Jumbo BSP rate cut hope rising

An outsized half-point interest rate cut by the Bangko Sentral ng Pilipinas (BSP) may be on the table after new data showed growth sliding to a four-year low, signaling a deeper easing cycle to support the economy.

This is according to Aris Dacanay, an economist at HSBC Global Investment Research. He said a jumbo cut could compensate for the lack of fiscal boost, as the ongoing probe into irregular public works has constrained government spending.

In a research note, Dacanay said the choice between a 25- or 50-basis-point reduction would likely hinge on moves by the US Federal Reserve, emphasizing the need to maintain a healthy policy rate differential to protect the peso. Already, the peso, which fell to a new record low late last month, has been under pressure as the corruption scandal triggered foreign fund outflows.

For now, the HSBC economist said the third-quarter growth of 4 percent—the weakest since the pandemic lockdowns that had sunk the economy by 3.8 percent in the first quarter of 2021—already sets the stage for another rate cut at the December meeting of the Monetary Board.

“History has shown us that the fiscal drag may persist for longer than warranted,” Dacanay said.

“Hence, to make up for the lack of a fiscal impulse, we think there is a downside risk that the BSP opts for an outsized rate cut of 50 bps (basis points) to 4.25 percent to support private sector demand and exporters,” he added.

Last October, the BSP’s policy-making board voted to cut the benchmark interest rate by a quarter point to 4.75 percent, citing the need to shore up business confidence bruised by a deepening investigation into dubious flood control projects.

That same scandal, the BSP said, could hurt government spending, adding risks to growth.

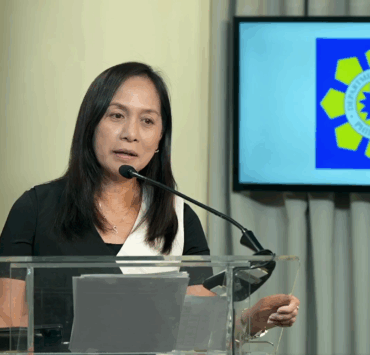

BSP Governor Eli Remolona Jr. previously said the “sweet spot” for the policy rate was now between 4 and 5 percent, adding that the central bank still had room to ease further—possibly as soon as December.

Separately, Arindam Chakraborty and Sanjay Mathur, economists at ANZ Research, said two additional quarter-point rate cuts were likely on the horizon.

“We do not anticipate a turnaround in government spending until governance issues are resolved,” they said. “Overall, it appears that the official 2025 GDP (gross domestic product) forecast of 5.5 to 6.5 percent will not be achieved.”

Gareth Leather, economist at Capital Economics in London, has the same projection, but said “the risks are skewed towards more easing than we currently anticipate.”