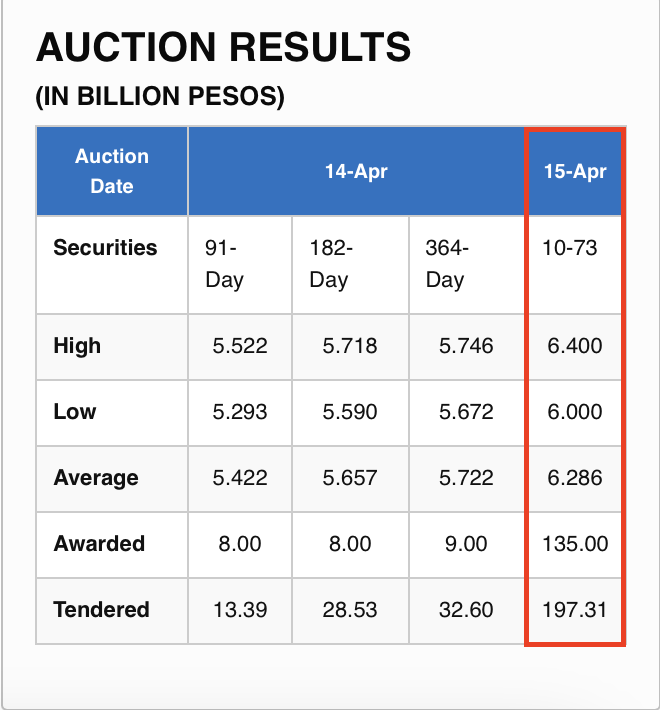

Gov’t raises P135B from 10-yr bond sale as rate rises

The Marcos administration was able to borrow 4.5 times more than it had planned on Monday’s sale of new 10-year Treasury bonds (T-bonds), even as local creditors asked for higher rates.

Auction results showed that the Bureau of the Treasury (BTr) raised P135 billion via the issuance of new T-bonds maturing in 2035, much larger than the original plan to borrow P30 billion from domestic investors.

The offering was met with strong demand. The BTr said the long-dated debt paper attracted P197.3 billion in total bids, exceeding the initial size of the issuance by 6.6 times.

However, the robust market appetite could not prevent creditors from asking for a higher yield.

The 10-year debt note fetched an average rate of 6.286 percent, a bit higher than the 6.271 percent quoted for the same tenor in the secondary market as of April 14.

Michael Ricafort, chief economist at Rizal Commercial Banking Corp., said yields went up in response to uncertainties over the tariff actions in the US.

“The 10-year T-bond average auction yield was slightly higher amid uncertainties on President Donald Trump’s higher US import tariffs, and trade war especially with China,” Ricafort said.

The new 10-year T-bonds will remain available to the investing public through qualified dealers from April 15 to 24, unless terminated by the BTr.

The debt securities are available for a minimum investment of P10 million and increments of P1 million thereafter.

The extended offer period format marks the first for a non-retail bond issuance as the BTr seeks to establish a new avenue for building liquid benchmarks.

A welcome approach in Congress