Business-friendly SEC fees

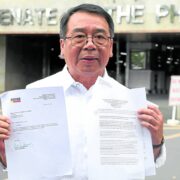

Shortly after Securities and Exchange Commission (SEC) Chair Francis Ed Lim assumed office last month, the SEC reduced by 50 percent the rates for documents in its database that the public can request copies of.

The most requested documents are articles of incorporation (or partnership), by-laws and general information sheet (GIS). The GIS, which is submitted under oath or notarized, provides significant information about the capitalization of a corporation and its corporate (if any) and individual stockholders.

From the previous rate of P750 for plain digital copies of those papers, the rate was pared down to P375.

The rate reduction may be a small hanging fruit, so to speak, but for startups and small-scale businesses (where every centavo counts) that have to verify the credentials of the companies they want to do business with, the rate cut is welcome relief.

Recall that last year, the SEC increased by up to 200 percent some of its fees and charges, a move that drew a strong howl of protest from several business organizations in the country.

Taken aback by that action, which was described as unreasonable and antibusiness, some of them used strong language that upset the then SEC leadership and demanded an apology as a condition for sitting down with them to discuss their grievance.

Although there was no question about the authority of the SEC to impose those new charges and fees, their rationale and timeliness in light of the tight business climate then prevailing were put in serious doubt.

The furor over the new imposition drew reference to the ethics-based phrase that “not all that is legal is moral.”

Since Lim had acted for decades as a lawyer of businesses that are subject to the SEC’s strict regulatory oversight, he is aware of the impact of those fees and charges on the finances of those companies.

To avoid getting hit by penalties and surcharges for failure to meet the SEC’s multifarious reportorial requirements, some businesses, especially listed and public companies, have to employ additional staff to prepare and submit reports, for example, monthly or quarterly reports, that are hardly read or mined for information that may guide the SEC in the performance of its regulatory functions.

It’s not too late for Lim to take a second look at those new charges to determine if they are commensurate with the work actually done by the SEC staff on documents filed with it, or the intended objective for which higher fees are imposed can be met with the least inconvenience to the affected segments of the business community.

In other words, the fees and charges should be business-friendly or take into consideration the interests of the affected stakeholders without sacrificing the integrity of the SEC’s regulatory responsibilities.

Note that the SEC is not meant to be a revenue-raising arm of the government like the Bureau of Internal Revenue and the Bureau of Customs. Neither is it required by law to meet annual quotas or declare dividends like government-owned and -controlled corporations that are required to remit a portion of their earnings to the government.

Under the Revised Corporation Code, the fees, fines and charges that the SEC is authorized to collect shall be used for, among others, modernization of its facilities and the provisioning of reasonable employee health-care services and insurance.

It’s not as if the SEC is cash-strapped that it has to raise funds for its operation from fees and charges considering that it gets a budgetary allocation from Congress in the annual national appropriations law.

The reduction of monetary impositions would be consistent with Lim’s announced plan to streamline the SEC’s transaction processes to make sure they are necessary, consistent and simplified.