BIZ BUZZ: Remolona’s benchmark revolution

The Philippines’ fledgling interest rate swap market is gaining serious momentum, and it might just be the spark needed to build a more reliable yield curve for pricing financial products—from bank loans to bonds.

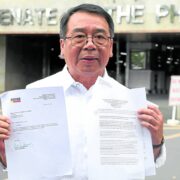

That’s the upbeat outlook from Bangko Sentral ng Pilipinas Governor Eli Remolona Jr., who sees developing a new benchmark as one of his top three goals to deepen the local capital market. He hopes it will eventually replace the “choppy” valuation curve at present.

Remolona, the guest speaker at the inauguration of Bloomberg’s new Philippine office at Zuellig Building in Makati on Wednesday, said, “Results speak for themselves.”

And the central bank chief pulled out numbers to back it up: trading volumes soared from P700 million in 2024 to a whopping P43.5 billion in January 2026. Activity is also stretching further along the curve, with one-year and even three-year tenors now showing life—a sign the market is finally forming clear interest rate expectations.

In short: the swap market isn’t just warming up, it’s showing off.

******

Get real-time news updates: inqnews.net/inqviber