BSP delivers 25-bp rate cut; more to come

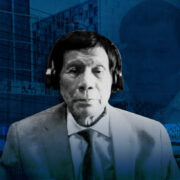

The Bangko Sentral ng Pilipinas (BSP) on Wednesday cut the policy interest rate by a quarter point again, with Governor Eli Remolona Jr. dropping clear hints of additional easing moves this year and in 2025 while aiming for a “measured” shift to a less restrictive monetary policy.

The decision of the powerful Monetary Board (MB) brought the overnight borrowing rate to 6 percent effective Oct. 17, continuing to unwind the previous tightening actions that had brought the key rate to a 17-year high in a bid to tame inflation.

There were no surprises: An Inquirer poll of 10 economists had correctly predicted the latest move of the MB, which will convene again in late December to decide on monetary policy before the year ends.

Zooming out, it was a busy day for central banks in Southeast Asia, with Thailand unexpectedly announcing a similar 25-bp rate cut while Indonesia decided to hold rates steady. What gave the Philippines enough room to further slash its policy rate was a softening inflation that had retreated to a four-year low of 1.9 percent in September.

And with inflation now sitting comfortably within its 2 to 4 percent target range, the BSP is at a point where it has to relax monetary conditions amid expectations that the economy may grow below target this year. The “risk-adjusted” inflation forecast of the BSP for 2024 is now at 3.1 percent, lower than the previous projection of 3.3 percent.

But for 2025 and 2026, the BSP slightly raised its risk-adjusted inflation forecast to 3.3 and 3.7 percent, respectively, to account for potential increase in power rates and higher minimum wages in areas outside of Metro Manila.

At a press conference, Remolona said a 25-bp cut at the Dec. 19 meeting of the MB is “possible”. But he said an outsized half-point cut is “unlikely” to happen.

”I would say 100 bps (reductions) in 2025 after the cuts we’ve made in 2024 would be somewhat on the dovish side. It’s possible, but it would be somewhat dovish,” he said.

”So if we rule out a hard landing, then as I have said, we prefer to take baby steps in terms of adjusting the policy rate—meaning 25 basis points at a time but not necessarily every quarter and not necessarily every meeting,” he added.

Larger cuts

Banks use the benchmark BSP rate as a guide when charging interest rates on loans. By bringing down borrowing costs, the central bank wants to stimulate bank lending to boost consumer spending, a traditional growth driver.

But unlike in the United States where a slowing job market had prompted the US Federal Reserve to deliver a jumbo 50-bp cut in September, the BSP entered its easing era in August with the traditional quarter point reduction to the policy rate, the first cut in nearly four years.

Wednesday’s action means the BSP was able to move ahead of the Fed again. The US central bank will hold its next key meeting in November, with analysts now seeing fewer chances of another forceful cut.

Miguel Chanco, economist at Pantheon Macroeconomics, expects “many more cuts” to come from the BSP, and potentially larger ones starting in December.

”We continue to believe that the pace of easing will be stepped up to 50 bps each time from the December meeting, until the benchmark rate falls to a terminal level of 4 percent by the middle of next year,” Chanco said.

He said the third quarter economic report in early November would likely induce a greater sense of urgency for the MB, as growth may fall sharply from the 6.3-percent pace in the second quarter, with base effects turning quite adverse.