Continued recovery of Philippine real estate

Colliers Philippines remains optimistic and confident as it highlighted positive signs that the property sector continues to recover.

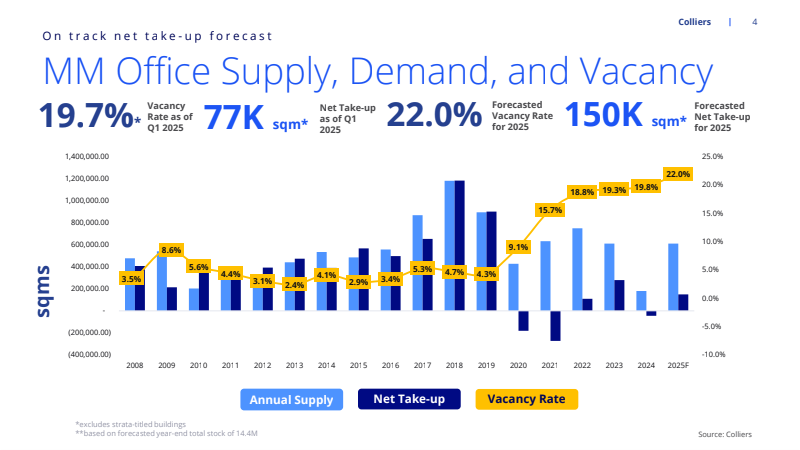

Positive net take-up

Colliers Philippines reported that Metro Manila’s office sector posted a net take-up of 77,000 sqm in the first quarter, while vacancy stood at 19.7 percent.

“We bounced back from the negative take-up that we experienced in the full year of 2024 with a positive 77,000 sqm net in the first three months of this year.” said Kevin Jara, director and head of Office Services-Tenant Representation at Colliers Philippines.

Despite this, Colliers has retained its net take-up forecast of 150,000 sqm for 2025 due to geopolitical challenges and shifting trade policies that may not directly impact the office sector, but might still “pause some investment decisions.”

Fort Bonifacio leads with the fastest pace of office space take-up. Makati CBD, meanwhile, saw a 189 percent increase in take-up compared to last year and doubled its Q4 numbers, mainly due to renewed growth from business process outsourcing (BPO) companies.

Outside Metro Manila, the provincial BPO market recorded an improved 55,000 sqm total transactions as of Q1 2025 versus the 46,000 sqm recorded in the same period last year.

“We are on track to hit our usual target of 200,000 sqm in markets outside Manila by the end of the year.” Jara added.

Slow down in new launches

For the residential sector, Colliers Philippines director of Research Joey Roi Bondoc said developers are launching less at the moment due to the sizable number of unsold units in the market. To help clear out pending inventories and buoy the residential sector, developers are now actively promoting ready-for-occupancy (RFO) units.

“We will still see sizable completion for the remainder of the year,” Bondoc said.

According to Bondoc, there would be 8,600 new condominium units that will be completed by the end of 2025. Of this number, 60 percent would be coming from the Bay Area. Those developments were launched in 2020 and 2021 and will only be completed this 2025 or 2026.

“Bay Area used to play catch up… It will now overtake and dominate across the capital region in 2025,” Bondoc added.

Residential projects outside Metro Manila meanwhile showed impressive take-up rates. Projects in Southern and Central Luzon regions have seen a 62 to 80 percent take-up despite the high price points ranging from P15 million to 22 million. Visayas and Mindanao are also demonstrating robust performance with 70 to 90 percent in the upper-mid to upscale projects.

“Note that these are projects that were only launched back in 2023. So, when you now look at the horizontal, which again supports our shift to suburbia statements, we are also recording decent, in fact, impressive take-up rates for these key cities and provinces,” Bondoc added.

Improving retail sector

Meanwhile, retail vacancy rates in Metro Manila have improved, dropping to 13 percent from 15 percent, indicating greater mall space absorption.

Colliers even projected a return to pre-pandemic levels by the fourth quarter of 2026, with vacancy rates expected to drop below 10 percent.

According to Bondoc, they’re seeing a lot of opportunities in the mall segment owing to the continuous expansion of foreign brands in the country. More than 40 percent of incoming foreign retailers are focused on the food and beverage segment (F&B), prompting mall developers to aggressively allocate capital for mall upgrades.