Bangko Sentral seen to keep interest rates steady for now

The Bangko Sentral ng Pilipinas (BSP) may keep cutting rates through 2026 as it tries to pick up the slack from an expected slowdown in government spending tied to a flood control scandal, while managing a host of other challenges to growth.

Michael Wan, senior currency analyst at MUFG Global Markets Research, said those headwinds may prompt the central bank to trim its policy rate at its final meeting of the year in December, followed by another cut in the second quarter of 2026.

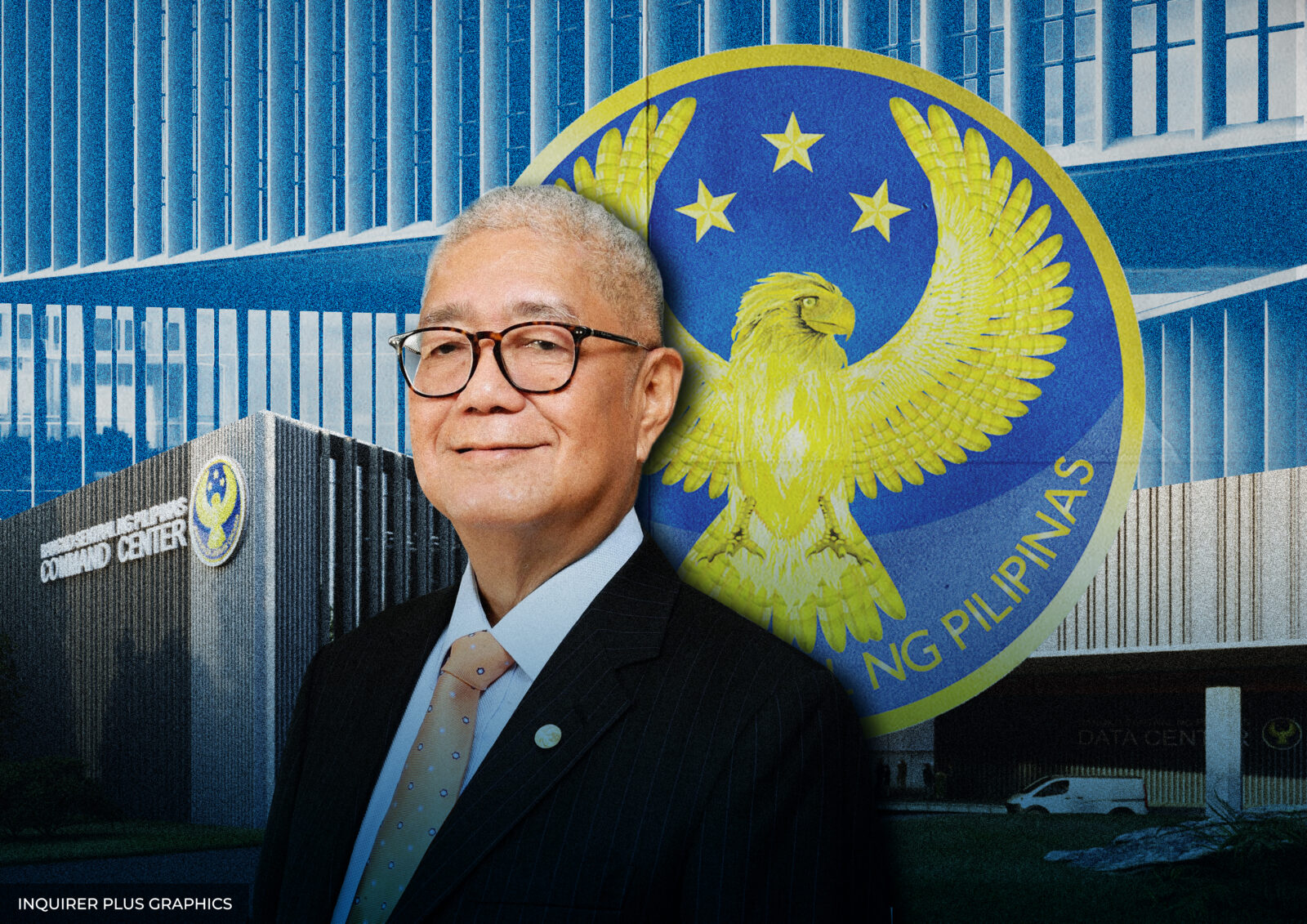

Such moves would bring the benchmark rate down to 4.5 percent—below the current 5 percent level that BSP Governor Eli Remolona Jr. had already called the “Goldilocks” rate, neither too low to stoke inflation nor too high to choke growth.

For now, MUFG expects the central bank to keep policy unchanged at its meeting on Oct. 9, noting the BSP’s more cautious tone on further easing as the peso weakens beyond 58 to the dollar.

“The path next year for the BSP is partially clouded by recent moves by the government to extend bans of rice imports,” Wan said in a commentary.

“But with government spending likely slowing due to recent flood projects corruption cases, and growth still below potential, we think the balance of risks still tilts towards at least one more cut in 2026,” he added.

In line with consensus

MUFG’s outlook is broadly in line with market expectations. In a survey by the Inquirer last week, 10 of 16 economists said they expect the Monetary Board (MB) to keep the benchmark overnight borrowing rate unchanged at its meeting today.

That decision would come as authorities widen a probe into alleged graft in flood control contracts, a controversy blamed for the peso’s weakness and one that threatens to slow infrastructure spending.

The government aims to keep infrastructure investment at 5 to 6 percent of gross domestic product. This spending is seen as crucial to meeting the Marcos administration’s 5.5 to 6.5 percent growth target this year.

When the MB convenes, they will have fresh inflation data to weigh: consumer prices rose to a six-month high of 1.7 percent in September, driven by higher food and transport costs.

Even so, the increase was milder than the 2 percent consensus forecast and marked the seventh straight month that inflation stayed below the central bank’s 2 to 4 percent target range.

A decision to stand pat would pause an easing cycle that began in August last year, during which the central bank lowered rates by a total of 1.5 percentage points.

In a separate note, Jun Neri, lead economist at Bank of the Philippine Islands, said the pace of monetary easing may slow as consumer price pressures could build in the coming months.

He added that the BSP may reduce rates further in 2026 if growth loses momentum, most likely in the first half of the year “before inflationary pressures build in the latter part.”

“A more conservative approach is justified as cutting rates aggressively could leave the economy vulnerable to inflation shocks that might force a sharp policy reversal later on,” Neri said.

“Another rate cut remains possible this year, although the decision will depend on the GDP data due in November.”