Philippine retail’s aggressive recovery

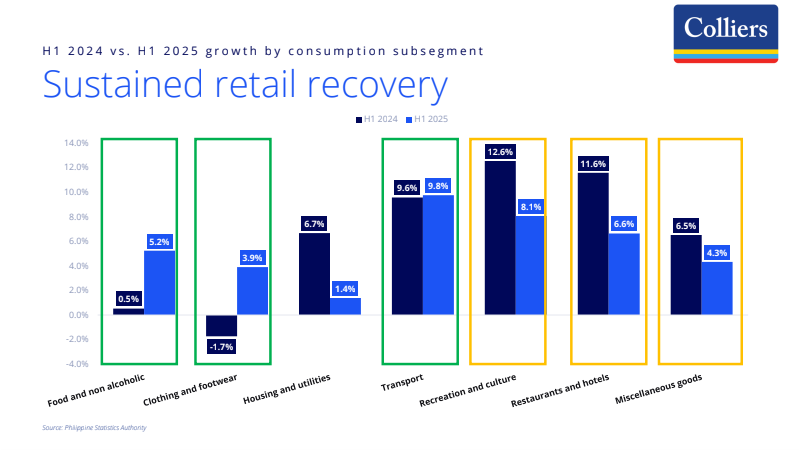

In the second quarter of the year, the Philippine economy grew by 5.5 percent–still among the fastest in Asia, next to Vietnam’s 8 percent growth.

Economic managers expect the economy to perform better in the second half and meet the lower end of the government’s growth target due to easing inflation, stronger household consumption, and the recovery in government spending following the election spending ban.

It helps that the Philippines is a household consumption-driven economy. So the billions of dollars of cash remittances sent home by Filipinos working abroad help propel the country’s economy.

With rising affluence and more young Filipinos being employed and contributing to the economy, we believe that the Philippines’ retail sector is well-positioned for stronger expansion in the years to come.

Rates ease, inflation cools

The Bangko Sentral ng Pilipinas (BSP) delivered its third consecutive rate cut for this year, lowering the policy rate by another 25 basis points (bps) to 5 percent in August as inflation continues to ease.

Inflation accelerated for the second consecutive month to 1.7 percent in September. As of the first nine months, average inflation hit 1.7 percent, below the government’s 2 to 4 percent target range.

In our view, easing inflation will likely prompt further rate cuts, supporting a recovery in the residential market that is still recording subdued take-up. Since August 2024, the BSP has already cut a total of 150 bps and has since indicated the possibility of another rate cut by yearend.

Cashing in on holiday spending

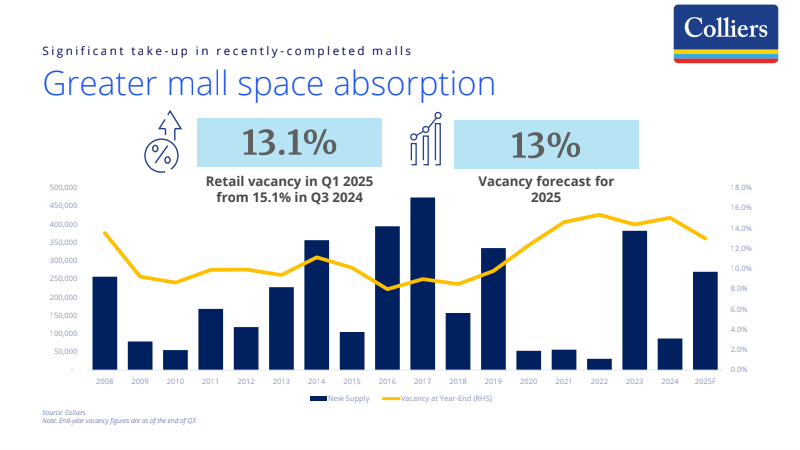

The fourth quarter is traditionally a strong period for retail and mall operators, who should take advantage of greater spending during this time.

Colliers believes that retailers need to ramp up their online and offline strategies especially now that demand is likely to increase due to holiday spending. In our view, holiday bonuses and additional remittances are likely to boost Filipinos’ purchasing power in Q4 2025.

Retailers and mall operators should seize this additional push for Filipinos’ propensity to spend.

Activity centers, events

In our view, mall operators should maximize the consumers’ willingness to visit brick-and-mortar mall spaces and participate in various activities held in malls’ activity centers.

Events such as wedding fairs, bazaars, and even housing summits can entice more consumers to visit malls, stay longer, and even spend more. Colliers believes that mall operators and retailers should closely coordinate in curating events that will be staged in malls’ activity centers

This is important as events play a key role in attracting mallgoers and in enticing them to spend more.

Assessing the ideal mix

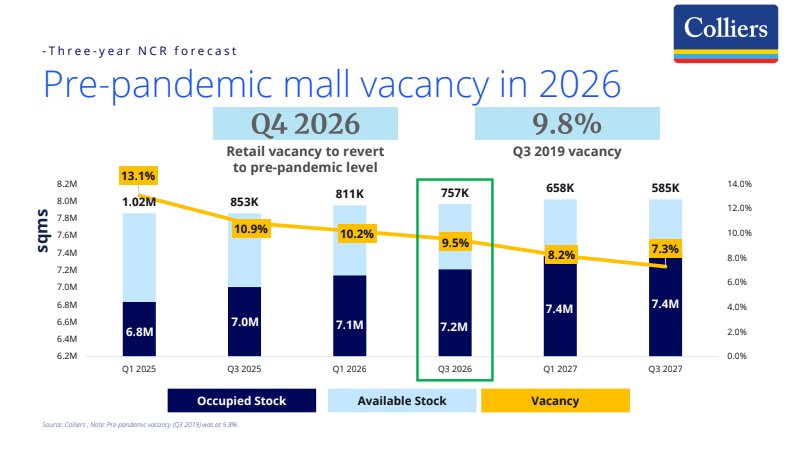

Mall operators should carefully reassess their retail mix, given the entry of more foreign retailers and expansion of local ones. This will especially be crucial for new malls that will open within the next 12 to 18 months.

Ramp up omnichannel strategy

Mall operators and retailers should work hand in hand in improving the omnichannel shopping experience of their consumers. While Filipinos have returned to brick-and-mortar shopping, retailers should also consider the segment of Filipino shoppers who continue to buy online.

In our view, redesigning physical mall spaces should be complemented by the improvement of retailers’ online shopping platforms. We see a continued reconfiguration of physical spaces and we see this trend even after the holiday-induced spending in Q4 2025 dissipates in early 2026.

Retailers should also be mindful of the security of their online platforms amid the proliferation of online scams. This is one measure that mall operators and retailers can implement to fully integrate and complement online and offline transactions.

Prior to joining Colliers in March 2016, Joey worked as a Research Manager for a research and consutancy firm where he handled business, political, and macroeconomic analysis. He took part in a number of consultancy projects with multilateral agencies and provided research support and policy recommendations to key government officials and top executives of MNCs in the Philippines.