Investment delays pose risk to PH credit standing

Delays in public investment and persistent governance weaknesses pose additional downside risks to the Philippines’ near-term growth and could pressure its stable credit standing, according to global debt watcher Moody’s Ratings.

The country holds a “Baa2” rating with a stable outlook from Moody’s, which has been maintained, but the credit rater flagged vulnerabilities that could temper its credit strengths.

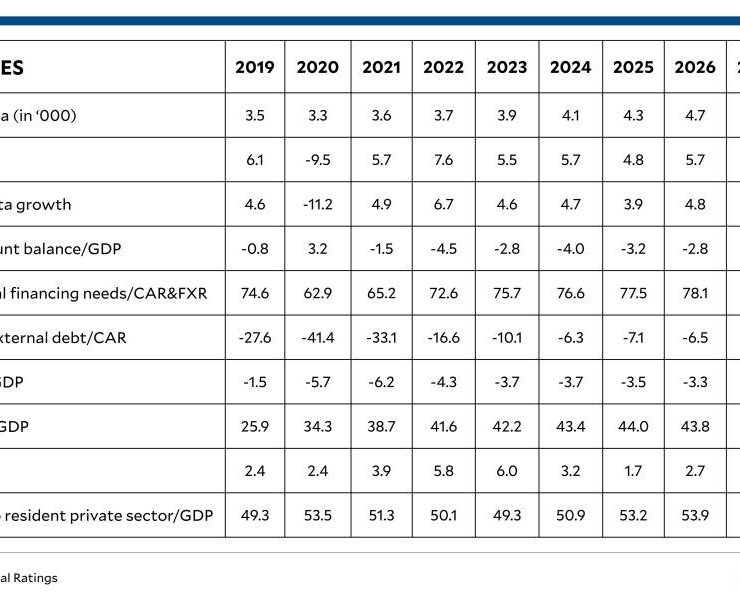

As it stands, the Philippines suffered from a disappointing 4.4-percent economic growth in 2025, mainly due to a sharp contraction in government infrastructure spending.

To support the recovery, Moody’s said public investment should start providing additional momentum, with the agency projecting gross domestic product growth of 5.5 percent in 2026 and 5.6 percent in 2027.

“Nonetheless, our baseline assumes that the recovery in public investment will be gradual and begin only in the second half of 2026, as the government continues to take concrete measures to address the temporary slowdown, including strengthening oversight of project disbursements,” Moody’s said in a credit opinion on Feb. 16.

“Any delays or implementation mishaps would pose additional downside risks to near-term growth,” it added.

Moody’s also noted that any material erosion in the quality of legislative and executive institutions would be credit negative.

The Philippines’ institutions and governance strength is scored at “Baa1,” which indicates a moderate credit risk on political and legal governance and contrasts with strong macroeconomic and fiscal policy.

Other downside risks highlighted by the credit rater include the Philippines’ low per capita income and high exposure to physical climate risks.

“Favorable demographics do not sufficiently mitigate negative exposures to social risks from uneven and limited access to basic services and housing. These negative exposures could exacerbate inequality and moderate per capita income growth despite strong headline GDP growth,” Moody’s said.

“Moreover, the high incidence of natural disasters and climate-related shocks increase volatility in economic activity and inflation, especially with respect to disruptions to agricultural production,” it added.