BSP: Growth in home prices slowed in Q1

Home prices in the country grew at a slower pace in the first quarter, as some households may have deferred their plans to buy new residential spaces to rebuild their savings.

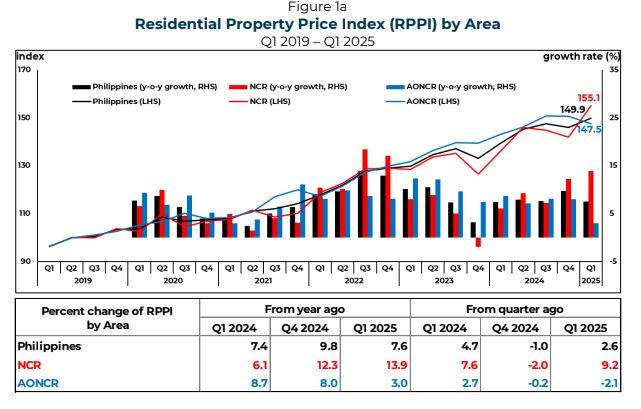

The cost of various types of housing units in the country—as measured by the Residential Property Price Index (RPPI)—went up by 7.6 percent year-on-year in the three months ending in March, easing from the 9.8-percent increase seen in the preceding quarter.

Quarter-on-quarter, the RPPI rose by 2.6 percent. This reversed the 1-percent sequential decline in home prices seen in the preceding quarter.

The RPPI—which the Bangko Sentral ng Pilipinas (BSP) released on Friday—replaced the previous gauge called the Residential Real Estate Price Index (RREPI). The BSP said the RPPI improved on the previous index by incorporating property-specific characteristics such as location, size and type.

The central bank explained that the shift to RPPI addressed the limitations of RREPI, which relied on simple averages and assumed that all properties within a group were similar.

Consumer sentiment

Broken down, the cost of shelter in the National Capital Region (NCR) rose at a faster annualized rate of 5.8 percent in the first three months, from 5 percent before.

That beat the growth in prices of residential properties in areas outside of NCR at 1.7 percent—which was softer than the 4.7-percent increase recorded in the previous quarter.

The BSP said condominium units were more expensive by 10.6 percent. This was a faster increase than the 9.5-percent growth seen before.

But houses saw a much slower increase in prices at 4.5 percent, from 9.9 percent previously.

According to the latest consumer expectation survey of the BSP, household sentiment on purchasing big-ticket items were “more pessimistic” in the first quarter. But the central bank said the buying intention of families for houses “improved” during the period.

In a report, ANZ Research said households may have been rebuilding their savings first before making big purchases.

Data showed the number of home loans granted by banks in the first quarter contracted by 4.4 percent compared with a year ago. This, however, was a milder slump than the 14.5 percent decline seen in the final quarter of 2024.

“The absolute price level remains elevated and despite high employment, private sector wages have not grown sufficiently to offset the price increase,” ANZ said.

“More interestingly, the BSP’s consumer expenditure survey shows that the top reason that households availed loans was to purchase basic goods. Additionally, we think households will continue to build-up savings which are currently low,” they added.