Office market is ‘Ce-boom-ing’

Cebu’s office market is finally off and running, as the Philippines shakes off the last remaining effects of the COVID-19 pandemic and uncertainties caused by the United States presidential elections.

The province’s office market is mirroring the early growth seen in Metro Manila and is expected to hold steady until the end of 2025.

Preliminary data from the upcoming 2025 second quarter (Q2 2025) report of Colliers, a professional services and management company specializing in real estate services and investment management, show a strong demand for office space in the provinces, particularly in Cebu.

Signs of recovery

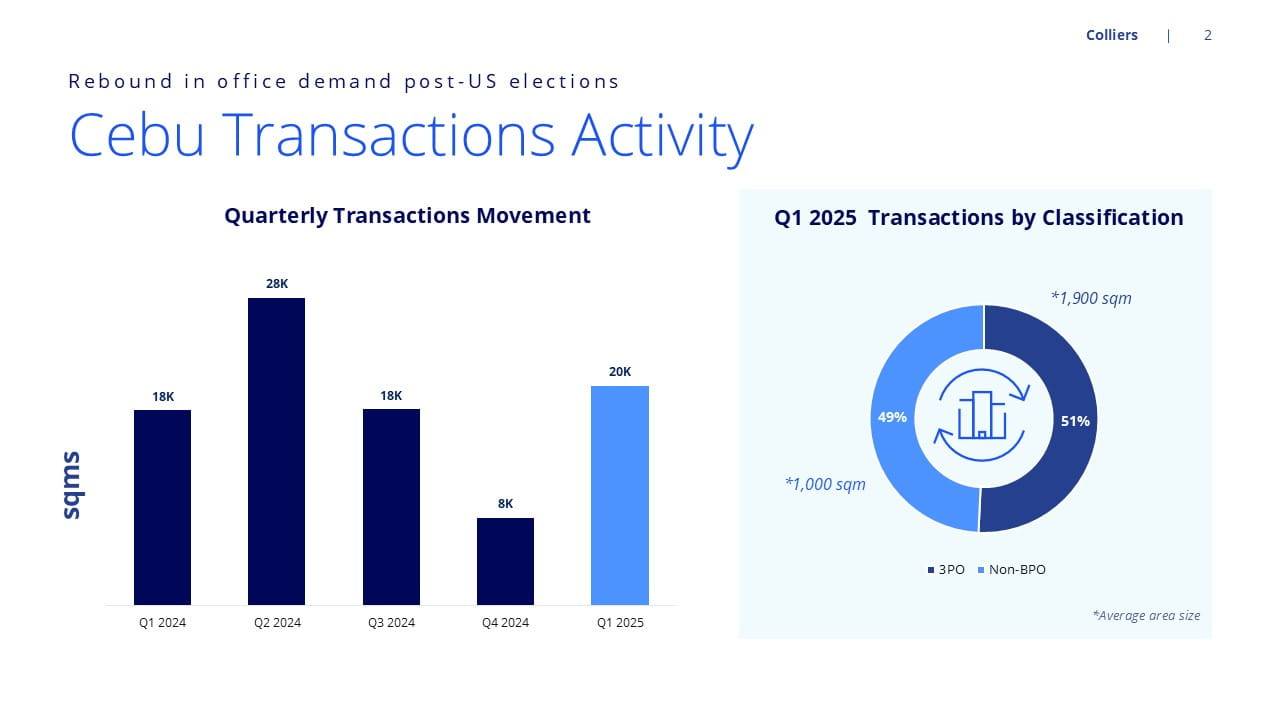

The first quarter of 2025 showed strong signs of recovery in the province, with a sharp uptick in transaction volume, according to a report by Colliers Kathlyn Atillo-Relatos, manager for office services Cebu, and Ohara Rosales, manager, office services tenant representation.

Investor caution and business uncertainty that resulted in a subdued performance in the last quarter of 2024 appear to have given way to optimism and confidence.

While some macroeconomic challenges remain, including American tariffs and geopolitical tensions, office demand has remained resilient and is expanding outside Metro Manila.

Expansion and new setup make up a majority of transactions recorded.

IT-BPM

The rise in demand is driven by major information technology-business process management (IT-BPM) occupiers securing large leases in newly completed developments.

With the continued growth of the outsourcing sector, the IT-BPM sector remains the primary demand driver in the rising demand.

The IT-BPM sector is followed closely by traditional corporate firms.

The outsourcing sector accounted for 51 percent of new leases signed in Q1 2025, followed by traditional firms (49 percent).

Expansion and new setup are the main reasons for firms to take up office space. They accounted for 82 percent of office deals recorded.

Cebu accounts for 36 percent of total demand for office space in the Philippines.

As of the first quarter of 2025, about 55,000 square meters (sq m) of office transactions were recorded across the country.

Cebu registered a 150 percent quarter-on-quarter increase in transaction volume in the first quarter, a sharp rise from the 8,000 sq m recorded in the last quarter of last year, which was due largely to businesses deciding to delay real estate decisions during the US elections period. This was also the case in Metro Manila.

The sharp rebound of Cebu’s office space market is proof that it remains the most preferred office destination outside the National Capital Region because of the high availability of quality buildings, mature infrastructure, rich talent pool and business-friendly environment.

As the Cebu office space market regenerates, new developments are being put on the market.

While there is currently a high vacancy rate, driven by new supply, this situation is expected to be temporary as demand continues to grow.

In the first quarter of 2025, Metro Cebu posted an overall vacancy of 21.2 percent, higher than the recorded end-2024 vacancy of 20.5 percent.

This increase is mainly attributed to the completion of Filinvest’s Cyberzone Cebu Towers 3 and 4 at the Cebu IT Park (CITP).

Colliers expects an additional 110,000 sq m of office space in 2025, with the bulk of new supply based at the Cebu IT Park and the North Reclamation.

Other notable developments expected to be mainstreamed soon include BDO (Banco de Oro) Corporate Center Cebu in Fuente Osmeña, Grand Tower in North Reclamation, Il Corso in South Road Properties, MAHI Center in Mactan and Patria de Cebu in Uptown.

With the high volume of new office spaces, the vacancy rate is expected to continue averaging at 20 percent until the end of the year.

Pre-leasing activities

A significant trend observed in the Cebu office market this year is the rise in pre-leasing activities. This is taken as a clear indicator of growing tenant confidence and long-term commitment to the region.

Several large IT-BPM companies—particularly those serving North American and Asia-Pacific markets—have accelerated their growth in Cebu, taking advantage of the city’s large labor pool, competitive operating costs and increasing government support for the outsourcing industry.

The firms are securing office spaces in advance, even in buildings still under construction or in precompletion phases.

Pre-leasing activity has been particularly notable in Filinvest Cyberzone Cebu Towers 3 and 4, with major sign-ups from well-known outsourcing companies. This seems to anticipate continued headcount growth. Companies are locking in strategic locations to deal with further market tightening.

The pre-leasing activity has helped push the net takeup back to positive territory.

A total of 13,000 sq m of net takeup was recorded in the first quarter, a major improvement from the 4,000 sq m negative net takeup recorded in the last quarter of 2024.

The rise in preleasing underscores Cebu’s resilience as a top-tier outsourcing hub. It also signals a forward-looking market sentiment. Occupiers are seemingly positioning themselves for sustained growth. And developers are responding to this challenge by exploring pipeline projects with greater confidence.

And it is not only office space that is making Cebu hum with business activities.

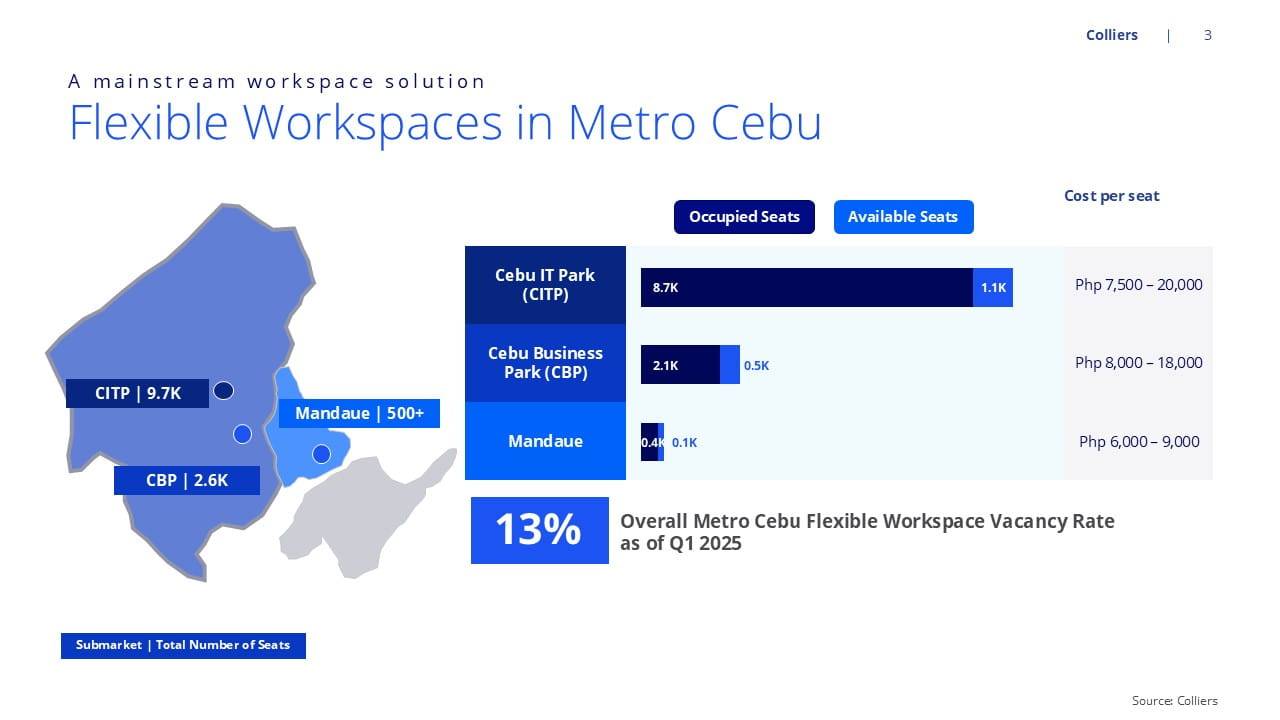

The flexible workspace market has gained ground in Metro Cebu in recent years, addressing a very specific pain point—high upfront capital expenditure—for the fast-growing outsourcing sector.

Flexible workspaces

Flexible workspaces—also known as seat leasing—allow outsourcing companies to start operations quickly without an upfront investment. This is a workspace model where a company leases a furnished space, complete with technology and facilities, from a provider.

About 70 percent of Cebu’s available office stock is in bare- or warm-shell handover condition. This means cost-sensitive occupiers may have to deal with the challenge of heavy capital expenditures.

A seat leasing model is a convenient startup arrangement as it spreads out the fit-out cost across the lease term. What would have been a steep one-time payment becomes a manageable and periodic operating expense.

The system appears to have become a preferred option for startups. Vacancy in Cebu’s flex space segment is only 13 percent, well below the vacancy in the traditional lease market. It also seems to suggest that occupiers are preferring plug-and-play solutions for their office requirements.

Flex operators are responding to the demand with both existing and new players expanding their footprint across the province.

With market conditions still favoring tenants, Colliers recommends that occupiers capitalize on this by including upcoming buildings in their site selection.

Engaging in pre-leasing opportunities not only secures favorable lease terms but also gives occupiers the ability to influence the design and functionality of their future workspaces.

For landlords, being competitive means understanding and adapting to evolving tenant needs. To stay competitive, Colliers encourages landlords to explore creative solutions, including more flexible lease structures and attractive rental rates.

With the growing demand for plug-and-play solutions, landlords—especially those with a high number of bare shell spaces—should consider partnering with flexible workspace providers.

The partnerships can help activate idle space, reduce time-on-market and cater to occupiers looking for immediate occupancy without the burden of upfront fit-out costs.