BSP cuts banks’ reserve requirement by 250 bps

The Bangko Sentral ng Pilipinas (BSP) has announced a supersized reduction to the cash requirements of banks, a move that would inject more funds to the financial system at a time borrowing costs are projected to fall.

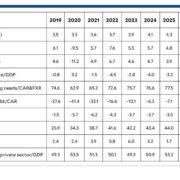

In a statement on Friday, the BSP said the reserve requirement ratio (RRR) for big banks and nonbank financial institutions would be slashed by 250 basis points (bps) to 7 percent, while the RRR for digital banks will be cut by 200 bps to 4 percent.

The BSP will likewise shave the RRR for thrift banks by 100 bps to 1 percent. Meanwhile, the reserve requirement for rural and cooperative banks will be removed after their RRR was also slashed by one percentage point to zero.

The new ratios will take effect on Oct. 25, 2024.

Adjustments

“The BSP emphasizes that these adjustments in reserve requirements are in line with its continuing efforts to reduce distortions in the financial system,” the central bank said.

“The reductions will lower intermediation costs and promote better pricing for financial services,” it added.

The RRR refers to the amount of deposits that banks must set aside as standby funds, which do not generate returns because they cannot be used for lending activities. This is to ensure that lenders are able to meet their liabilities in case of sudden withdrawals.

The last time that the BSP trimmed the RRR was in June last year. That decision brought the reserve requirements to their current levels of 9.5 percent for big banks and non-bank financial institutions; 6 percent for digital banks; 2 percent for thrift banks; and 1 percent for rural and cooperative banks.

By slashing the RRR, the BSP is allowing banks to deploy more cash for lending, which can help boost an economy that historically gets about 70 percent of its fuel on consumption.

That said, the upcoming reduction would complete BSP Governor Eli Remolona Jr.’s plan to create easier liquidity conditions for the economy. Remolona earlier this week said he wanted “substantial” cuts to the RRR this year and in 2025.

Prior to yesterday’s announcement, the BSP had trimmed its policy rate by 25 bps to 6.25 percent at the August meeting of the Monetary Board (MB), with the central bank chief hinting at one more cut of the same size either at the October or December meeting of the MB.

But Remolona had recognized that the lower reserve requirement would not have an immediate impact on the economy because interest rates are still high, which may prompt banks to deposit their additional cash back with the BSP to earn an attractive yield.

”As inflation continues to track a target-consistent path over the next two years, the BSP will reassess the need for further reductions in the RRRs to better align them with regional norms over the medium term,” the BSP said.