Overcoming Philippine property doldrums

(Conclusion)

Last Saturday, I discussed the interesting results we gathered from our briefing surveys.

It appears that office landlords and tenants are tweaking their development and leasing strategies to respond to market dynamics. Majority of our respondents are now more productive in a traditional office setup, while most of our clients and partners are now implementing 100 percent return to office.

Today, I’ll be featuring our residential and retail survey questions. Recalibration is seen across all property segments, and we encourage stakeholders to remain proactive in responding to shifts in the Philippine property market.

Design, feature priorities

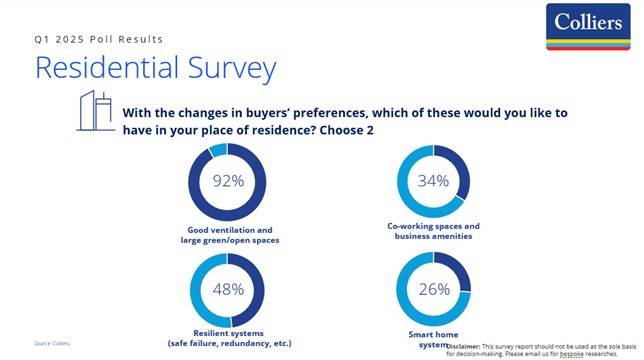

If there is one trend that was highlighted by the pandemic, it is the preference for good ventilation, and presence of greener and more open spaces.

Interestingly, this applies to office spaces and residential units. Nearly 50 percent of our respondents chose resilient power systems and internet connection as important considerations, especially for those still working from home or working under hybrid arrangements.

Developers should also consider integrating co-working spaces and business amenities to cater to employees who still work from home.

Property preferences

What also stood out is that majority of our respondents now prefer condominium units within and outside Metro Manila.

Colliers believes that the growing popularity of condominium units can be attributed to the attractive and innovative ready-for-occupancy (RFO) payment and lease terms being offered by developers. The continued offering of RFO promos is crucial in stoking appetite for vertical units especially in Metro Manila, which still has a sizable number of unsold condominium RFOs.

We expect firms to implement out-of-the-box RFO promos beyond 2025.

E-commerce platforms

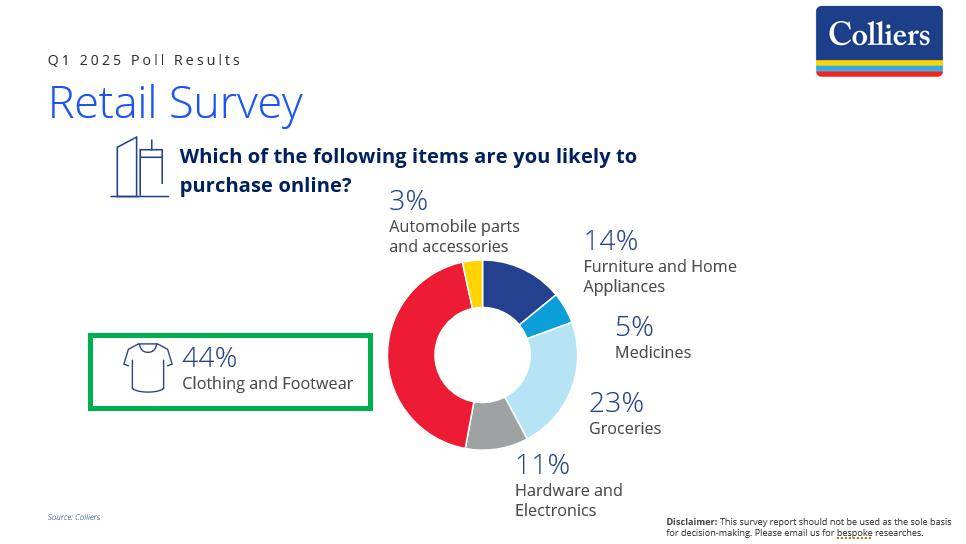

The same survey further revealed that more than 40 percent of our respondents prefer to purchase clothes and shoes online, while about a fifth buy groceries using e-commerce platforms. Nearly 15 percent buy furniture and home appliances online despite the proliferation of big-box home furnishing retailers in Metro Manila.

We expect online platforms to remain popular despite the expansion and refurbishment of brick-and-mortar malls.

As developers continue to refresh mall spaces to draw more in-person traffic, we expect online shopping platforms and their retailers to offer more promos to expand a loyal online customer base.

We expect online platforms to ramp up data security and feedback mechanisms to continue attracting buyers, especially the young workforce that has a constantly rising purchasing power. Logistics and delivery time should be improved as well, as this is a major concern of online shoppers.

On top of these, e-commerce platforms should also ensure the safety and reliability of their sites. Product variety is important, too, especially for young and affluent buyers who have constantly evolving preferences.

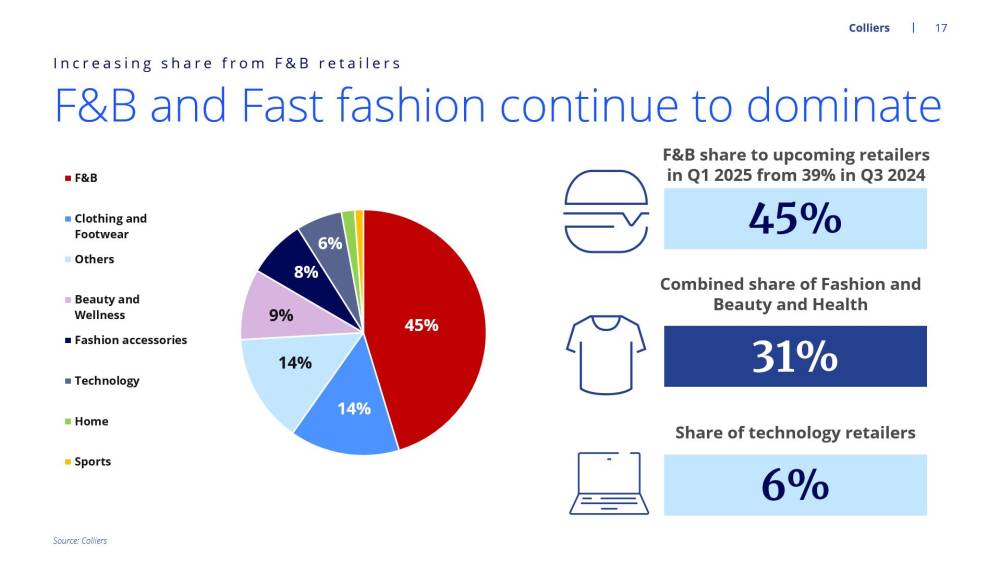

It is obvious that the country’s retail sector has been recording a sustained pace of growth. On a macro level, we attribute this to the Philippine economy’s continued expansion and tempering inflation resulting in interest rate cuts.

With the Bangko Sentral ng Pilipinas poised to implement more rate cuts for the remainder of the year, we see the retail sector further growing in H2 2025.

For feedback, please email joey.bondoc@colliers.com

Prior to joining Colliers in March 2016, Joey worked as a Research Manager for a research and consutancy firm where he handled business, political, and macroeconomic analysis. He took part in a number of consultancy projects with multilateral agencies and provided research support and policy recommendations to key government officials and top executives of MNCs in the Philippines.