SC upholds forfeiture of Ligot assets listed under kin’s name

Wealth acquired by a public official while in government service and which exceeds his or her lawful income is presumed ill-gotten and may be forfeited, even if placed under the name of other individuals.

The Supreme Court’s Third Division made this ruling as it upheld the forfeiture of the properties, bank deposits, and investment accounts of former military comptroller Lt. Gen. Jacinto Ligot, including assets traced to him but registered under his widow, children, and relatives.

Ligot served in the Armed Forces of the Philippines as commissioned comptroller from 1970 until his retirement in 2004.

After he died in 2024, his family continued to question the inclusion of some condominium units among the forfeited properties.

The high court decided the consolidated cases that stemmed from the lifestyle checks conducted by the Ombudsman to determine whether Ligot’s wealth accumulated while in active service was manifestly disproportionate to his AFP salary and other lawful income.

Family as fronts

A review of his statements of assets, liabilities and net worth from 1982 to 2003 found that a total of P135 million in funds and properties were illegally acquired, leading to a petition for forfeiture filed before the Sandiganbayan in 2005.

The petition cited the role of his wife, children, and his sister and brother-in-law, who were allegedly used as fronts to conceal his assets.

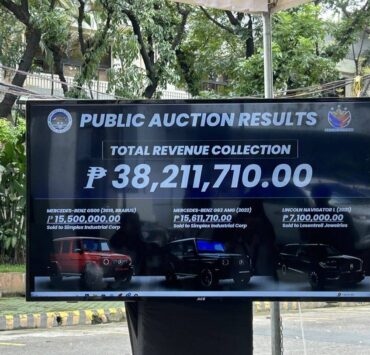

In the assailed 2021 ruling, the Sandiganbayan granted the petition in part and declared the properties amounting to P102 million as having been unlawfully acquired and subject to forfeiture.

The antigraft court found several undeclared properties registered under Ligot’s name and/or his wife’s name, while other undeclared properties were under their children’s names.

The Sandiganbayan also traced condominium units to Ligot, including units in Makati City listed under his sister’s name, for which most amortization payments were made by Ligot and his wife; and a unit in Taguig City registered under his brother-in-law, which had originally been purchased by Ligot’s wife.

Second petition

Eight years after the first civil forfeiture petition was filed, the government filed another forfeiture petition against Ligot and his family, alleging that bank deposits and investment accounts under their names were manifestly out of proportion to Ligot’s lawful income.

In this second case, the Sandiganbayan found that the investment funds amounting to P53.8 million were unlawfully acquired.

Ligot and his family then sought relief from the Supreme Court, arguing that the condominium units did not belong to him and were legitimately acquired by his relatives.

They also claimed that their deposits and investments were not disproportionate to the family’s income.

Ligot passed away in 2024 during the pendency of the petition but his family continued to pursue the case.

His sister and brother-in-law also filed their own petitions, maintaining that they owned the condominium units and should not be subjected to forfeiture.

No other sources

The Supreme Court ultimately rejected these claims and affirmed the Sandiganbayan’s ruling.

It noted that Ligot’s wife and children had no independent income sources yet owned properties and maintained substantial bank and investment accounts.

Meanwhile, although the condominium units were under his sister’s name, the amortizations were paid by Ligot, and the unit registered under his brother-in-law was initially purchased by Ligot’s wife, who likewise had no income of her own.

According to the high court, these circumstances showed that Ligot was the true owner of the assets, even if the legal titles were held by others.

“It bears emphasizing that Republic Act No. 1379 covers not only properties directly under the name of the public officer or employee, but also to those concealed or transferred to their spouse, relative, or any other person, so long as the true ownership is traceable to the said public officer or employee,” the Supreme Court said.

It stressed that RA 1379 would be useless if public officials could escape the law just by putting their illegally acquired properties under a third person’s name.

Under Section 2 of the law, the presumption of ill-gotten wealth still applies even if the property is registered to another person.

The 27-page ruling promulgated on March 5 and made public on Thursday was penned by Associate Justice Japar Dimaampao.