BIR suspends tax audits following complaints of abuse, corruption

The Department of Finance (DOF) on Monday announced the suspension of all field audits and related operations by the Bureau of Internal Revenue (BIR), following complaints regarding letters of authority (LOAs) and mission orders (MOs) issued by its personnel to harass taxpayers.

LOAs empower the bureau to examine a taxpayer’s books, records and other relevant documents to ensure tax compliance, while MOs authorize revenue officers to conduct surveillance on business establishments and apprehend violators of tax laws and regulations, among other functions.

The suspension covers the issuance, creation, printing and signing of those documents, effectively pausing all audit-related enforcement for the time being. There was no word yet until when the suspension is in place.

All BIR units involved in audit and field operations are directed to follow that order, including the Large Taxpayers Service, Revenue Regions and District Offices, Assessment Divisions, VAT Audit Units, and Intelligence and Special Audit Units. Only legally mandated or urgent cases are exempt from the suspension.

‘Taxpayer rights’

Finance Secretary Frederick Go said the tax audit suspension would “protect taxpayers from potential abuse.”

“All taxpayers shall be treated with the highest degree of professionalism, courtesy, and adherence to the rule of law. Our economy is built upon the contributions of our taxpayers who deserve fair and honest tax audits,” said Go, whom President Marcos appointed only on Nov. 17.

BIR Commissioner Charlie Mendoza, who took over the agency on Nov. 13, said in a statement: “This suspension is necessary to protect taxpayer rights, strengthen internal discipline, and ensure the integrity of our audit processes.”

“We take every complaint seriously, and any misuse of authority, harassment, or irregularity has no place in the bureau,” Mendoza said.

Money-making scheme

Last week Sen. JV Ejercito raised the bureau’s alleged “weaponization” of LOAs to “make money,” saying this has lowered confidence among domestic and foreign investors and undermined the country’s tax system.

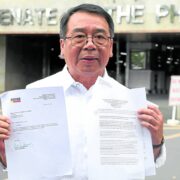

On Monday Sen. Erwin Tulfo filed Senate Resolution No. 180, directing the blue ribbon committee to investigate the alleged misuse of LOAs.

At a news conference and during plenary debates on the BIR’s proposed 2026 budget, Tulfo lamented the “corruption also happening at the BIR” while the country is preoccupied with anomalies regarding flood control projects.

“Even if a businessman has paid his taxes, his business is still subject to inspection. From what I understand, the LOA is being used as a search warrant. They will issue you an LOA if they have doubts about the taxes you paid,” Tulfo said.

He also cited complaints alleging that “examiners up to regional directors” are among the revenue officials involved in the alleged LOA scheme.

“This is why I say, if the [Department of Public Works and Highways] is the number one agency in corruption, the BIR is the second,” the senator said.

‘Trust, compliance’

Tulfo said he would invite Mendoza’s predecessor, Romeo Lumagui Jr., to the blue ribbon inquiry.

According to the senator, “corruption” in the BIR worsened last year on Lumagui’s watch.

In a statement on Nov. 17, the BIR said Lumagui had “concluded a transformative and high-performing tenure marked by strengthened enforcement, digital modernization, and consistent revenue growth.”

It also quoted Mendoza as saying that “When people walk into our offices and experience clarity, courtesy, and consistency, their trust in us grows. And when trust grows, compliance follows naturally. This is how we change the narrative, not through slogans, but through service. Because those paying taxes for the country are the true VIPs in our agency.”

Mendoza said on Monday that the BIR had established a technical working group on “LOA and MO Integrity and Audit Reforms,” to evaluate current tax audit protocols and recommend safeguards moving forward.

Apart from the controversy over its tax audit procedures, the BIR is also under pressure to meet revenue targets after the flood control corruption scandal slowed down government spending.