Benign inflation deepens BSP’s dovish bias

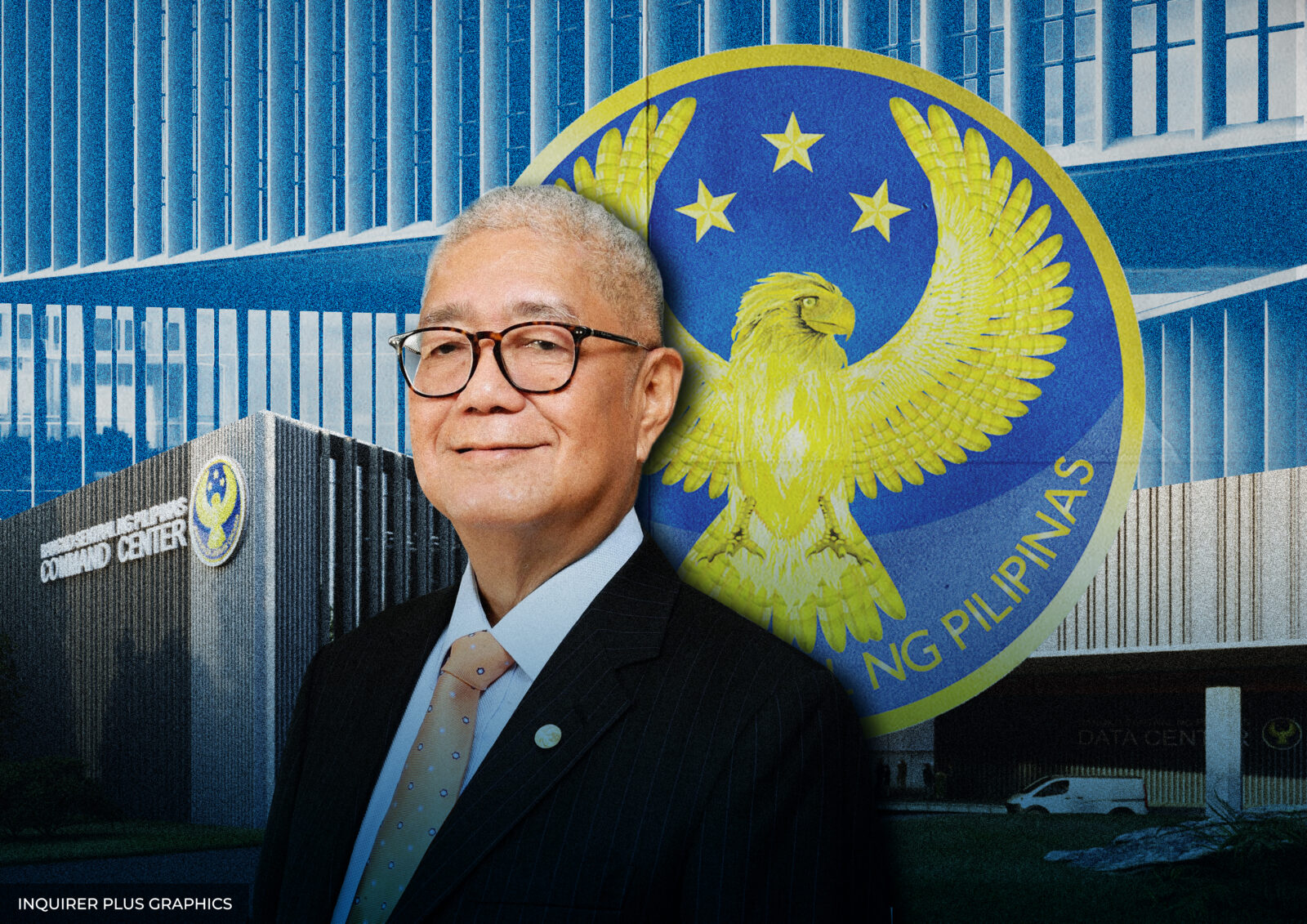

Bangko Sentral ng Pilipinas (BSP) Governor Eli Remolona Jr. said an interest rate cut is now “more likely” in August after July inflation had come in below expectations, adding that the easing cycle could extend beyond 2025.

In a report by Bloomberg, Remolona was quoted as saying that the BSP may further cut rates “as long as the numbers look good, inflation remains low and the economy can still afford.”

“Something unexpected would have to happen for us not to cut rates,” he added.

The consumer price index (CPI) rose 0.9 percent year-on-year in July, slower than June’s 1.4 percent print. The latest figure was the softest since October 2019, when inflation stood at 0.6 percent.

It also marked the fifth consecutive month that inflation remained below the 2 to 4 percent target range of the BSP.

The number beat the 1.1 percent median forecast of 13 economists polled by the Inquirer last week. It also landed within the BSP’s 0.5 to 1.3 percent projection for the month.

Data showed that the multiyear-low inflation in July was partly driven by a sharp drop in prices of rice, which makes up 9 percent of the CPI basket used to compute inflation.

The price of the household staple fell by 15.9 percent—the steepest drop since records began in 1995—following lower import duties aimed at curbing retail prices. This, along with a 4.7-percent decline in vegetable prices, caused the overall food index to dip by 0.2 percent, helping bring down headline inflation.

In June, the powerful Monetary Board (MB) trimmed the policy rate, which banks use as a guide when pricing loans, by a quarter point to 5.25 percent to support economic growth.

It was a widely expected decision that brought the cumulative rate reductions under the current easing cycle to 1.25 percentage points.

2 more rate cuts in 2025

Remolona earlier said the MB may deliver two more cuts before year-end, with the next decision due on Aug. 28. Additional meetings are set for October and December.

Aris Dacanay, an economist at HSBC Global Investment Research, said the soft inflation last month would likely increase the BSP’s conviction and confidence to cut policy rates without having to wait for the move of the US Federal Reserve.

But Dacanay said changes in rice policy “remains a risk.”

“Looking ahead, we think July inflation is the floor of the Philippines’ inflation outlook. Headline inflation is likely to accelerate in the months ahead as the base effects of the rice tariff rate cut in 2024 fade,” he said.

On the proposal of the Department of Agriculture to impose a 1-million metric ton quota on imported rice, Dacanay said, “Market watchers will likely keep a tab on the proposal’s legislation since the impact would be enough for the BSP to rethink its easing cycle.”