Corruption concerns wipe out P1.7T in stock market value–SEC

Mounting allegations of corruption against high-ranking government officials have wiped out P1.7 trillion in the market value of companies listed on the Philippine Stock Exchange in just three weeks, reflecting that public trust—not strong fundamentals—remains the economy’s main growth driver, according to the Securities and Exchange Commission (SEC).

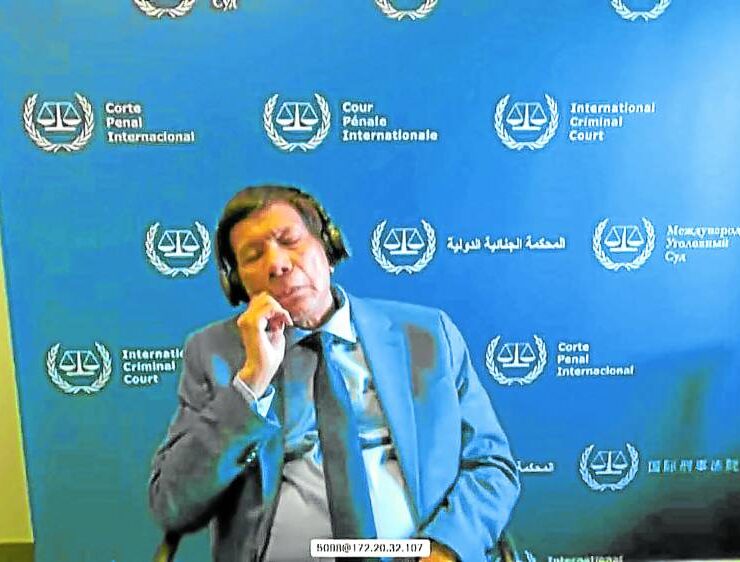

“When trust breaks down, capital dries up, and everyone—government, business and the public—pays the price,” SEC Chair Francis Lim said in a speech before members of the Financial Executives Institute of the Philippines (Finex) on Oct. 7 and released to the media on Wednesday.

From Aug. 11 to Aug. 29 this year, the total value of listed companies plunged 12 percent, tumbling to P12.6 trillion from P14.3 trillion, according to S&P Global Market Intelligence.

Lim noted that the stock decline came despite improving corporate earnings, indicating that “investors aren’t fleeing because of weak fundamentals; they’re fleeing because of weak integrity.”

“Let’s face the hard truth: our stock market is a laggard,” he said.

“Sadly, this reflects something deeper—a crisis of confidence.”

Lim said the billion-peso flood control scandal has shaken public confidence and “it’s a stark reminder that corruption is a weapon of mass wealth destruction.”

Analysts have noted that corporate earnings were robust in the first half of the year, but this was not enough to lift the stock market.

Year-to-date, the benchmark Philippine Stock Exchange Index has tumbled by 7.12 percent and struggled to stay above the 6,000 support level. It slipped to a six-month low of 5,997.60 on Sept. 29.

Reputational issue

Alfredo Panlilio, president of the Management Association of the Philippines (MAP), noted that while investors were still coming to the private sector through the capital market, overall sentiment remained bearish because of corruption.

“This affects the perception of the country … it’s more reputational, more than anything, because fundamentally, the companies are strong,” Panlilio told reporters on the sidelines of MAP’s general membership meeting on Wednesday.

“It’s important that something should happen. I think people are expecting that certain actions are done to prove that the government means change and means to clean up itself,” he pointed out.

A decline in market value essentially means that the share prices of companies are going down due to investors choosing to sell their stocks.

These billion-peso companies, including giants like SM Investments Corp. and Ayala Corp., are now being valued lower, according to Ron Acoba, Trading Edge Consultancy chief investment strategist.

This may hurt investors who previously bought shares with the intention of gaining profit in the belief that the share price would appreciate over time.

“With valuations lower, investors in general are facing significant losses,” Acoba told the Inquirer in a text message.

“The mid- to long-term impact depends on how the government responds—credible reforms and accountability could restore trust and drive recovery, while weak or selective action may lead to prolonged undervaluation, capital flight and slower economic momentum,” he added.

Acoba likewise warned that the market’s lackluster performance would discourage investors to come to the Philippines, instead preferring stronger markets, such as the United States, whose stocks have been seeing record performances in the past months.

Bank secrecy lifting

In order to rebuild public trust, Lim urged financial executives to comply with regulations as this would likewise help attract investment and create opportunities for economic growth.

For its part, the SEC, a member of the Anti-Money Laundering Council, recently voiced its support for the lifting of the bank secrecy law to aid in the government investigation of anomalous flood control projects.

“As a corporate and capital market regulator, the SEC welcomes the proposed easing of our bank secrecy laws as a necessary measure to uphold trust and confidence in the Philippine capital market and overall economy,” Lim said.

Several bills are currently pending before the House of Representatives for the lifting of the bank secrecy law primarily to promote transparency and tackle corruption in the government.

Reasonable ground

Generally, the amendments seek to empower the Bangko Sentral ng Pilipinas to inquire into and examine deposits when there is reasonable ground to believe that fraud, serious irregularity or unlawful activity has been committed by certain individuals or entities.

“The ability to access critical financial information, particularly in cases of insider trading, market manipulation, and investment fraud, will significantly enhance the enforcement capabilities of the SEC. More importantly, it sends a clear message that the capital markets are governed by transparency and accountability,” Lim noted.

The bank secrecy law has often been used as a shield for owners of bank accounts in cases of violations of Republic Act No. 8799, or the Securities Regulation Code, and Republic Act No. 11232, or the Revised Corporation Code of the Philippines, among other laws implemented by the SEC, limiting the enforcement capacities of the SEC.

REITs reform

Lim clarified, however, that Congress would need to determine to what extent it intends to liberalize bank secrecy, and whether certain exemptions should still be allowed.

He also promised that the SEC would strengthen the role of independent directors, reform the Real Estate Investment Trusts (REITs) sector, and champion financial literacy to restore trust in capital markets.

REITs are companies that own and operate income-generating real estate and investors who buy their shares earn a return from rental income.

Lim said the goal is to show the world that “in the Philippines, doing good and doing well can truly go hand in hand.”