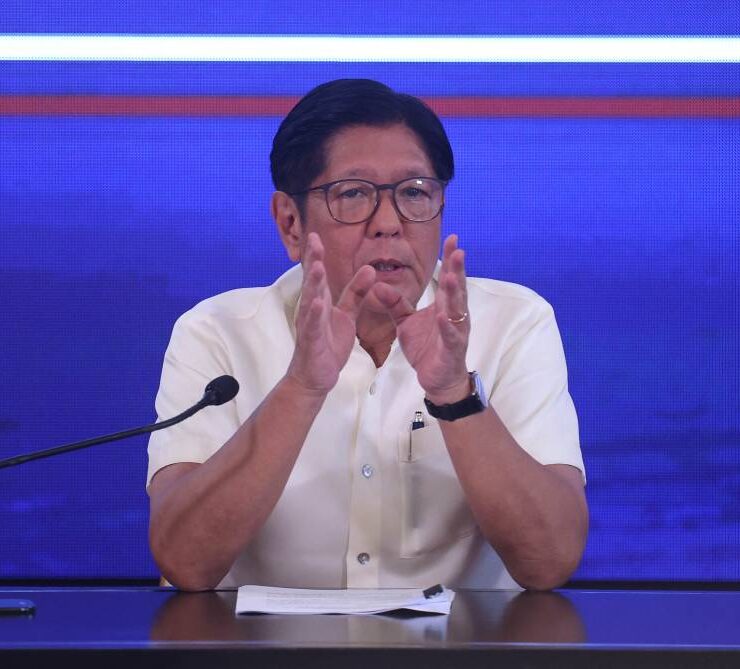

As next Sona nears, has Marcos done enough?

When President Marcos delivers his State of the Nation Address (Sona) tomorrow, Filipinos won’t just be listening for new economic promises. They will also be looking for proof that he’s delivered on those he made last year.

In 2024, the economy grew by 5.7 percent—falling short of the government’s target for the second consecutive year. Late-season typhoons disrupted the usual surge in holiday spending, dragging down what could have been a stronger year-end growth.

This sluggish momentum carried into 2025. Data showed the economy expanded at a slower-than-expected pace of 5.4 percent in the first three months, as fears over a brewing global trade war bruised business confidence.

Unlike other economies, however, the Philippines is weathering these headwinds with a manageable inflation environment.

Agri and food security

In June, the consumer price index rose to 1.4 percent, undershooting the 2 to 4 percent target of the Bangko Sentral ng Pilipinas. The central bank is now firmly in an interest rate-cutting cycle, signaling confidence in the inflation outlook.

With all the pledges he laid out in his previous Sona, can Mr. Marcos now show if his words translated into action?

Mr. Marcos opened his Sona last year with a promise to tackle the food supply problem as he acknowledged the “hard lesson” of the past year: “Whatever current data proudly bannering our country as among the best-performing in Asia means nothing to a Filipino, who is confronted by the price of rice at P45 to P65 per kilo.”

He then pledged to prioritize local rice production over importation despite the shortfalls, as well as maintain price stability through temporary tariff reductions.

Latest data showed rice prices deflated at a faster rate of 14.3 percent in June, from a 12.8-percent drop in May.

Figures from the Bureau of Plant Industry showed that overseas rice purchases totaled 2.002 million metric tons (MT) as of June 12. The volume represented a 14.4-percent drop from the 2.34 million MT recorded in the comparative period last year amid expectations of a better rice harvest.

The United States Department of Agriculture (USDA) slightly raised its forecast on local rice production to 12.25 million metric tons for marketing year 2025 to 2026, which begins in July—from its projection of 12.20 million MT for marketing year 2024 to 2025. The USDA said “continued support from the government for the rice industry and the sale of subsidized milled rice supports the estimated increase in rice production.”

Palay (unmilled rice) production totaled 4.698 million MT in the first quarter of 2025, slightly higher than 4.685 million MT in the same quarter a year ago, according to the Philippine Statistics Authority.

Electricity

Mr. Marcos also promised “fair” energy prices for consumers. And in doing so, he sought the help of Congress to amend the Arroyo-era Electric Power Industry Reform Act (Epira).

The Epira was passed in 2001 to resolve the power crisis of the 1990s and reduce the cost of electricity by privatizing the generation, transmission and distribution assets of the power sector. After 23 years, however, the Epira has also been blamed for the country’s energy problems, including high electricity rates and spotty power supply, as shown by the shortage experienced at the peak of El Niño in the first quarter.

But with the 19th Congress ending and a new one set to begin, the proposed measure has yet to be enacted. Energy regulators hope the bill will be given priority when it is refiled in the 20th Congress.

Investments

The President last year also threw his weight behind the Create More bill, saying the measure would attract investments.

A few months after his Sona, Mr. Marcos signed the tax measure into law. Under this law, companies that had been granted tax breaks even before the enactment of the Duterte-era corporate tax law have until 2034 to enjoy such fiscal perks, giving these firms more time to transition to the revamped incentives system.

But it appears that concerns over global uncertainties—like the US trade war and tensions in the Middle East—are outweighing the optimism from any regulatory push.

Data from the central bank showed that net inflows of foreign direct investments in the Philippines decreased by 33.4 percent year-on-year to $2.4 billion in the first four months of 2025.