P1.6-billion tax cases brought against ‘BGC Boys’

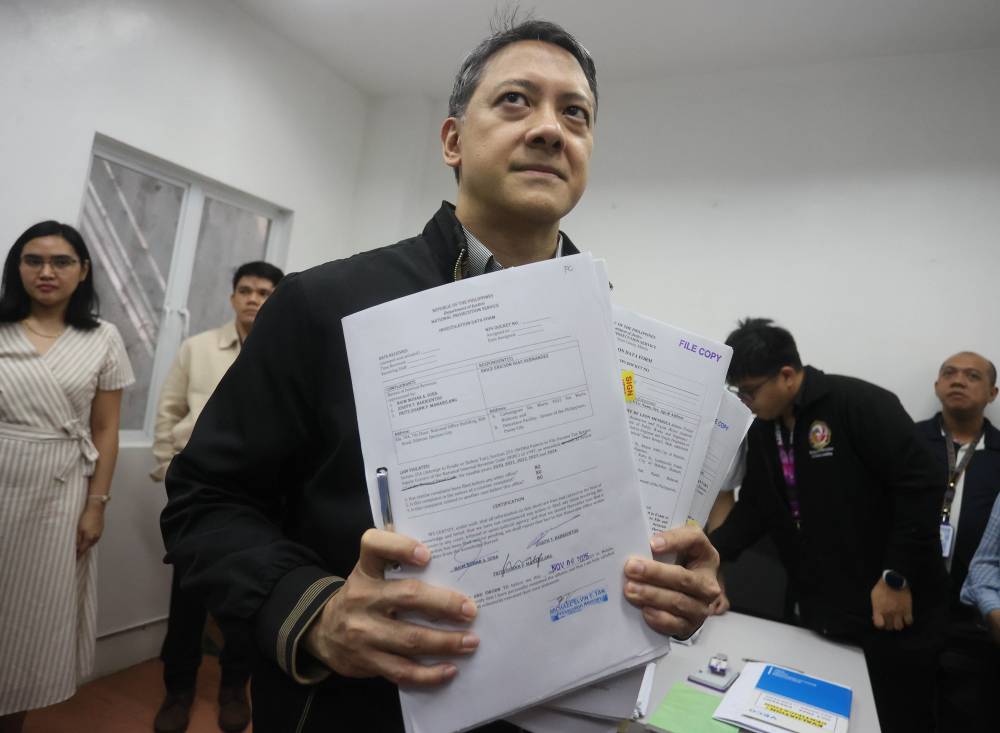

The Bureau of Internal Revenue (BIR) on Thursday filed before the Department of Justice criminal cases against the so-called BGC Boys (for Bulacan Group of Contractors), in connection with P1.6 billion in unreported income and related tax deficiencies from 2020 to 2024.

Named in the complaint are former Department of Public Works and Highways (DPWH) Bulacan first district engineer Henry Alcantara, former assistant district engineer Brice Ericson Hernandez, and former construction section chief Jaypee Mendoza.

The three have been charged with tax evasion and willful failure to file and to supply correct and accurate information in their income tax returns.

Alcantara, Hernandez and Mendoza also face criminal charges for their alleged involvement in allegedly fraudulent flood control projects.

BIR Commissioner Romeo Lumagui Jr. said their cases are the second batch related to that issue.

The BIR earlier filed a P7.1-billion tax evasion case against contractor-couple Pacifico “Curlee” and Cezarah “Sarah” Discaya in connection with their liabilities from 2018 to 2021.

SALN mismatch

Lumagui said three separate cases were also filed against the couple for unpaid individual income taxes, excise on their nine luxury vehicles, and documentary stamp taxes linked to their supposed divestment from four construction firms.

“We conducted a lifestyle check on Alcantara, Hernandez, and Mendoza. These three ex-DPWH officials had lavish lifestyles. We discovered P1.6 billion in income tax deficiencies alone after investigating the financial transactions, properties, business interests and tax returns of the aforementioned individuals. This is a clear case of tax evasion,” Lumagui told reporters.

He said in filing the cases, they used the DPWH officials’ statement of assets, liabilities and net worth (SALN) as well as the findings at the Senate hearings.

“In the SALN, we can see how much they declared, or how much assets or what properties they have. That’s why we saw that these properties do not match their income based on our records,” he said in Filipino.

Lumagui cited as an example the luxury vehicles that the former DPWH engineers owned.

“The vehicles are a different case. Those are included in the assets we also saw. So we included that in the tax liabilities because they were able to buy those. Based on their income tax or the taxes they paid, they had no capacity to buy these kinds of expensive vehicles,” Lumagui said.

More cases

He said the BIR is continuing its inquiry into other contractors and officials linked to the flood control anomalies.

Earlier Lumagui said the BIR is coordinating with the Independent Commission for Infrastructure and other government agencies in investigating government officials and contractors named in the flood control probe for possible tax evasion.

He said the amount involved will run to billions of pesos, noting that in one particular case, “in just one taxable year for a single taxpayer, we already found a billion in tax evasion.”

According to the tax chief, those found liable for tax evasion will face penalties, including payment of deficiency taxes, and may also face imprisonment.

“First, we will collect the deficiency tax—the amount they were supposed to pay,” Lumagui said in Filipino. “Second, if it is found that there was criminal intent, such as fraud, a criminal case for tax evasion will also be filed. So they will pay the deficiency tax and face a criminal complaint.”