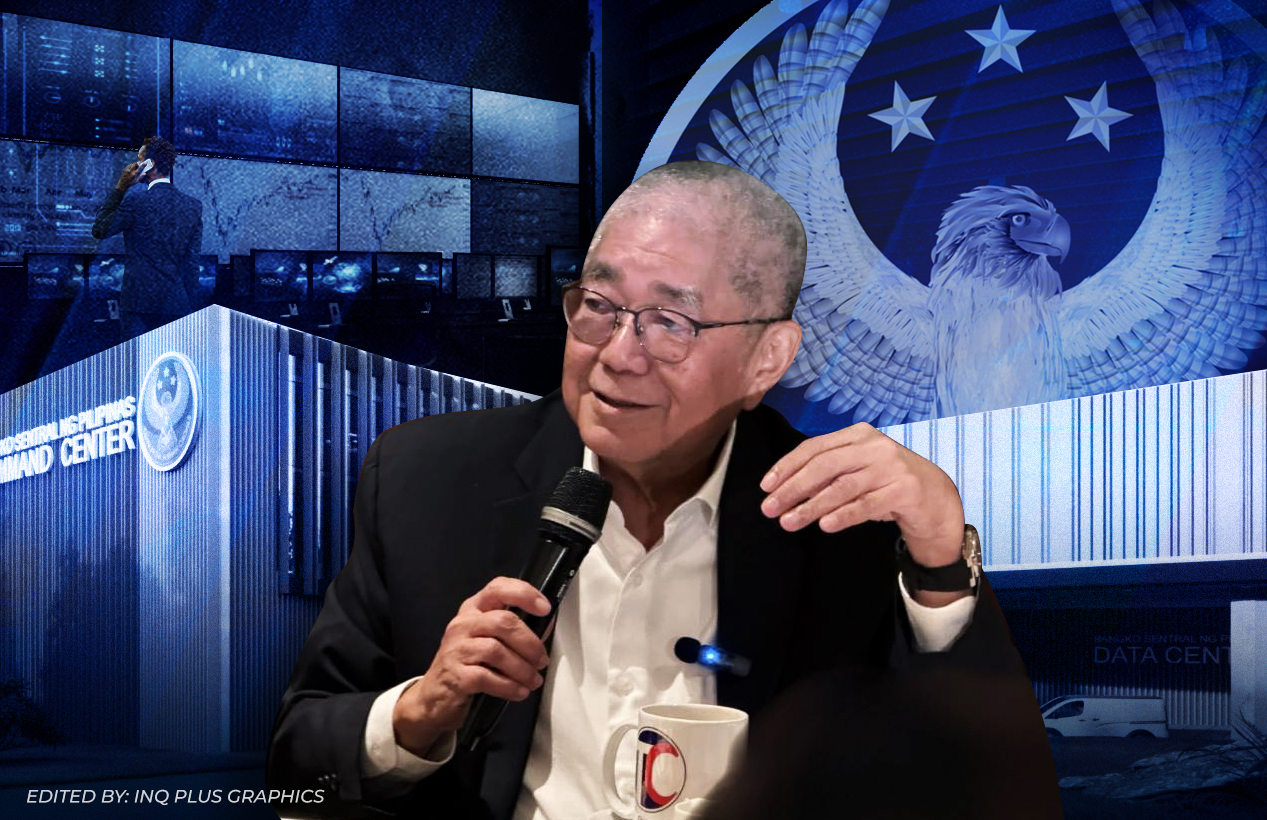

BSP chief rules out 3 more rate cuts this year

Bangko Sentral ng Pilipinas (BSP) Governor Eli Remolona Jr. said it was unlikely the central bank would deliver three more rate cuts this year, despite the slew of new data that may support further easing.

Remolona said two more rate cuts were likely for the rest of 2025, even as inflation stays below target and second-quarter growth falls short of forecasts.

He said that deeper reductions could drive borrowing costs below the BSP’s estimated neutral rate.

“I think two [rate cuts] are more likely than one,” Remolona told reporters on the sidelines of a forum organized by the Economic Journalists Association of the Philippines (Ejap) on Monday.

“Three is unlikely. That’s beyond the goldilocks rate that we’re looking at,” he added, referring to the hypothetical policy rate that the central bank sees as neither inflationary nor restrictive to economic growth.

At its meeting last June, the powerful Monetary Board (MB) trimmed the policy rate, which banks use as a guide when pricing loans, by a quarter point to 5.25 percent.

It was a widely expected decision that brought the cumulative rate reductions under the current easing cycle to 1.25 percentage points.

The MB has three more policy meetings scheduled this year—in August, October and December.

When the BSP’s highest policymaking body convenes on Aug. 28, it will have fresh domestic and global data in hand. The US Federal Reserve kept its policy rate unchanged for the fifth-straight time last month, lifting the dollar.

At home, inflation cooled to 0.9 percent in July, the weakest pace in nearly six years, as rice prices plunged to a record low.

Meanwhile, the economy expanded 5.5 percent in the second quarter, up slightly from 5.4 percent in the first, with easing prices helping sustain household spending.

In the same interview yesterday, Remolona said a rate cut this month was “quite likely,” adding that the central bank has been intervening in the spot foreign exchange market to limit any peso volatility.

“We want to keep the peso at a certain level,” he said. “We want to prevent it from weakening too much over a short period of time.”