BSP seen keeping key rates steady

The Bangko Sentral ng Pilipinas (BSP) is expected to leave interest rates unchanged this week, pausing after three consecutive cuts as officials wait for clearer signals on the state of the economy and weigh the peso’s slide.

Ten out of 16 economists surveyed by the Inquirer last week projected that the Monetary Board (MB) will keep the overnight borrowing rate that banks use as a guide when pricing loans at 5 percent when the policymaking body meets on Oct. 9.

A decision to stand pat would mark a pause in an easing cycle that began in August last year, during which the central bank lowered rates by a total of 1.5-percentage points.

Softer inflation gave officials room to loosen policy to shore up growth, which has been strained by global headwinds amid higher US tariffs.

This time, though, analysts see risks that may prompt the central bank to slam the brakes on easing.

A separate Inquirer poll of 14 economists pegged inflation at 2 percent in September, a seven-month high but still within the 2- to 4-percent target range, largely on faster food price gains because of storms and a freeze on rice imports.

The peso’s slide to 58 against the dollar last week has added to the pressure.

Weaker currency levels could feed into inflation, particularly as the US Federal Reserve slows the pace of its own rate cuts.

“A pause at the current level would also minimize the depreciation pressure on the peso since the BSP has eased more than the Fed so far this year,” Alvin Arogo, economist and research division head at Philippine National Bank, said.

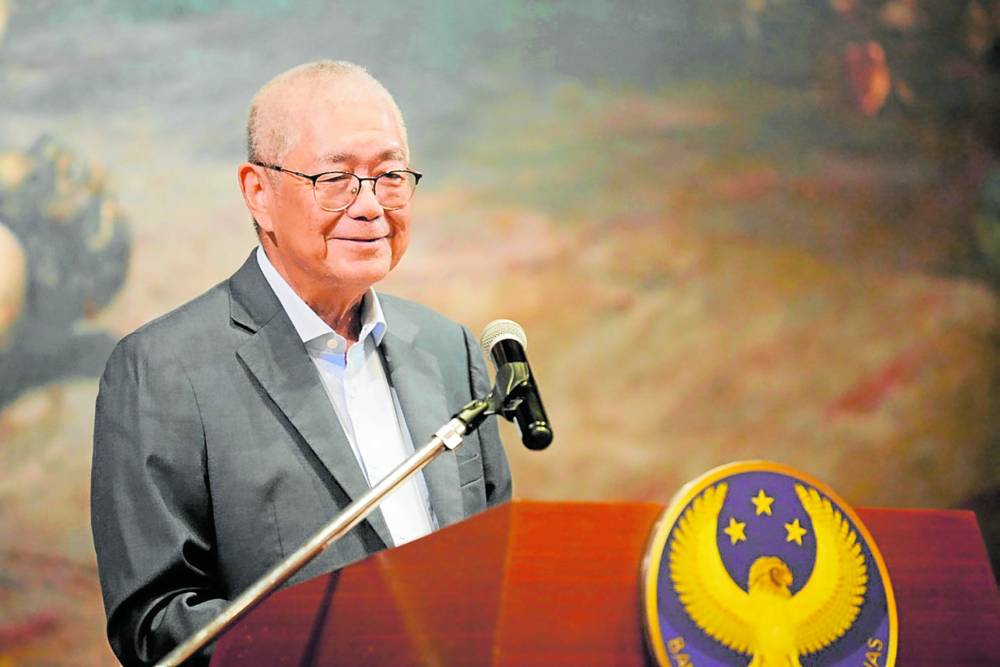

At its last August meeting, when the BSP cut by a quarter point, Governor Eli Remolona Jr. said monetary policy was in a “sweet spot”—neither too low to fuel inflation nor too high to choke growth.

Since then, markets have increasingly expected the easing cycle to near its end, though Remolona has left the door open to another reduction later this year if demand falters.

Waiting game

For analysts at Chinabank Research, the BSP may wait for firmer economic data before deciding whether another cut is warranted.

“With the central bank describing the current policy rate as the ‘Goldilocks rate,’ policymakers may require a firmer justification for an immediate adjustment to monetary policy,” they added.

Others remain convinced, however, that more easing is warranted.

Gareth Leather, senior Asia economist at Capital Economics, expects another quarter-point cut this week, arguing that “the economy could do with more support” amid tighter fiscal policy and weaker exports. “But the main reason we are expecting further easing,” Leather added, “is that price pressures are weak.”

Even if policymakers hold steady this week, most analysts believe the BSP still has space to reduce borrowing costs further.

“While we have a 25-basis point rate cut in our fourth-quarter forecast profile, risks on the horizon lead us to believe the BSP will likely delay acting until December,” said Deepali Bhargava, economist at ING Bank.