Aboitiz Group net income down 23% in 2024

One-time gains recognized in 2023 and impairment losses from its cement investment the following year reflected on the earnings of the Aboitiz Group in 2024 as it dropped by 23 percent to P18.1 billion.

Without P7.4 billion worth of nonrecurring items, the net income of Aboitiz Equity Ventures Inc. (AEV) would have climbed by 15 percent to P25.5 billion, the conglomerate said in its stock exchange filing on Monday.

Aboitiz Power Corp. remained the group’s main income contributor as it booked a 4-percent gain to P18 billion. This was due to higher energy sales as demand increased during the El Niño weather phenomenon.

Its generation and retail supply unit had an 11-percent increase in earnings before interest, taxes, depreciation and amortization to P66.7 billion on additional capacities from the 159-megawatt (MW) Laoag and 94-MW Cayanga solar plants.

Banking under Union Bank of the Philippines (UnionBank) ended the year with a 32-percent income surge to P6 billion on growth in its loan portfolio.

Net interest income rose by 12 percent to P58 billion, buoyed by an 8-percent increase in consumer loans after the Bangko Sentral ng Pilipinas began its monetary policy easing cycle.

As of end-December, UnionBank’s total assets have already reached P1.1 trillion.

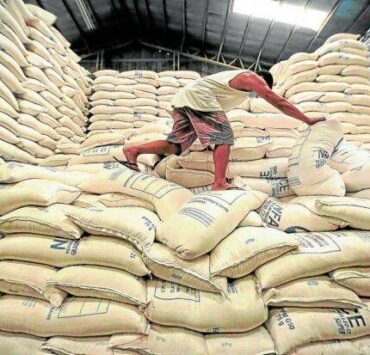

The food and beverage segment, which includes Pilmico Foods Corp., Pilmico Animal Nutrition Corp., Pilmico International Pte. Ltd. and Coca-Cola Europacific Aboitiz Philippines Inc. (CCEAP), quadrupled its net income to P5.9 billion amid stabilizing commodity prices and fresh contributions from the group’s newly acquired beverage firm.

AEV bought a 40-percent ownership stake in CCEAP, formerly Coca-Cola Beverages Philippines Inc., in February 2024.

Meanwhile, Aboitiz Land Inc. reported a net income of P943 million, down 9 percent due to the absence of asset monetization gains recognized in 2023.

Aboitiz InfraCapital Inc. likewise saw its earnings plunge by 73 percent to P644 million as it came from a high base due to a one-time gain recognized the previous year.

According to AEV, the infrastructure unit also suffered as Republic Cement and Building Materials Inc. reported a P1.1-billion net loss due to lower sales volume, reflecting weak market demand and a still challenging environment for the sector.

On top of this, AEV said it also recorded a P7.5-billion impairment loss or a decrease in the value of its investment in Republic Cement.

AEV owns Republic Cement jointly with CRH, an Irish infrastructure firm that operates in 29 countries.