BSP wants bank secrecy law amended to avoid return to ‘gray list’

DUMAGUETE CITY—The Bangko Sentral ng Pilipinas (BSP) will press for a sweeping overhaul of the country’s Bank Secrecy Law that would allow authorities to scrutinize accounts across a broader swath of the economy suspected of moving illicit funds.

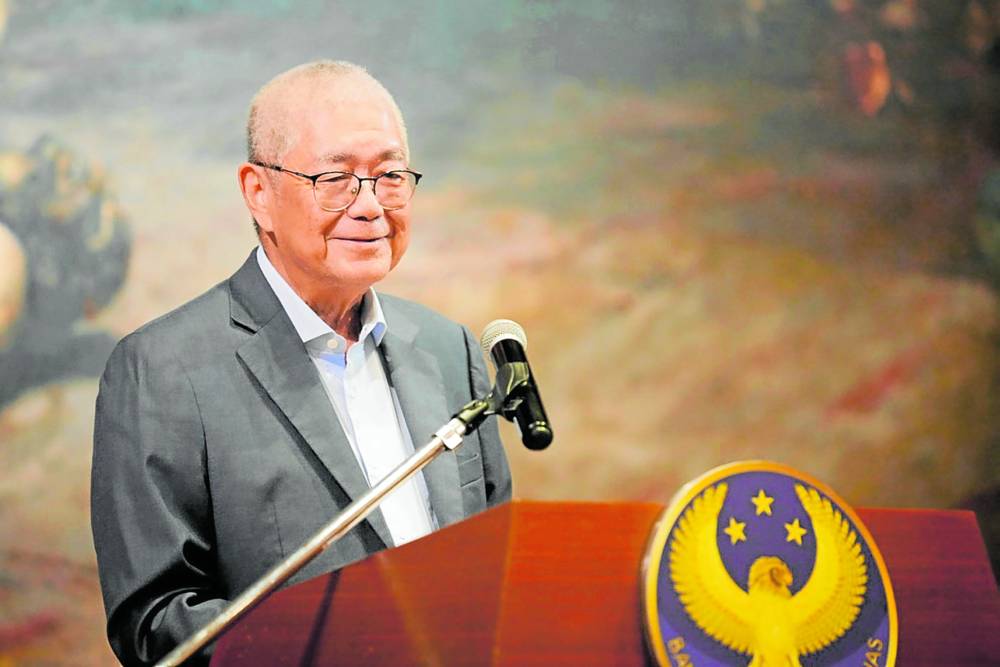

Roberto Figueroa, the central bank’s general counsel, said officials were counting on looser secrecy rules to help keep the Philippines off a global “gray list” for money laundering, as a corruption scandal could risk drawing renewed international scrutiny of the country’s financial system.

BSP Governor Eli Remolona Jr. expressed a similar sentiment during a forum on Monday with journalists, saying that the graft fallout could risk dragging the Philippines back onto the Financial Action Task Force’s “gray list”—a watchlist the country had just exited in early 2025 after over three years of efforts to remedy gaps in its antimoney laundering and counter-terrorism financing campaigns.

“To be honest, we have a risk of returning to the gray list,” Remolona said. “Although we’re doing what we can to prevent that.”

Figueroa added that the BSP is backing the Senate’s version of proposed amendments to the law, which would empower not only the central bank but also other regulators, including the Securities and Exchange Commission, to inquire into bank deposit accounts to safeguard the integrity of the financial system.

In December, the House of Representatives approved its own version on third and final reading, although it narrowed the range of people subject to investigation to stockholders, owners, directors, trustees, officers or employees of BSP-supervised firms, as well as alleged conspirators.

Broader Senate version

While the BSP also supports the House bill, Figueroa said the Senate proposal was “much broader.” “We will voice our support to that broader scope of specified or covered persons. So that’s how we’re going to do it,” he told reporters at the same forum.

The central bank once exercised authority to look into bank deposit accounts under a 1981 presidential decree, but it was stripped of that power in 1993 when the BSP Charter was enacted. Today, the Philippines remains the only country with bank secrecy rules that restrict prudential supervision.

Perfect timing

Figueroa said the expanding investigation into the flood control mess—which has ensnared lawmakers, Cabinet officials and public works engineers—had heightened the urgency of easing bank secrecy rules. He added that public demands for greater transparency and accountability could help rally legislative support for the proposal.

“I’m optimistic,” he said. “Because the amendments to the bank secrecy law are related to these other political developments.”

Since the start of its crackdown last year, the Anti-Money Laundering Council has obtained court approvals to freeze assets totaling P24.7 billion, believed to be connected to the flood control scandal.