Underspending flagged as key PH hurdle

Plunder stings, but it is underinvestment that has stalled PH progress, experts say.

As outrage over the flood control scandal intensifies, economists warned that stolen taxes are only part of the problem, saying the Philippines’ slow economic progress stems just as much from years of underinvestment in key government agencies.

A 10-page commentary by De La Salle University (DLSU) economists analyzed that while the alleged plunder of billions of pesos has eroded public trust and weakened institutions, the country’s long-standing habit of allocating too little to education, industrial policy and infrastructure has had an equally damaging effect on long-term growth.

According to the economists, even if the Philippine government were entirely free of corruption and all corrupt officials jailed, it would not undo “generations of underinvestment in public services.”

“Philippine national budgets have always been too timid, over-indexed on the same macro-stability indicators favored by international credit agencies, and largely ignored by governments focused on growth,” said DLSU economists Jesus Felipe, Gerardo Largoza and Mariel Sauler.

“It is this persistent collective failure to grasp the country’s monetary reality that has likely cost the Philippines ‘lost decades’ of development, with or without corruption,” they added.

The hundreds of billions of pesos plundered, which the economists described as “the bad,” only proved that the country has long had the fiscal space to fund proper public spending.

Underinvestment, they said, is “the ugly.”

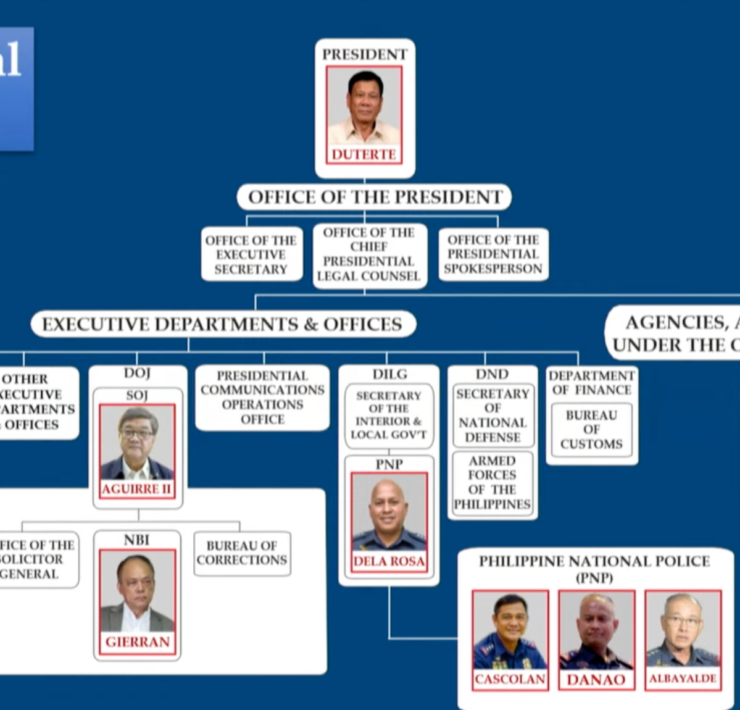

“It (corruption) is deeply immoral and must be fully prosecuted. But some forms of plunder are more destabilizing to the economy than others,” the economists said.

They pointed out that some countries richer than the Philippines have similarly corrupt governments—or even worse—but their economies are not dwindling.

“Philippine administrations have simply lacked the vision and leadership to do what every single developed country has done when it reached this stage: mobilize resources boldly to boost national productivity, while aggressively pursuing the kind of industrialization that rapidly raises incomes,” they added.

Populist solutions not the key

DLSU economists also warned that slashing the Department of Public Works and Highways budget, eliminating unprogrammed funds and declaring a tax holiday are populist measures that do not constitute good governance.

“The ugliest outcome from this historical moment would be for bad governance to be compounded by craven economics. That is, if well-meaning lawmakers and economic planners fear fiscal collapse so much they’re happy to continue a decades-long pattern of public underinvestment,” they said.

The country recorded a four percent gross domestic product (GDP) performance in the third quarter—the weakest since the first quarter of 2021, when the economy had contracted by 3.8 percent due to the pandemic.

The economy was largely dragged down by government spending cuts amid the anomalous flood-control projects, with infrastructure spending contracting to a decade-low of 26.2 percent as the scandal delayed fund releases and prompted stricter budgetary measures.

According to Secretary Arsenio Balisacan of the Department of Economy, Planning, and Development, the GDP could’ve been higher if not for the contraction.

Still, the DLSU economists said the Philippine economy did not collapse.

“However scandalous these crimes, both the national budget and the Philippine economy are today much larger than the public likely realizes. This means the economy can still absorb the conspicuous consumption of nepo-wives, nepo-kids, and nepo-sidepieces without triggering inflationary pressures.”

They added that the “possibly good” from the flood-control scandal is that, beyond jailing the corrupt, it has highlighted the need for reforms in public spending and fiscal management to drive Philippine economic growth.