Building business beyond the puff: Transitioning to a smoke-free future

With just 5.4 percent of its population lighting up a cigarette every day, Sweden believes that it is on its way to becoming practically smoke-free, way ahead of other countries in the European Union, where one in five citizens is a daily smoker.

There was a time, however, when a much higher percentage of its population smoked traditional, combustible cigarettes that score the highest on the “relative risk spectrum” among 15 nicotine product categories.

That Sweden was able to bring the incidence closer to 5 percent it puts down to a combination of factors, including strict rules on smoking, a hard ban on tobacco advertising and the availability of what it believes to be less-harmful alternatives in the market.

These products targeting daily smokers who are unfortunately unable to totally kick the habit include heated tobacco and nontobacco or nicotine pouches.

From the time they were introduced to the Swedish market, consumption patterns shifted away from the more harmful combustibles to the “less harmful” smoke-free alternatives, such as those produced by Japan Tobacco Inc. (JTI).

JTI produces leading tobacco brands Winston and Camel, which still account for the bulk of its revenues.

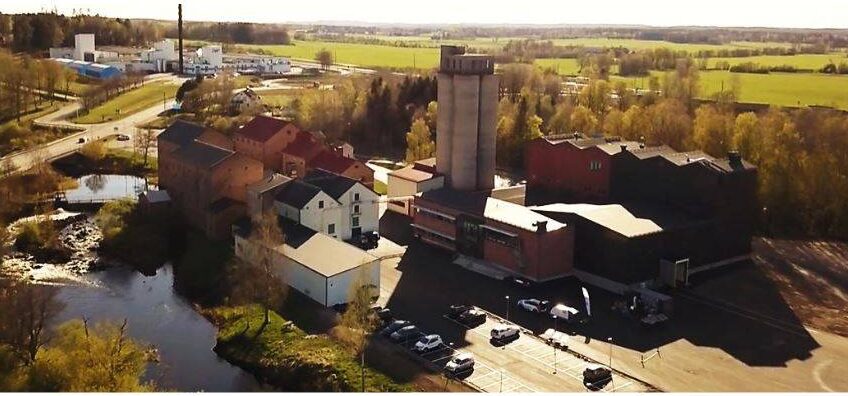

But it has laid out aggressive plans to grow its presence in the tobacco-free nicotine pouch category through the Nordic Spirit brand produced in its storied Vargarda factory on the western coast of Sweden and about an hour’s flight from the capital of Stockholm.

In 2018, JTI’s Nordic Spirit was launched in Sweden, where it was easily accepted, primarily due to the nation’s long history with snus, a type of smokeless, oral tobacco product that is typically placed in the mouth, usually between the upper lip and gum.

Consumer profile

As of JTI’s latest count, 80 percent of the snus users are male but nicotine pouches are consumed equally by both male and female. They also tend to be younger than the pure snus users.

Sara Sillen, JTI Corporate Affairs and Communications director Nordic, tells journalists who visited the Vargarda factory that convincing Swedish smokers to switch to nicotine pouches is not “too difficult”.

JTI figures show that some 60 percent of the nicotine pouch users today are former smokers, indicating that they welcomed the shift to alternative ways to indulge in their nicotine habit.

These are certainly not risk-free, as the World Health Organization has repeatedly said, but the industry has presented studies showing that they are at the very least less harmful than traditional cigarettes.

If the trend toward alternatives continues, it is possible that nicotine pouches will eventually have the biggest slice of the category in Sweden, overtaking combustibles and even the traditional snus.

As such, there is intense competition in this crowded market, where JTI (Nordic Spirit) competes against rivals, such as Philip Morris International (Zyn) and British American Tobacco (Velo, Lyft, Lundgrens).

From Sweden, JTI started exporting Nordic Spirit in 2019 and this year, the Vergarda factory is ramping up production to serve new markets, such as Canada, France and the Philippines.

The Philippines is deemed a “high-growth market” for nicotine pouches that come in a variety of flavors, concentrations and packaging sizes.

First mover

Karin Tan, director for reduced risk products at JTI Philippines, says in a briefing in Stockholm that since Nordic Spirit was introduced in mid-2023, it has already shown promise, and enjoys a first-mover advantage being the first nicotine pouch brand to enter the Philippine market and also the first to introduce the category to Filipino consumers.

“The growth has been quite phenomenal,” Tan says, with some Filipinos finding it easy to make the switch as consuming nicotine through the mouth is not a strange thing given the traditional enjoyment of betel nut by some Filipinos.

“When we tested the market, eight of 10 of them gave positive consumer feedback,” says Tan.

“We are bringing Sweden’s best to the Philippines, with Filipino consumers in mind,” she adds.

In the Philippines, JTI introduced a special pack sold for P35 or P7 a piece, a sachet containing five nicotine pouches to suit the need for more value packaging.

It is categorized under novel tobacco products, as it does not contain tobacco but nicotine extracted from tobacco.

First in Asia

The Philippines is the first outside of Western European markets to be introduced to the nicotine pouch, thus its lead in the category in the region.

Helping the consumption along are the restrictions on cigarette smoking and the limited breaks that prevented some smokers, for example, from going down from their offices to go to the designated smoking area for their cigarette break.

“We saw how the environment was evolving, so we thought that the opportunity was there to bring an option to consumers,” says Tan, who was able to convince the global headquarters to consider bringing the nicotine pouches to the Philippines.

That faith has paid off as Nordic Spirit has been gaining ground, helping Filipino smokers make the switch.

Nordic Spirit has just been launched nationally and JTI is under no illusion that the product will be able to instantly flip the tobacco market considering that the Philippines, like most of Southeast Asia, is still dominated by combustibles.

“It is still very early days but we are truly excited about the market,” she says.

Is Philippine agriculture really protected by high tariffs?