AMLC may review banks tied to flood control funds

The Anti-Money Laundering Council (AMLC) said it may look into banks after a congressional inquiry flagged large cash transactions linked to a flood control scandal, although the watchdog declined to say whether such an investigation was already underway.

The state-run Land Bank of the Philippines (LandBank), meanwhile, “strongly refuted” any insinuations of irregularity in its handling of government contractor accounts, stressing that all questioned transactions had complied with mandated procedures.

AMLC Executive Director Matthew David told the Inquirer that under its supervisory and investigative mandates, the council also examines potential administrative and criminal liabilities of covered entities, including banks and their employees, for compliance lapses.

Still, David stopped short of saying whether the AMLC had opened a specific probe, citing confidentiality rules.

Sanctions

But he said the AMLC may check whether banks and other covered entities were meeting their legal duties, including vetting clients under “know your customer” rules, keeping proper records, and filing required transaction and suspicious activity reports on time.

“Noncompliance with these obligations may result in enforcement actions under the Enforcement Action Guidelines, and administrative sanctions under the Rules of Procedure in Administrative Cases,” David said, adding that failure to submit required reports may also give rise to liability under the Anti-Money Laundering Act.

“The AMLC remains committed to upholding the integrity of the financial system and ensuring that all covered entities adhere to their legal obligations in the fight against money laundering and terrorism financing,” he continued.

The Bangko Sentral ng Pilipinas (BSP) has launched its probe into potential vulnerabilities of concerned banks in relation to transactions involving flood control projects. The review, it said, was aimed at determining the scope of any lapses and holding lenders accountable where shortcomings are found.

The BSP opened the inquiry following explosive testimony in congressional hearings, where witnesses described large cash withdrawals and deliveries to lawmakers allegedly tied to irregular flood control projects.

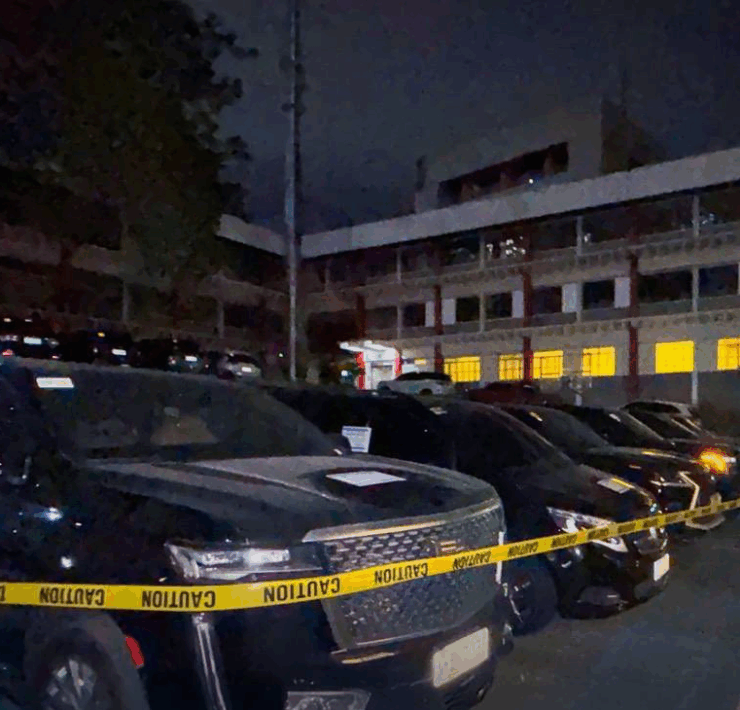

Photos of stacks of banknotes submitted as evidence of kickbacks to legislators intensified public anger, sparking mass protests on Sept. 21. The AMLC has issued more than 700 freeze orders covering bank accounts, insurance policies and other assets of individuals linked to the alleged scheme.

At a Senate hearing on Sept. 25, senators questioned contractor Sally Santos, who admitted withdrawing P457 million in cash in just two days from a LandBank branch in Bulacan. Santos, owner of Syms Construction Trading, is among several contractors implicated in the flood control scandal.

Not suspicious

Lawmakers also pressed Ma. Lilibeth Lim, the branch manager who authorized the withdrawal. Lim reasoned out that since the account was tied to a government agency, it was not treated as suspicious. Under existing laws, transactions involving P500,000 or more in cash must be reported to the AMLC as a covered transaction.

In a statement on Monday, LandBank said the funds were legitimate government allocations under the annual national budget law, not private or unverified sources. Therefore, it argued that the bank, “or any other financial institution, has no legal authority to block or question duly appropriated government disbursements.”

“LandBank reiterates that its role is to faithfully execute banking transactions in accordance with law and regulatory standards, and not to assume investigatory functions outside its legal mandate,” it added.