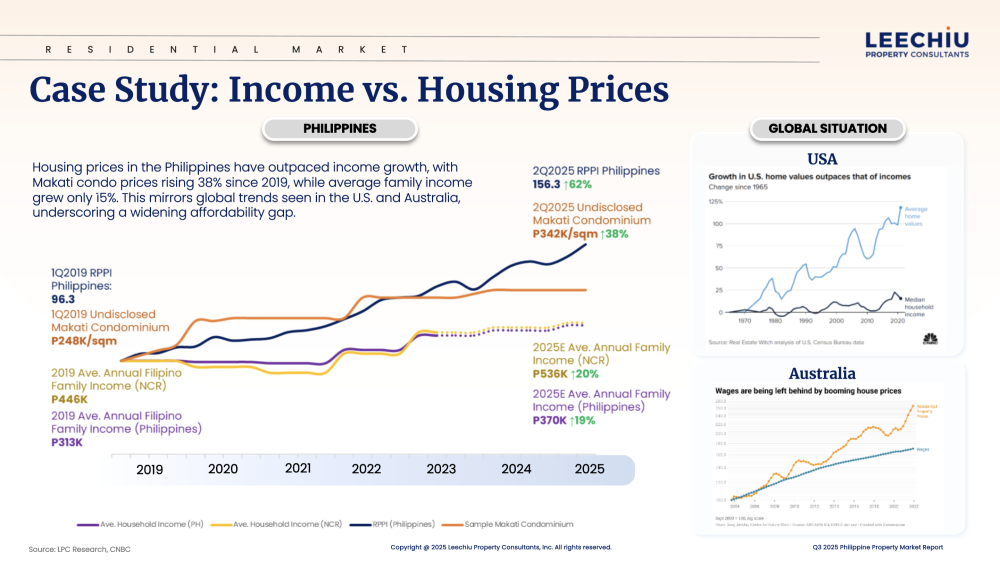

Affordability gap widens as home prices outpace income growth

Even as the residential market shows signs of renewed activity, property prices continue to rise faster than household incomes.

A case study of a condominium unit in a CBD highlights how this imbalance can play out at the individual level. Over the past five years, the price of this unit has increased by 38 percent, while average family income has risen by only 20 percent. While this example does not represent the entire Makati market, it illustrates how property values in prime locations are outpacing income growth.

But this situation is not unique to the Philippines. Countries like the United States and Australia are likewise experiencing housing costs rising much faster than income.

Steady demand for upscale

While the upper-income brackets continue to drive the bulk of residential sales, the middle-income segment, traditionally considered the backbone of the housing market, has softened.

The large supply of units prompted developers to scale back project launches in this range, mindful of higher financing costs and inflation that continue to affect buyers’ purchasing power.

Despite these challenges, demand remains steady in the upscale and high-end categories, where buyers have greater financial flexibility and are less impacted by loan rate fluctuations.

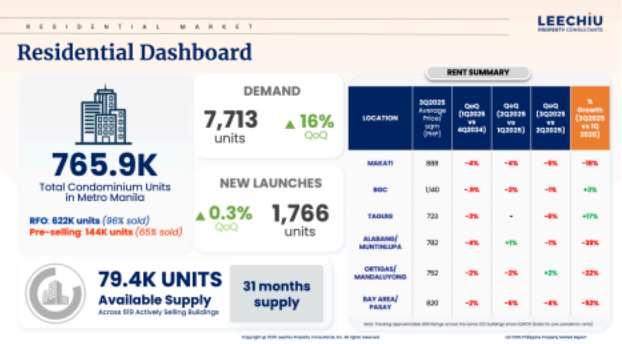

As of the third quarter of 2025, Metro Manila’s residential condominium inventory stands at 765,900 units, with 79,400 units still unsold across 619 actively selling projects. This translates to roughly 31 months of supply, down from 37 months in previous quarters.

Developers have deliberately moderated new launches to align demand with existing supply. This measured approach is helping stabilize the market, but it also highlights how access to new housing remains out of reach for many middle-income buyers.

Absorption across segments

Activity across different price segments reflects a similar divide.

The upper-middle and upscale markets, priced between P4 million and P12 million, continue to record strong absorption, supported by end-users and investors who can better adjust to rising costs.

In contrast, the middle-income segment, typically priced between P2.3 million and P4 million, is facing increasing pressure.

Many prospective buyers are struggling to qualify for housing loans or meet higher monthly amortizations, even with extended payment terms. Some have chosen to postpone their purchases altogether, while others are opting for smaller units or moving to more affordable developments outside Metro Manila.

Rental trends

Rental trends tell a related story. Rental yields currently range between 2.5 percent and 7.9 percent, though they generally lean toward the lower end of the spectrum.

Rents across most districts remain below pre-pandemic levels, particularly in the Bay Area and Alabang, which continue to feel the effects of the Philippine offshore gaming operators’ (POGO) exit.

Cautious optimism

Even so, the market has largely stabilized. Many investors are cautiously optimistic, encouraged by moderating property prices and the reduction in Bangko Sentral ng Pilipinas’ policy rates, leading to expectations that borrowing costs will gradually decline in the months ahead.

This has prompted some to re-enter the market early, anticipating stronger yields as rental rates begin to recover.

The divide between those who can buy and those who cannot, continues to grow.

Buyers with access to cash or equity financing remain active, while those reliant on long-term loans face greater barriers to entry. Saving enough for a downpayment has become one of the biggest hurdles for working professionals.

Developers are responding with extended payment terms and occasional discounts, but these measures can only go so far in addressing the structural challenges caused by slow wage growth and rising housing costs.

Finding balance

Narrowing this affordability gap will require coordinated efforts among developers, policymakers, and financial institutions.

This is already underway through the initiatives of key housing industry stakeholders. Encouraging affordable housing developments, providing competitive financing options, and improving transport links to emerging residential areas can help make homeownership more attainable.

For now, the market appears to be finding balance.

Developers are exercising restraint, inventory levels are moving toward healthier levels, and confidence remains intact in the higher-end segments.

Yet the widening gap between income and property prices remains a pressing concern, one that will shape how inclusive and sustainable the next chapter of the Philippine housing market will be.

The author is the director for Research, Consultancy, and Valuation at Leisure at Leechiu Property Consultants