BSP easing may end sooner than expected

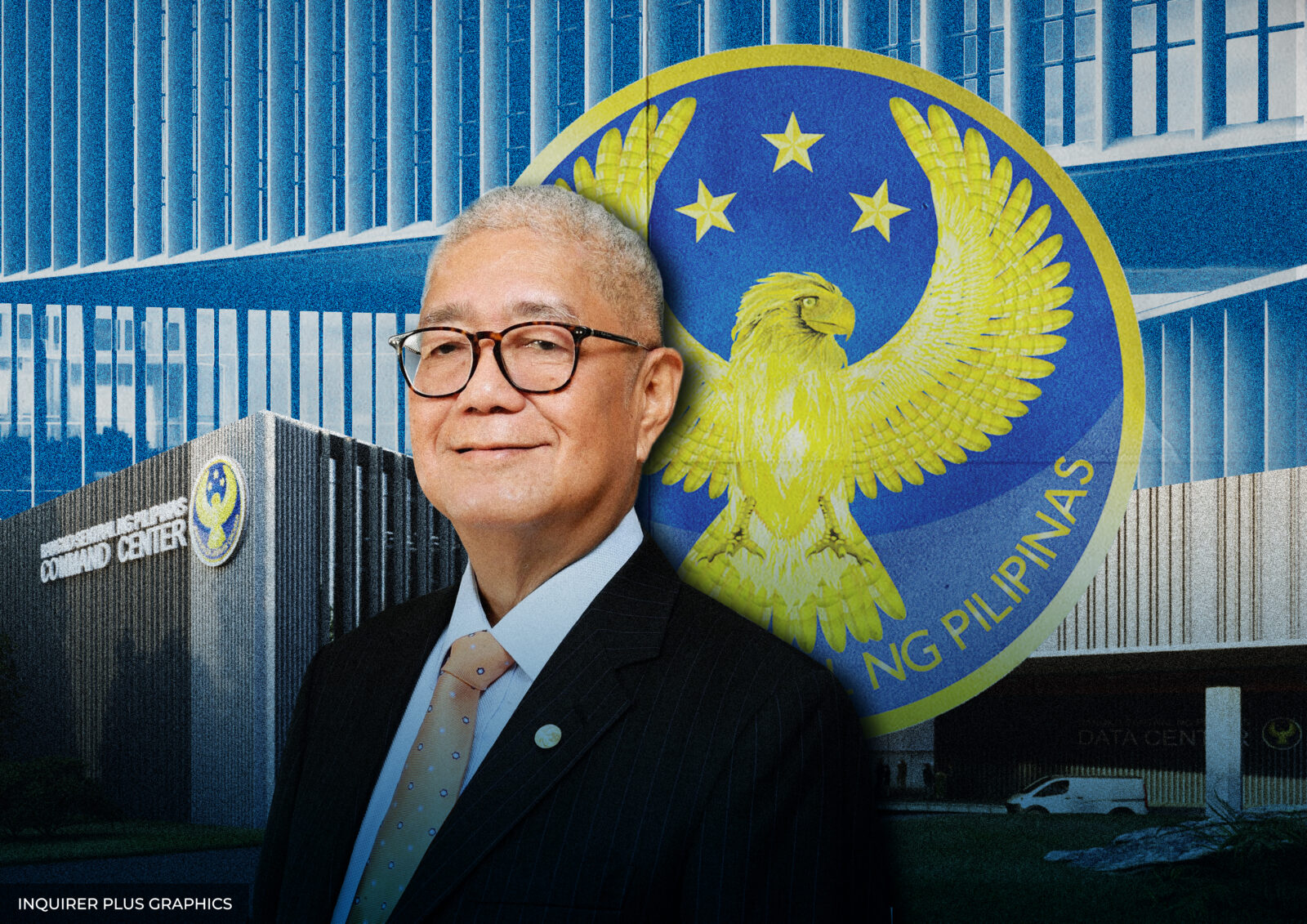

Recent developments like the peso’s back-to-back record losses and a spike in global oil prices amid heightened geopolitical upheavals may prompt the Bangko Sentral ng Pilipinas (BSP) to end its rate-cutting campaign sooner than expected, UnionBank said.

In their latest MktsFocUs report, economists at the Aboitiz-led bank said the BSP was still expected to focus on supporting economic growth amid a sweeping anticorruption drive that has exposed weaknesses in governance and battered confidence.

“Fragile growth momentum is expected to persist into much of 2026, constrained by stalled infrastructure spending as the government prioritizes anti-corruption reforms, alongside weak sentiment, and cautious private consumption,” UnionBank said. “This backdrop implies further BSP easing.”

However, UnionBank economists said increasing bets of further BSP cuts could weigh on the peso, which may test new record lows and trade between 59.30 and 59.70 in the near term.

The local unit, they warned, remained vulnerable to pressures both at home and abroad.

Among the risks, they cited heightened tensions involving Iran, which have driven up energy prices and threaten to hurt net oil importers such as the Philippines.

“Broader confidence continues to be weighed down by the daunting task of addressing systemic government corruption, which remains a structural handicap for the local currency,” they said.