Get ready for ‘Next Asian Wave’

No stress, and an “unapologetic energy” with East Asian influences—this is the vibe that consumers are bringing into 2026.

According to a recent report by Euromonitor International, four significant behavioral shifts will define shoppers this year, as they continue to face volatility and constant pressure society: a retreat into “Comfort Zones,” the rise of the “Fiercely Unfiltered” individualist, a “Rewired Wellness” revolution demanding clinical-grade solutions, and the “Next Asian Wave” of cultural and commercial influence.

According to the newly released Top Global Consumer Trends 2026 report, nearly 58 percent of consumers worldwide experience moderate to extreme stress daily, yet fewer than half participate in regular stress-reduction activities.

The gap between pressure and relief has never been wider, and it’s fundamentally reshaping how people spend, what they value and who they trust.

Comfort zones

The research, which synthesizes data from five Voice of the Consumer surveys across 140 markets, reveals how consumers are adapting to what feels like unrelenting volatility.

Two out of five feel that they are always under pressure to get things done, and two-thirds are actively seeking ways to simplify their lives. Their response? A strategic withdrawal into carefully curated comfort zones.

“Consumers are reevaluating how they spend their time, money, and energy,” the report states. Their new standard is “less but better”; embracing simplicity and practical routines over the exhausting pursuit of optimization.

This shift manifests in unexpected ways. Take sustainability: The percentage of consumers who believe they can make a difference through their choices fell from 56 percent in 2024 to 51 percent in 2025. Rather than feeling defeated, consumers are adapting pragmatically by, for example, purchasing air conditioners to cope with climate change rather than attempting to reverse it. Sales are expected to surpass 189 million units globally in 2026.

The home has become a haven. Adult pacifiers went viral in 2025 as stress-relief tools, while scented candle sales are projected to exceed $3 billion in 2026. There is likewise rising demand for products with natural, wholesome ingredients.

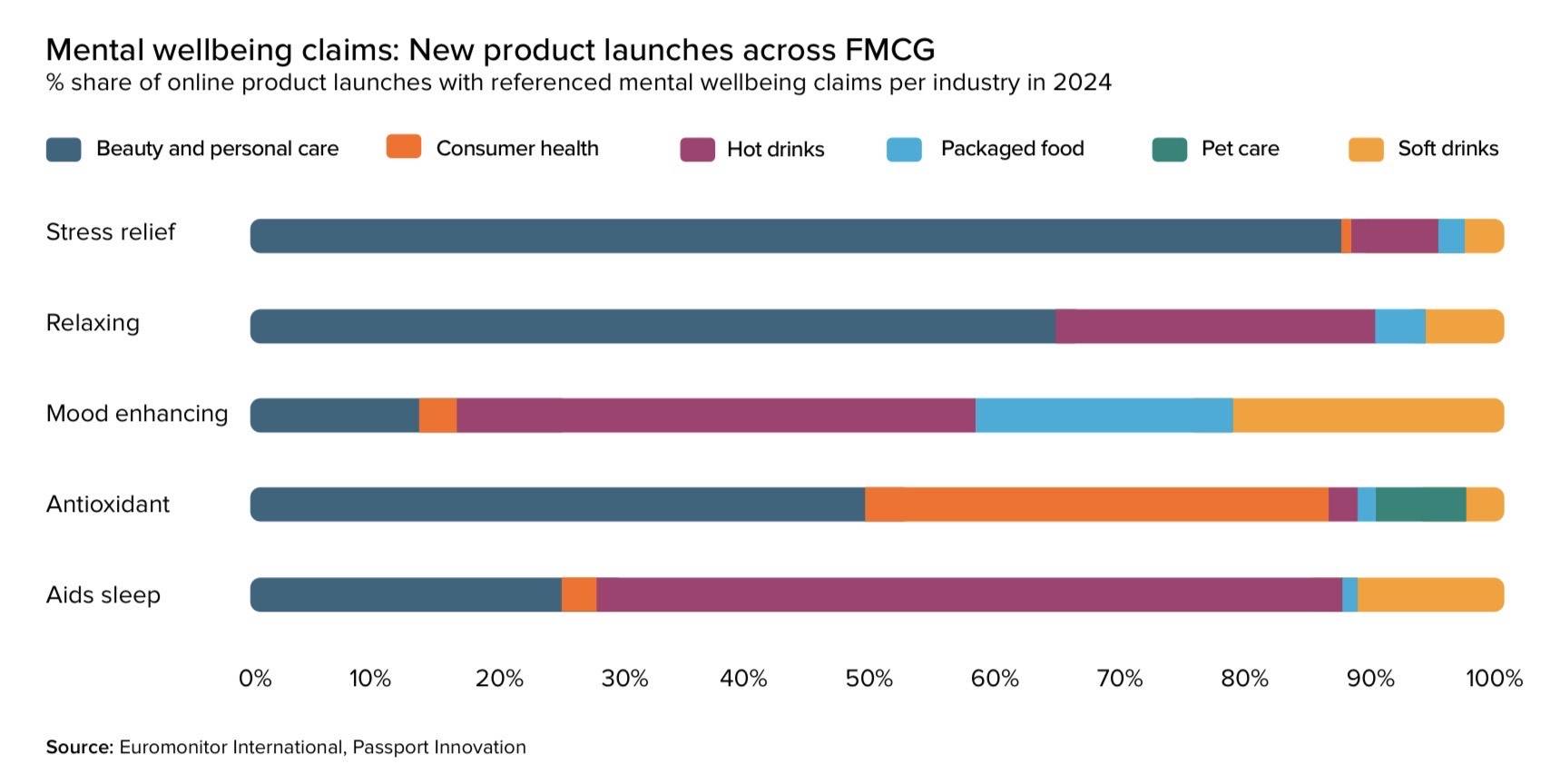

Mental well-being claims are appearing in 10 percent of new health-focused product launches, with stress relief, relaxation and mood enhancement leading the charge. Companies are responding with everything from calming botanicals to smart home devices that promise to streamline daily chaos—though one in three voice assistant users report using them simply to make routines easier.

Fiercely unfiltered

Yet even as consumers seek comfort, they’re simultaneously demanding radical honesty and celebrating defiant individualism. The Fiercely Unfiltered trend captures a generation—particularly Generation Z and younger millennials—rejecting curated perfection in favor of raw authenticity.

Only 15 percent of consumers now associate social acceptance with beauty. Instead, 38 percent define it as being comfortable in your own skin, while 36 percent see it as inner confidence. Nearly half of consumers like to be distinct from others, and two-thirds feel comfortable expressing their identity with friends and family.

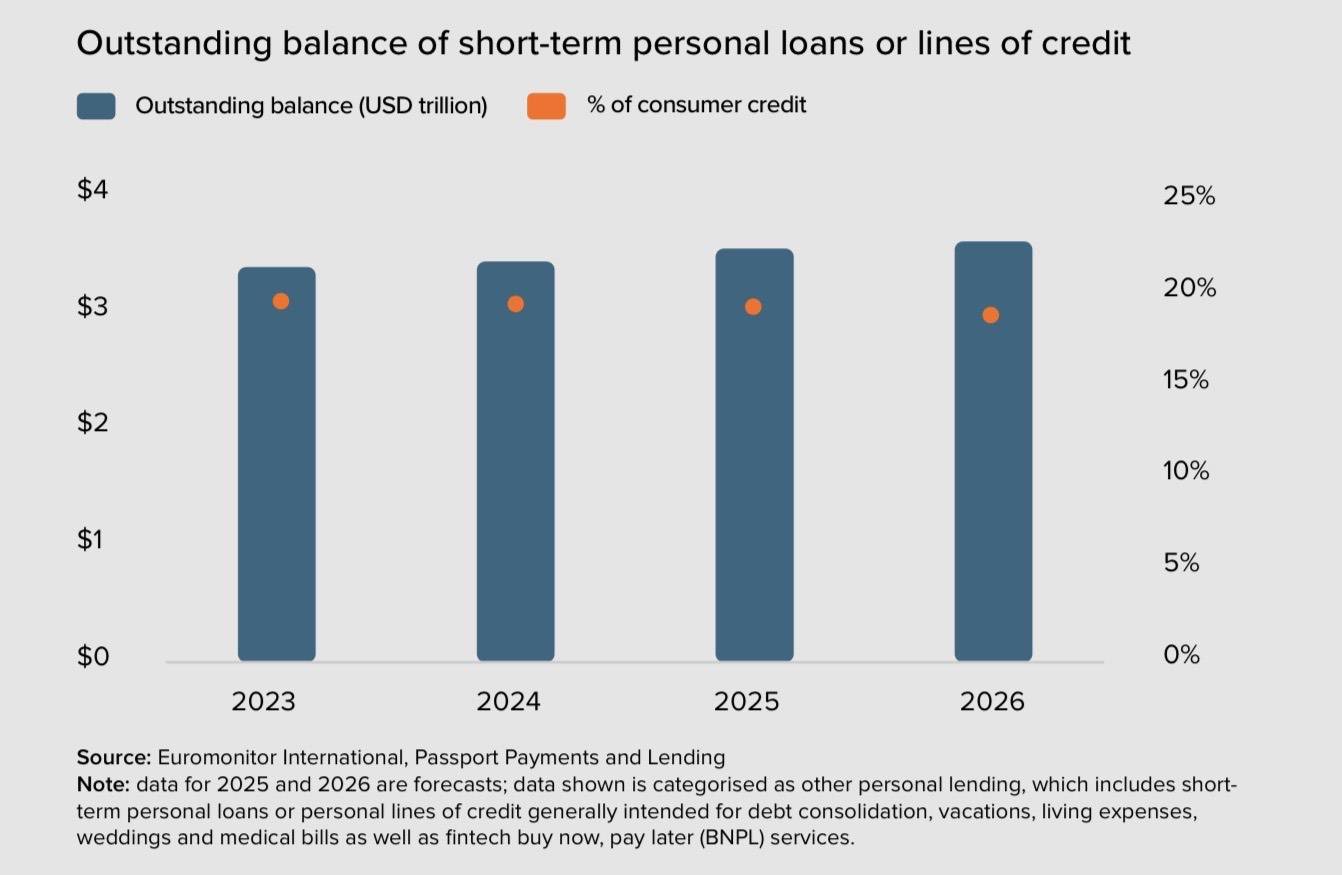

This isn’t just philosophical posturing; it’s reshaping consumption patterns. Three out of seven consumers admit they like to enjoy life without worrying about planning for the future, even as long-term milestones like homeownership feel increasingly unattainable. Outstanding balances on short-term personal loans continue to climb globally, reflecting what some call “doom spending”—the prioritization of immediate fulfillment over deferred gratification.

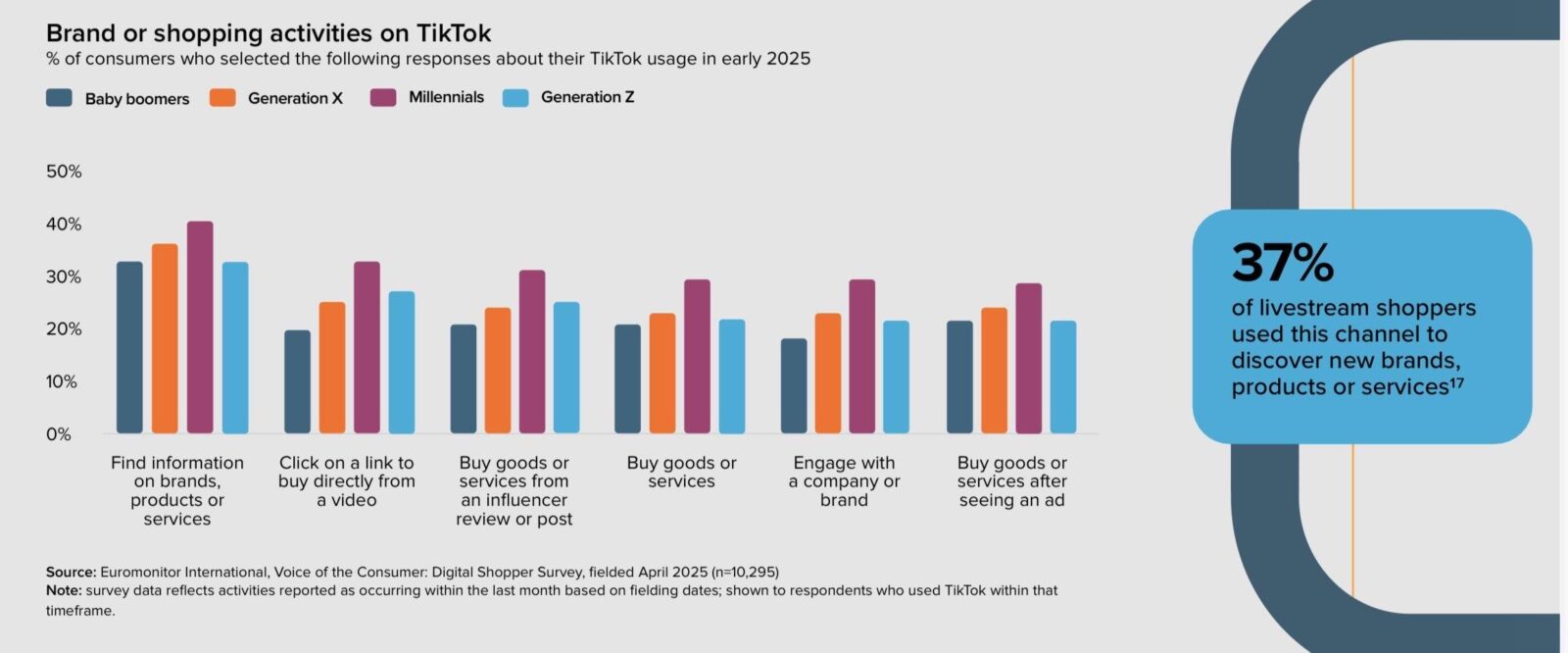

“Purchases aren’t just about utility, but reflect their authentic selves and aspirations,” the report explains. One out of four livestream users cite community as their primary motivation, gravitating toward voices that challenge mainstream narratives and validate their experiences.

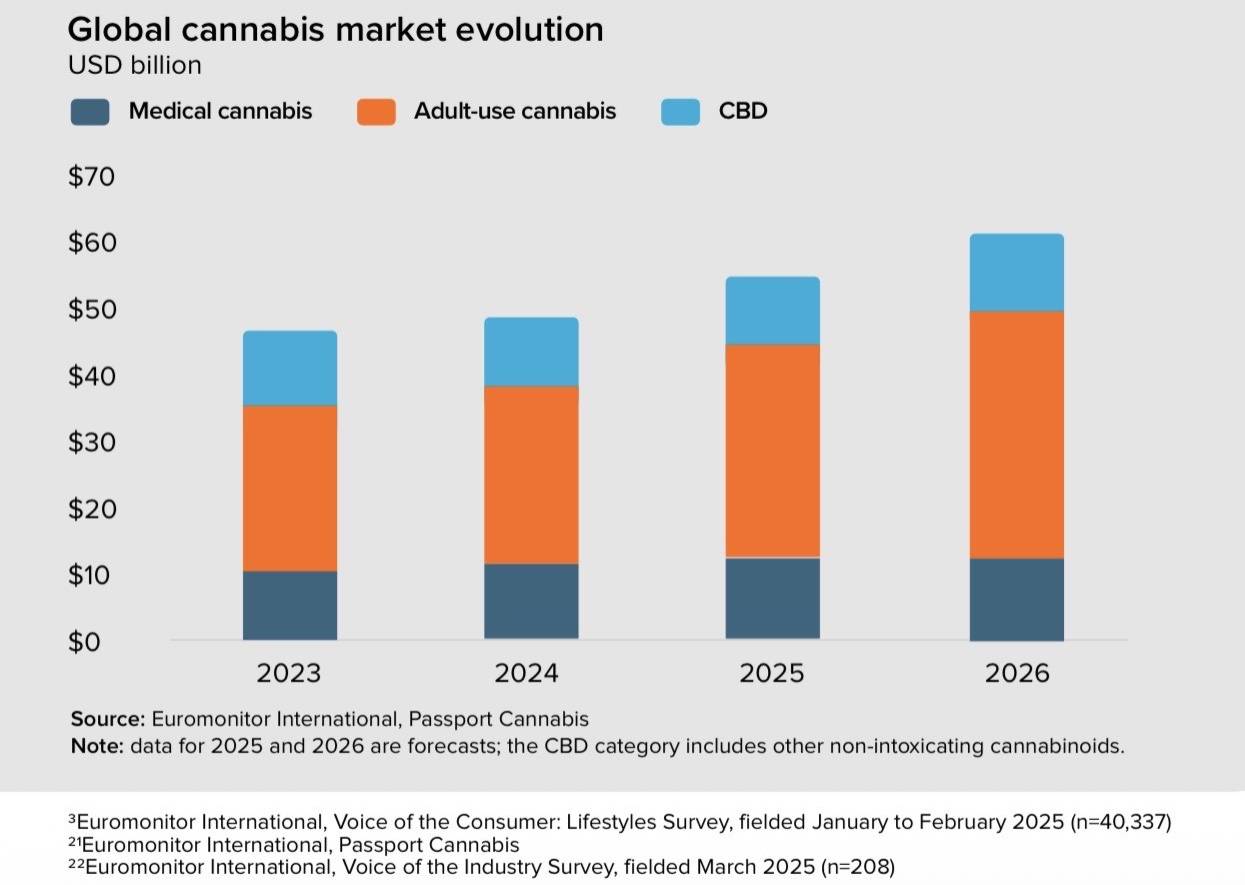

The implications for business are profound. Nearly half of consumers want products uniquely tailored to them, while 58 percent seek curated experiences matching their tastes. Successful companies are abandoning one-size-fits-all strategies for hypersegmentation, from customizable travel to distinct flavor profiles to cannabis-infused formulations (a market expected to reach nearly $40 billion in legal recreational sales in 2026).

Rewired wellness

Consumers are now rejecting traditional wellness in favor of what the report calls “Rewired Wellness,” or the expectation that everyday products deliver pharmaceutical-grade results.

Three out of four consumers now track their health with devices or apps. Among those trying to lose weight, 9 percent take GLP-1 drugs (used primarily for type 2 diabetes and chronic weight management, up from 6 percent in 2024. What was once considered taboo or limited to clinical settings is rapidly moving mainstream.

The shift cuts across generations, though with different motivations. Nearly a third of baby boomers track blood pressure, monitoring age-related concerns. Meanwhile, 34 percent of Generation Z and 31 percent of millennials track sleep, adopting preventative habits earlier to shape lifestyle choices. Close to 40 percent of consumers are comfortable using at-home diagnostic kits.

These consumers demand real-time tracking and instant insights to make on-the-spot adjustments—and they’re willing to pay for it. Nearly half would spend at least 10 percent more for beauty products with scientific formulations, while medical endorsements and medicated formulations command similar premiums.

The numbers tell the story: global consumer expenditure on health goods and medical services is projected to reach $6.9 trillion in 2026. Dermocosmetics posted double-digit growth in every region from 2020 to 2024. Nearly 1,200 new high-protein products launched online between September 2024 and August 2025, many positioned to complement GLP-1 therapies.

“Wellness is no longer a universal journey or slow progression but an agile, science-driven pursuit of quick, visible benefits,” the report states.

Next Asian wave

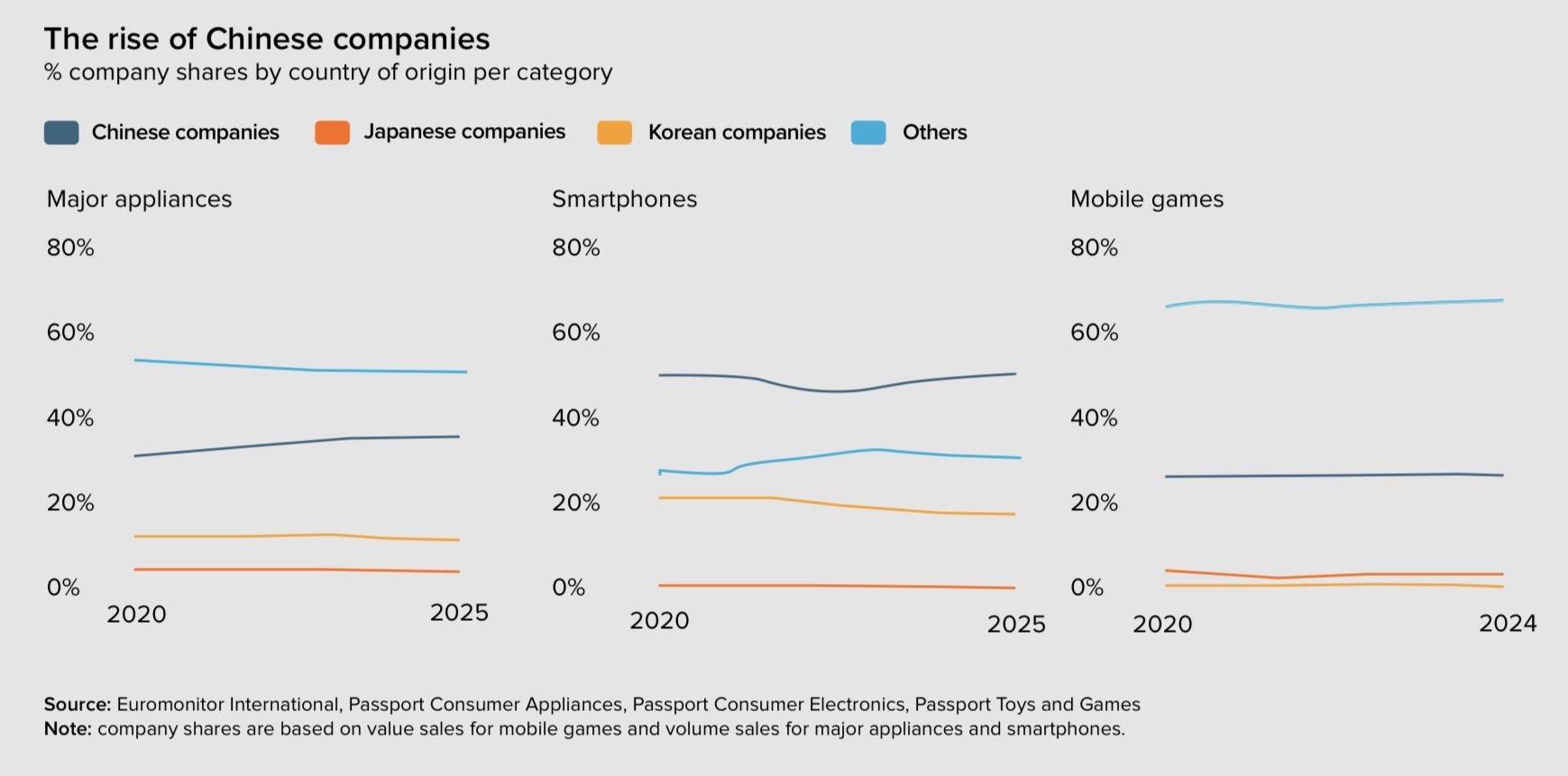

Weaving these trends is a cultural influence impossible to ignore: that of East Asia, particularly China. While Japanese anime and Korean beauty have long influenced global consumption, Chinese brands are now entering the spotlight.

Pop Mart’s Labubu toys have become a worldwide sensation. Ne Zha 2 claimed the top spot as the highest-grossing animated film ever. One out of five consumers in 2025 associated Chinese beauty products with innovative technology and formats.

The shift is powered by digital platforms and price accessibility. In early 2025, one out of four TikTok users made purchases on the platform. Chinese-founded platforms like SHEIN, Temu and TikTok Shop attract shoppers with wide assortments, personalized recommendations and mobile-first interfaces featuring gamification.

Four of the top five global e-commerce retailers in terms of 2024 sales either originated or are based in China. The country is forecast to export $4 trillion in goods and services globally in 2026, with cross-border retail e-commerce sales projected at $127.4 billion.

Chinese electric vehicle manufacturer BYD dominated the electric vehicle market and led global unit sales in 2024, reshaping price expectations worldwide. Even with export markups and tariffs, these vehicles typically undercut Western competitors.

More than 60 percent of consumers report that international products are more readily available now than five years ago. Two in three believe experiencing cultures other than their own is important.

What emerges from these trends is a portrait of a consumer caught in between contradictions: seeking simplicity while demanding personalization, craving authenticity while embracing high-tech interventions, retreating into comfort while fiercely asserting individuality.

In a world that feels increasingly out of control, it seems consumers are exercising control wherever they can—whether that’s turning their homes into sanctuaries, their bodies into optimization projects, or their purchasing decisions into acts of self-expression.

“Consumers will focus on what they can control to remain grounded, reclaim balance, and build a foundation for long-term resilience,” the report suggests.

For businesses, the message is clear: the old playbook won’t work. Success in 2026 will require delivering products and services that offer not just functionality but emotional resonance. That means comfort without compromise, authenticity without pretense, clinical results without complexity, and cultural relevance without appropriation.