Philippine tourism set for growth in 2026

As someone who closely follows the rhythms of the Philippine tourism and hospitality sector, I’ve learned that progress in this industry rarely moves in a straight line.

The last few years challenged long-held assumptions and forced stakeholders to reevaluate strategies. Despite fluctuations in visitor arrivals and shifts in global travel patterns, one thing has remained clear to me: the fundamentals of Philippine tourism are sound and 2026 is shaping up to be a pivotal year of renewed growth.

While 2025 introduced its share of headwinds, the alignment of reforms, infrastructure improvements, and private sector investment is creating a foundation for a stronger, more sustainable industry moving forward.

Foreign arrivals: A softer 2025, but a clearer path ahead

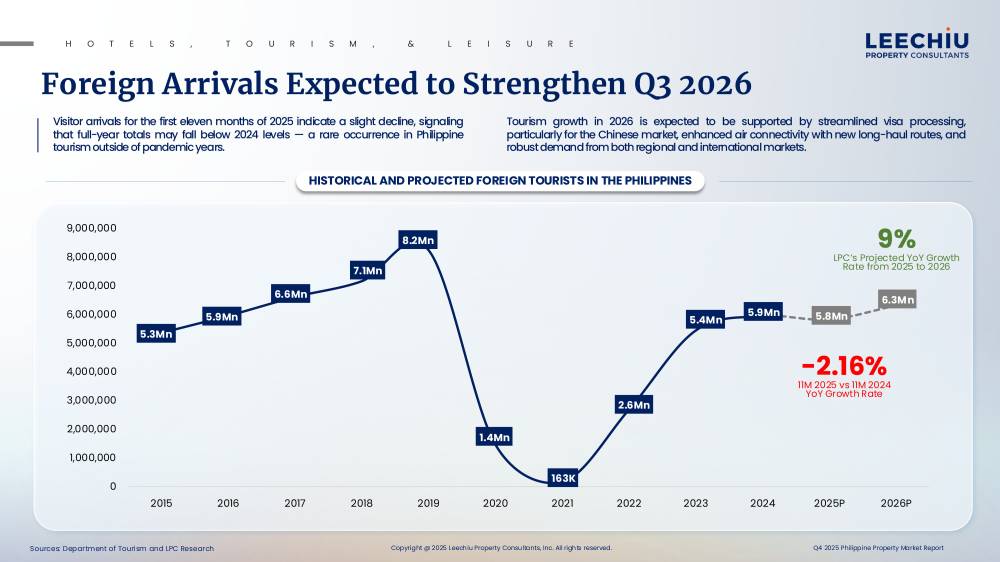

Foreign arrivals dipped slightly in the first 11 months of 2025 compared to the previous year–an unusual development in a non-pandemic period and one that naturally prompted questions. However, from my vantage point, the broader direction still trends upward.

Key structural changes are already in motion: More direct international flights, streamlined visa procedures (notably the Chinese e-visa rollout), and a deliberate diversification of source markets. These are long-term levers that expand access and reduce friction for inbound visitors. Their full impact will unfold gradually, but by the third quarter of 2026, we expect a stronger and more sustained rebound.

Airlines are restoring long-haul connectivity and adding regional routes. With improved accessibility comes greater traveler confidence, which is an important factor that enhances our competitiveness across Asia.

Domestic tourism: The industry’s steady anchor

One constant throughout my years observing this sector is that domestic tourism remains our most dependable engine of growth.

Filipinos continue to travel, spend, and discover new destinations across the archipelago. Even with softer foreign arrivals this year, hotels are projected to end 2025 with an average occupancy of 60.17 percent, slightly higher than 2024’s 59.62 percent. This resilience underscores the strength of local demand.

The return of business travel as well as meetings, incentives, conferences, and exhibitions (MICE) events, the rising consumer confidence, and the improved mobility across provinces will keep domestic tourism as a critical stabilizer in 2026.

Robust hotel pipeline signals investor confidence

If investor sentiment is a barometer of future performance, then the hotel pipeline offers a compelling signal. The Philippines is slated to add 12,249 rooms across 50 projects in 2026, a volume that reflects long-term confidence rather than caution.

Metro Manila will see the most additions, but the spread of development across Cebu, Palawan, Baguio, Boracay, and Davao points to a sector broadening its horizons. Upper midscale hotels continue to attract developers because of more manageable costs and quicker returns, while local brands are expanding to capture evolving traveler preferences.

These developments point to a maturing hospitality landscape and investors who believe in sustained demand beyond cyclical swings.

A renewed push for global visibility

The Department of Tourism’s restored P1-billion promotions budget for 2026 is another welcome catalyst. Though still modest compared to our regional peers, it signals a renewed focus on global presence at a time when tourism marketing has become increasingly competitive.

With strengthened public-private collaboration and better targeted campaigns, we expect this investment to help amplify international arrivals toward late 2026 and into 2027.

A recovery that builds, not bounces

Investors and operators often ask me the same question: Is the tourism recovery truly underway?

My response is clear yes, but it will build gradually rather than surge overnight.

Domestic travel will continue to anchor the industry. Improved connectivity will open new growth corridors. A softer peso enhances our attractiveness to foreign visitors. And the increasing role of private operators in airports is already poised to improve the travel experience.

Taken together, these factors provide strong reasons for confidence. Despite the marginal decline in foreign arrivals in 2025, I believe the sector is entering 2026 with renewed momentum.

Let me put it succinctly: We expect inbound foreign arrivals to grow steadily in 2026. The rollout of e-visas for Chinese travelers, expanding flight routes, and a more diversified tourist mix are all supporting recovery. A softer peso is also making the Philippines more competitive, and with private investors now taking a larger role in airport operations, connectivity is set to improve. Growth will be modest, but the trajectory is unmistakably upward.

As the landscape continues to evolve, what matters most is that the direction is clear—and firmly set for growth.

The author is the director for Hotel, Tourism, and Leisure at Leechiu Property Consultants Inc.