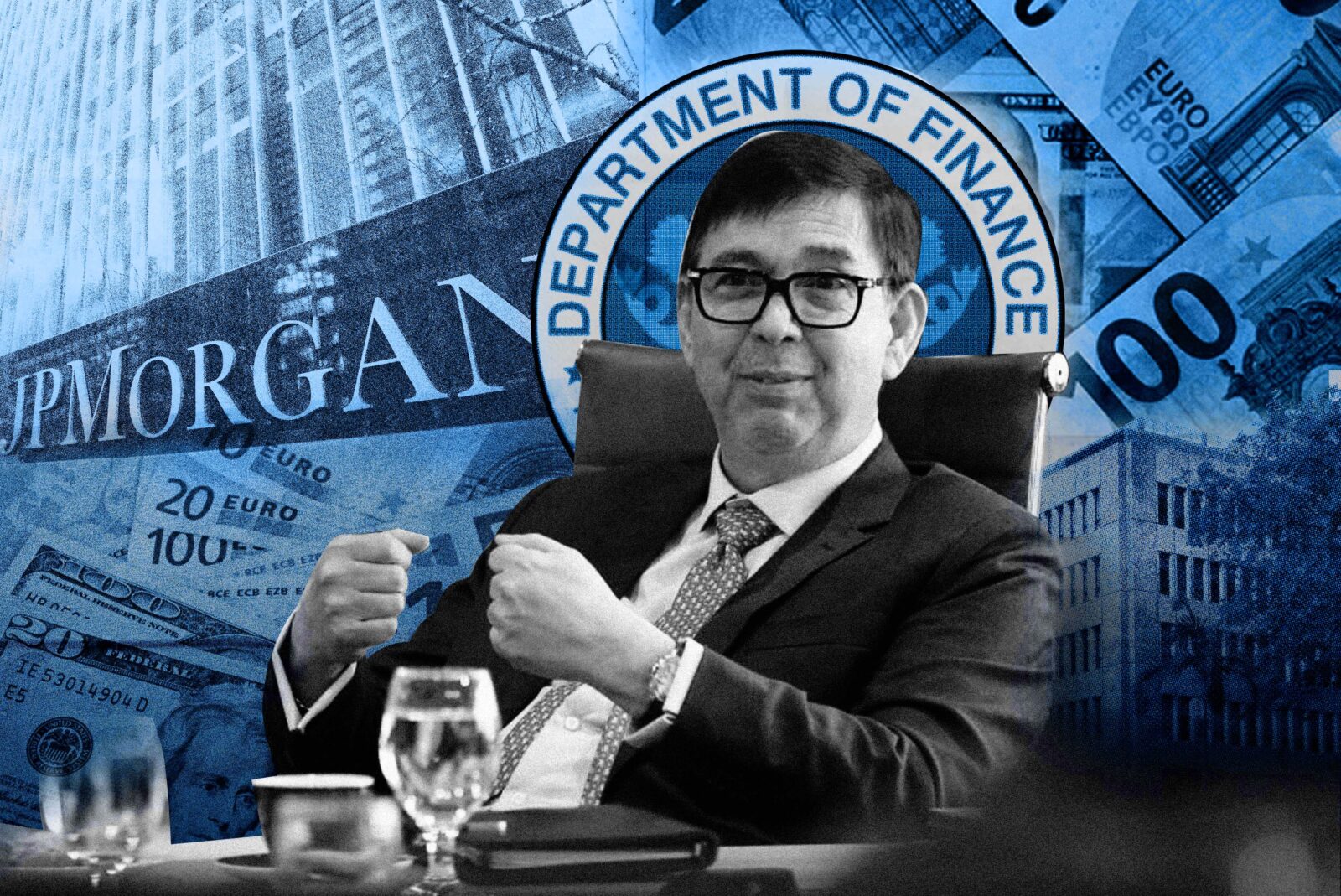

PH eyes ‘samurai,’ US dollar, euro bonds amid J.P. Morgan nod

The Philippine government is considering another sale of US dollar and euro bonds in 2026, Finance Secretary Ralph Recto said, while also signaling a possible return to the Japanese debt market for the first time in three years.

Recto revealed the plan as he welcomed the country’s potential inclusion in J.P. Morgan’s key emerging-market bond index—a development that, he said, could help the government secure cheaper financing.

The Marcos administration aims to raise P627.1 billion in foreign debt next year, with roughly P302 billion expected to come from bonds and other inflows.

Recto said the commercial borrowing program could include US dollar- and euro-denominated offerings. The government is also considering “samurai” bonds for Japanese investors, following its previous sale in 2022, when it borrowed ¥70.1 billion.

“Nothing is off the table,” Recto said, adding that the final details, including the timing of the issuances, will “depend on the market.”

Rate reduction

“What is important is that we may be included in the J.P. Morgan Index. That will reduce rates as well. So, we’re very excited about that,” he added.

J.P. Morgan said in a report on Sept. 12 that it had placed peso-denominated government securities on a “positive watch list,” the final stage before potential inclusion in its The Government Bond Index-Emerging Markets, or GBI-EM.

It cited a string of “proactive market reforms” by Philippine authorities, including streamlined tax treaty procedures, the revival of the domestic repurchase market and the launch of a peso interest rate swap market.

The GBI-EM tracks local-currency sovereign debt across 19 countries and is closely followed by global fund managers. Inclusion could draw P100 billion in foreign capital, National Treasurer Sharon Almanza said, based on an estimated 1 percent weighting for the Philippines.

The bank’s index assessment is expected to last six to nine months, with further updates and any applicable index rebalancing estimates to be provided in the first quarter of 2026. Almanza said the government will continue implementing reforms meant to boost liquidity in the secondary market, and seal more tax treaties offering preferential rates abroad.