply and demand naturally rebalance over time.

The road ahead

The Philippine real estate market is undergoing a necessary transformation—one that prioritizes long-term stability over short-term speculation.

As the market continues to normalize, well-informed buyers and investors who take advantage of this window of opportunity will be the ones to reap the benefits in the years to come.

Instead of viewing the oversupply as a cause for alarm, it should be seen as an invitation for strategic decision-making. For those ready to invest wisely, this is not a downturn–it’s an opportunity.