BSP poised to cut key rate to 5% in Aug, says ING

Another research group has added its voice to the growing chorus saying that the Bangko Sentral ng Pilipinas (BSP) will further cut its key interest rate, starting with a 25 basis point reduction to 5 percent when the Monetary Board meets on Aug. 28.

The research group of Netherlands-based global banking group ING said in a commentary that they expect the BSP to decide on further easing this month, even if inflation in the Philippines is expected to heat up in the months ahead.

They also expect this even if the Philippine economy is growing faster relative to its neighbors in the region.

“We don’t believe that the relative strength in growth data will deter the central bank from cutting rates in August as CPI (consumer price index)inflation remains firmly below the inflation target,” ING said.

Headline inflation read out at 0.9 percent year-on-year in July. That was the fifth straight month that the data had been below the BSP’s target range of 2 percent to 4.

“While CPI readings should accelerate from here, contained domestic rice prices and a reversal in oil should keep inflation subdued,” ING said.

Further, the bank said recent comments from the central bank itself suggest more active steps to intervene in foreign exchange markets, to contain currency volatility.

“This should keep imported inflation contained,” it added.

In its two most recent meetings, the BSP reduced its key policy rate by 25 basis points to 5.5 percent in April and again in June to bring it down to 5.25 percent.

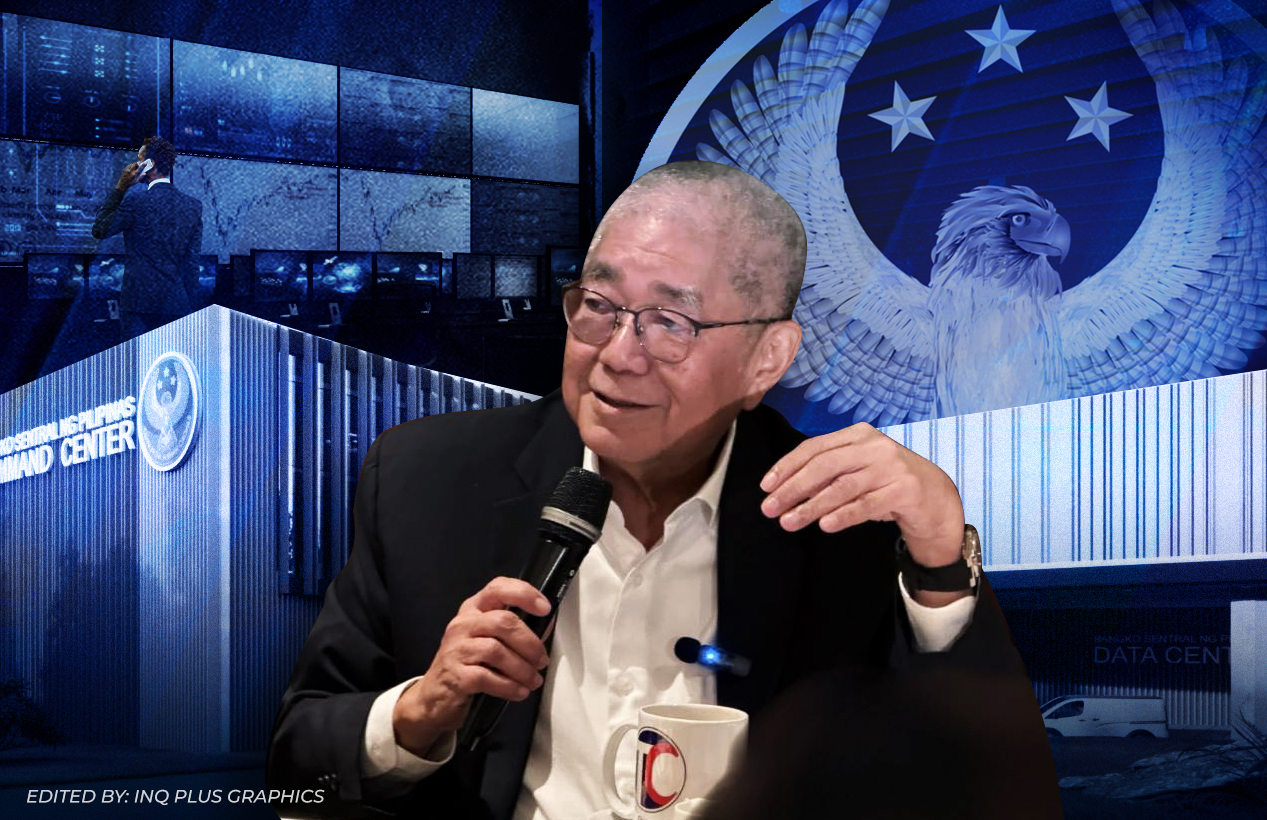

In July, BSP Governor Eli Remolona Jr. said they might reduce the benchmark rate twice more in the remainder of this year.

Policy meetings

There are three more policy meetings scheduled this year—in August, October and December.

Remolona told reporters there was room for further reductions “because inflation is low and [economic] growth is a bit lower also.”

The growth of Philippine gross domestic product slowed to 5.4 percent year-on-year in the first quarter. GDP growth in the March quarter fell short of the lower end of the government’s own goal.

Last June 26, the interagency Development Budget Coordination Committee (DBCC) said it lowered the growth target range for 2025 to between 5.5 and 6.5 percent.

Before this, the Marcos administration was striving for this year’s gross domestic product to increase by 6 percent to 8 percent.

The DBCC itself is banking on continued BSP rate cuts, saying that this is expected to improve credit conditions and support sustained consumption and domestic activity.

But in his chat with reporters last month, Remolona said interest rate cuts “cannot really compensate entirely for the slowdown in growth.”