BDO Network sees minimal impact of zero RRR on its loan growth

This week, the Bangko Sentral ng Pilipinas (BSP) will eliminate the cash requirement of rural banks while further easing the rule for big lenders. But the country’s largest rural bank does not expect this move to bring a significant boost to its lending activities.

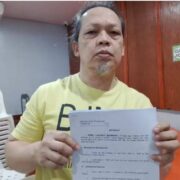

In an interview with the Inquirer, Jesus Antonio Itchon, president of BDO Network Bank, said that what the company needs the most to stimulate its loan growth is more deposits. But Itchon nevertheless stressed that the upcoming removal of the reserve requirement ratio (RRR) of rural banks is a “welcome” development not just for BDO Network but also for the industry.

“So this release of cash from reserves, it’s a big help for rural banks because such a requirement can choke lending. So it will allow us to be more aggressive,” Itchon told the Inquirer.

Standby funds

“We need 200 percent funding. So [eliminating the RRR] can help but if you look at the magnitude of [gains], it’s not that big,” he added.

The RRR refers to the certain amount of deposits that banks must set aside as standby funds, which do not generate returns because they cannot be used for lending activities. This is to ensure that lenders are able to meet their liabilities in case of sudden withdrawals.

The BSP in September announced that the RRR for big banks and nonbank financial institutions will be trimmed by 250 basis points (bps) to 7 percent from 9.5 percent. Meanwhile, the reserve requirement for rural and cooperative banks will be removed after their RRR was also slashed by one percentage point to zero.

The new ratio will take effect on the reserve week beginning on Oct. 25. Trimming the RRR would “lower intermediation costs and promote better pricing for financial services,” the central bank explained. But for Itchon, raising more deposits would allow BDO Network to intensify its lending, which would mostly benefit small businesses in the countryside.

Data from the BSP showed BDO Network has total deposits of P82.5 billion as of June 2024. Itchon said the rural banking arm of Sy-led BDO Unibank Inc. has around 1.5 million customers.

Ahead of target

Meanwhile, its total loans, which are unsecured, amounted to P91.7 billion, figures showed. Of that amount, Itchon said only around 3 percent is considered nonperforming, or 90 days late on a payment and at risk of default.

“We’re a little ahead of our target (loan growth),” Itchon said.

To raise more deposits, Itchon said one of BDO Network’s strategies was its partnership with the life insurance unit of BDO. Such a tie-up created a unique microinsurance product that would require policyholders to open an account with the rural bank.

“The growth of our lending is double the growth of our deposits. We’ve been growing much, much faster,” he said.