Understanding why horizontal is ideal

The end-use market has been driving demand for horizontal (house-and-lot and lot-only) developments outside Metro Manila. This segment has consistently recorded strong take-up and price appreciation, even at the height of the pandemic.

The results of our residential survey showed that nearly 30 percent of our respondents prefer a lot-only unit in the province for their next residential investment, while 18 percent selected a house-and-lot (H&L) unit.

This proves the popularity of horizontal projects in high growth regions where major developers are aggressively landbanking, taking advantage of end-user demand from affluent local buyers and Filipinos working abroad.

Southern Luzon: A horizontal powerhouse

The Calabarzon Region continues to be a major economic hub, supported by infrastructure developments, proliferation of local and foreign manufacturing companies, and a favorable investment climate.

Data from the Philippine Statistics Authority (PSA) showed that the regional economy of Calabarzon grew 5.6 percent in 2024, almost at par with the national growth of 5.7 percent. It is also the second largest contributor to the national economic output, next to the National Capital Region (NCR).

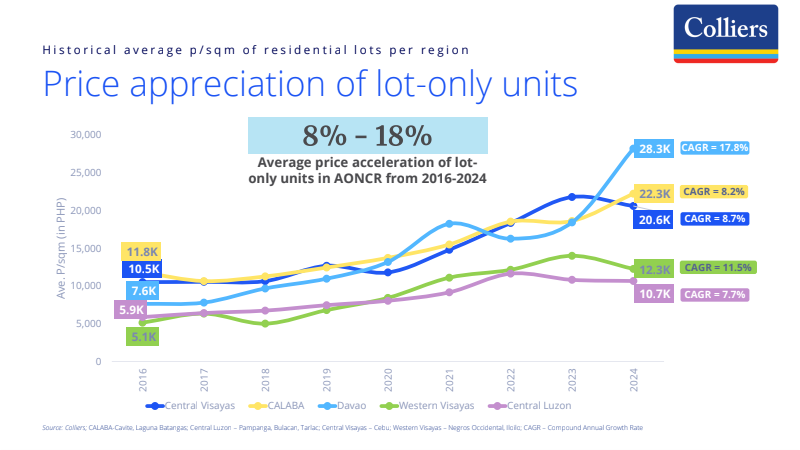

Horizontal projects remain attractive especially those in the Cavite-Laguna-Batangas (Calaba) corridor. Lot-only offerings in the region recorded a price appreciation of 8 percent annually from 2016 to 2024.

This growing residential demand should be supported by the completion of key infrastructure projects such as the North-South Commuter Railway, LRT-1 Cavite Extension, NLEx-SLEx Connector Road, and Cavite-Laguna Expressway (CALAx), Bataan-Cavite Interlink Bridge, Cavite Bus Rapid Transit, Cavite-Batangas Expressway (CBEx) and the Nasugbu-Bauan Expressway (NBEx).

Central Luzon: At the center of viable property options

Central Luzon remains a major economic center outside of Metro Manila, posting a 6.5 percent growth in 2024, the fastest in Luzon during the period. Its property market has substantially evolved the past few years with national players seizing opportunities by aggressively land banking in the region.

The growing attractiveness of the region as a property hotspot is facilitated by the completion of key infrastructure projects, like the Bulacan international airport and Central Luzon Link Expressway, which should further raise land and property prices in the region.

From 2016 to 2024, lot-only projects in the region recorded an 8 percent price increase on an annual basis. With more infrastructure in the pipeline, supported by solid take-up, we see steady growth for lot-only developments in the medium to long term.

Central Visayas: A property royalty in VisMin

In 2024, the Central Visayas Region had the fastest growing economy, rising by 7.3 percent. It was also one of the major contributors to the national GDP, accounting for 6 percent, next to NCR, Southern Luzon and Central Luzon.

Cebu is a top-of-mind option for national players planning to capture demand outside the Philippine capital. From 2016 to 2024, prices of lot only units in Cebu appreciated by an average of 9 percent annually.

With massive public infrastructure investments in place (Cebu Bus Rapid Transit, Metro Cebu Expressway, Lapu-Lapu Expressway, Bohol-Panglao Airport Redevelopment, and the Cebu-Mactan 4th Bridge), we see the further unlocking of land and property values in Cebu and its environs.

Davao Region: A hub that keeps thriving

In Mindanao, Davao remains the most attractive property investment destination. Its competitiveness and stature as an outsourcing hub in Mindanao, backed by steady regional economic growth, should retain the city’s attractiveness for more residential projects.

Davao Region’s economy expanded by 6.3 percent in 2024, the fastest growing region in Mindanao and higher than the national average of 5.7 percent.

Davao is undeniably a residential sweet spot in Mindanao and is a preferred site of property end-users and investors. The sustained demand over the past few years has encouraged national and homegrown developers to launch massive horizontal residential projects in Davao.

Based on latest Colliers Philippine data, prices of lot-only projects in Davao grew by 18 percent annually from 2016 to 2024.

There’s no question that the strong appetite for horizontal is unequivocal.

Prior to joining Colliers in March 2016, Joey worked as a Research Manager for a research and consutancy firm where he handled business, political, and macroeconomic analysis. He took part in a number of consultancy projects with multilateral agencies and provided research support and policy recommendations to key government officials and top executives of MNCs in the Philippines.