SM Prime in ‘no rush’ to launch $1-B IPO

The Sy family’s SM Prime Holdings Inc. is reassessing plans to launch a $1-billion real estate investment trust offer in 2024 given its large cash horde and the weak market performance of recent REITs, spelling potential delays for the country’s largest initial public offering (IPO).

“I’m not ruling it out this year but there’s no purpose right now to immediately go into [an IPO],” tycoon and SM Prime executive committee chair Hans Sy said in an interview on the sidelines of the Bangko Sentral ng Pilipinas’ annual banker’s night on Friday.

“The cashflow of SM is very strong so we’re banking on that first unless we see another big opportunity to go in, then we will consider [launching the IPO],” he added.

Some of the company’s large-scale projects include the ongoing 360-hectare (ha) reclamation project in Manila Bay. Sy said they were also in talks to acquire a 200 to 300 ha property in Luzon, which SM Prime plans to develop into mixed-use township development.

The company aims to make an announcement before its annual stockholders meeting, which is usually held in April, should they reach a successful deal with the landowners.

Nicky Franco, head of research at stock brokerage house Abacus Securities, was among the analysts that cast doubts on big-ticket IPOs for the year due to the still-volatile environment for equities.

Not so good

These challenging conditions have also weighed on the broader Philippine Stock Exchange Index (PSEi) and other REIT companies.

“Frankly, I’m watching how the other REITs are going and it’s not so good,” Sy said.

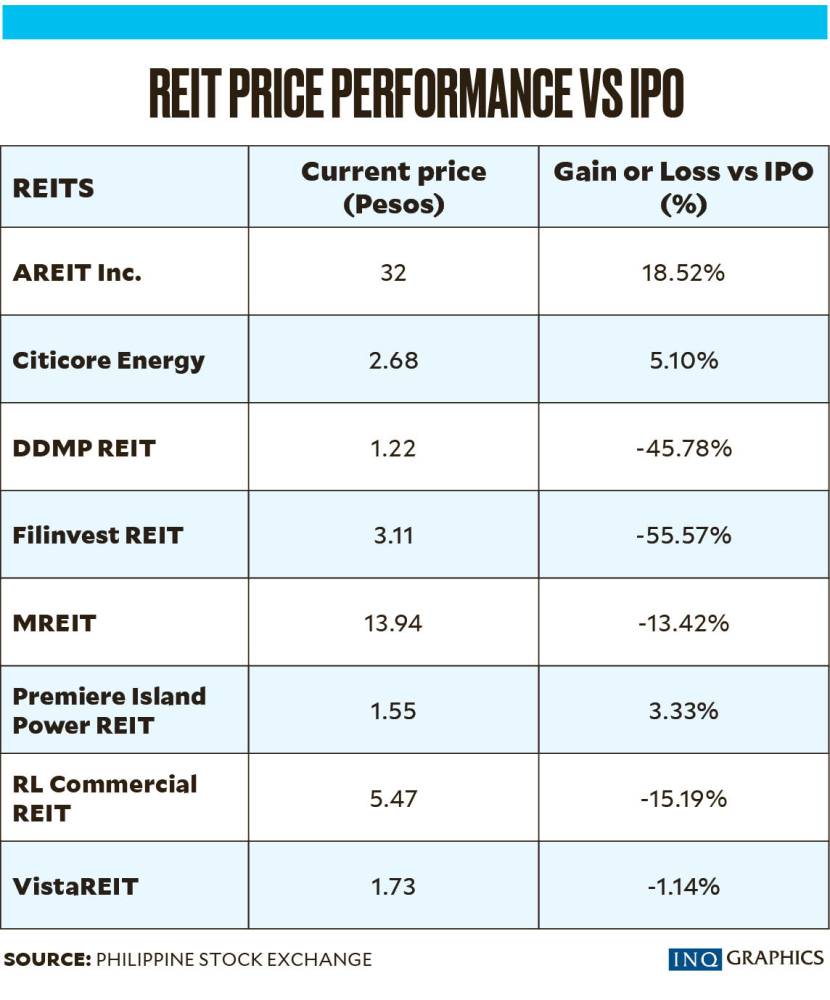

Data from the PSE showed most long-term REIT investors were underwater with just three out of eight REITs outperforming their valuations during the IPO.

SM Prime’s latest financial report showed cash and equivalents of nearly P36 billion at the end of September last year.

Net income during the first nine months of 2023 soared 37 percent to P30.1 billion while revenues climbed 26 percent to P92.6 billion.SM Prime’s latest profits were ahead of its prepandemic income in 2019 by over 9 percent.

The property group earlier announced plans to inject 12 to 15 shopping malls—a major driver of earnings in the aftermath of the health crisis—into their REIT company.