Protect your hard-earned money from real and virtual thieves

Whether it is digital or face-to-face, con artists will find ways to try to separate people from their hard-earned money.

Scam artists have offered quick and high-return investments, well-paying jobs, or anything that performs every imaginable task, to lure people of all ages, educational attainment and economic status to “buy” the dream stuff they are peddling.

The recent edition of Campus Talks, the Philippine Daily Inquirer’s initiative to bring experts to discuss current and urgent concerns with students in different educational institutions, shares ways by which young people can protect themselves from being victimized.

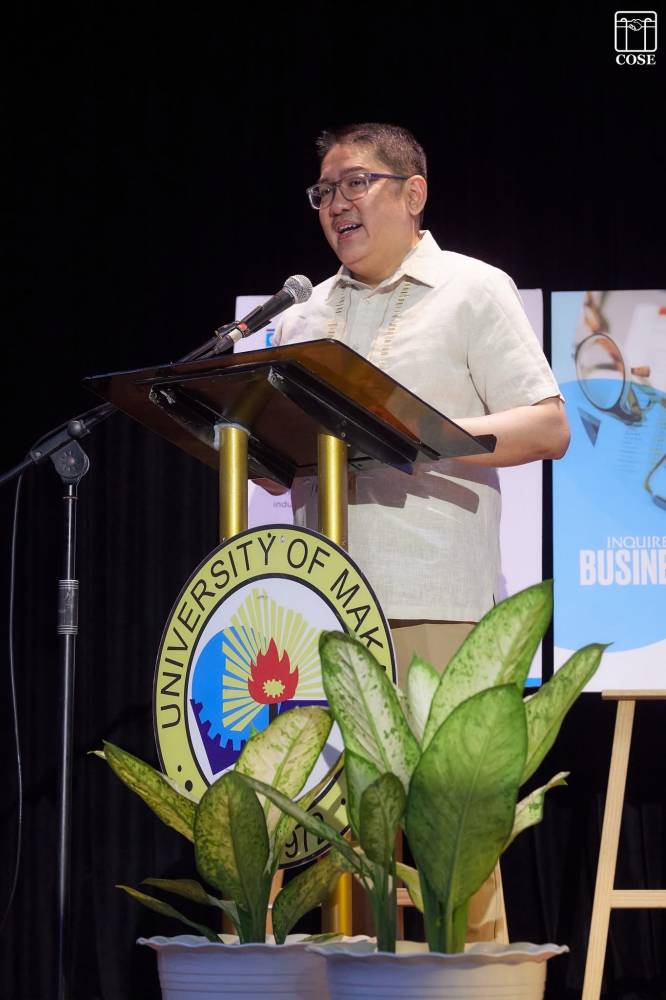

Filbert Catalino Flores III, director of the Securities and Exchange Commission (SEC) Enforcement and Investor Protection Department, and Jose Paolo Palileo, president of the Rural Bankers Association of the Philippines (RBAP), are the featured speakers on the topic “Smart and Safe: Protecting Your Money from Scams and Bad Decisions.”

Both speakers allay fears that technology will make everyone vulnerable and unable to protect themselves from bad actors looking for targets in cyberspace.

Vigilance and knowledge of tricks that criminals use are as useful in actual situations as they are in cyberspace.

Know the modus

Flores, in his presentation on “How to Spot Investment Scams,” identifies some of the ways con artists try to get money from their victims.

The Ponzi Scheme, for example, a con game that has been around since the 1920s, lure people with promises of quick return on investments. Prospective investors are promised a profit of as much as 50 percent in just 45 days or less, supposedly with little or no risk.

But what actually happens is early investors are paid from money earned from new investors. The scheme collapses when no new investors are “recruited,” so no new money can be distributed to members.

Job offer scams, quite prevalent these days, tell people they can earn money without leaving their homes. They will “simply” rate products, click on certain links or place small online orders.

Initially, recruits get small payments or commissions to build trust, but are later on encouraged to spend more time and money.

Cryptocurrencies or tokens, which many people still do not understand quite well, have become the scam du jour. Precisely because many people have little or no understanding of how the system operates, they are vulnerable to grandiose promises from glib scammers.

Pyramiding scams—where members buy products to join and have to recruit others to earn more—are probably more familiar to people.

Flores lists the common red flags associated with scams.

- All communications are done online without confirming the true identity of the person or entity behind the lucrative “offer.”

- Invitations are extended to private chat groups through referrals.

- Advertisements of investment or other income-generating opportunities are placed by persons or entities impersonating companies for the purpose of defrauding others.

Who’s legit?

Media reports say that online hackers are now getting into legitimate message boards of corporations and government agencies to make fraudulent offers.

Flores reminds his audience to report suspicious activities involving investments to SEC, which “is mandated to regulate the securities market and investigate fraudulent activities.”

RBAP’s Palileo, talking about “The Role of Rural Banks in the Future of Finance amid Digital Transformation,” points out that rural banks have built strong relationships with their clients. They are “known and trusted by their clients,” he notes.

“For Filipinos, relationship is important,” Palileo stresses. “Technology changes quickly but relationships are established over time.”

He also admits that it’s difficult to promote digital technology in rural areas. “People have a certain level of mistrust in technology.”

Education on technology is still inadequate or lacking in many sectors. But for Palileo, this does not mean rural banks should abandon financial technology (fintech) and deprive their clients of the convenience, security and speed that scientific advances offer.

Rural banks, he says, could connect and teach people the advantages of fintech and how to avoid its pitfalls.

He expects rural banks to be “innovation hubs in local communities” that will introduce their clients to the benefits of digitalization and give them the skills and tools to protect themselves from cybercrimes.

As there is not enough sharing of information in rural areas, he says RBAP members have programs to teach certain groups and communities about digitalization and cyberscams.

Flores adds that, in rural areas, scams are being committed face-to-face. Thus, SEC, through its extension offices, has embarked on an educational campaign to make people aware of these attempts to steal their money and also to warn those who have adopted fintech to watch out for online criminals.

Campus Talks “Smart and Safe: Protecting your money from scams and bad decisions” edition is presented by Gcash and Havaianas.