Megaworld moves to jack up shares with P2-B buyback

Megaworld Corp. intends to buy back up to P2 billion worth of its shares in hopes of raising the value of its stock as it continues to pursue township expansion, its main income driver.

In a regulatory filing on Thursday, the developer led by billionaire Andrew Tan said its board of directors had approved the share buyback program.

The program will have a 24-month term, and Megaworld will use internally generated funds to buy back its shares.

“The board believes that current market prices do not reflect the true value of the company’s shares and seeks to enhance shareholder value through a share buyback program,” Megaworld said in its disclosure.

Its share price has gone down by 13.56 percent to P2.04 each from its 52-week high of P2.36 apiece.

Megaworld’s buyback program comes amid its plans to expand its leasing portfolio via its pipeline projects.

Last week, Megaworld sold P2.2 billion of its shares in its real estate investment trust (REIT), MREIT Inc. This is to support the completion of projects in Cebu, Palawan and Bacolod.

MREIT said in a separate disclosure that Mactan Newtown in Cebu will get P830 million of the total proceeds. Paragua Coastown in Palawan will be allocated P845 million. The Bacolod township will be allocated P537.92 million.

Mactan Newtown and Paragua are slated for completion in 2028. The Bacolod project will be completed in 2029.

Strong demand for its township developments lifted the first-semester net income of Megaworld by 23 percent to a record P12.09 billion. Meanwhile, revenues climbed by a tenth to P43.09 billion.

The company said its township strategy was the main driver for its bottom-line growth, including its other core businesses.

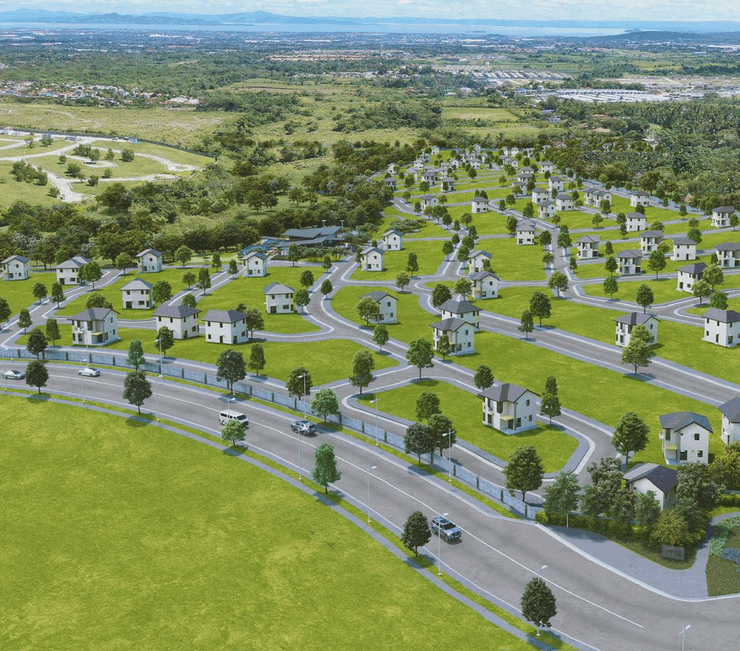

Megaworld recently launched its 36th township. This is the P5-billion Nascala Coast in Batangas province that subsidiary Global-Estate Resorts Inc. is developing.