Dec inflation seen stable despite holiday, storm impact

The lingering effects of late-season storms and the customary holiday surge in consumer demand may have nudged inflation higher in December, though overall price pressures still looked subdued—leaving the central bank room to further support a slowing economy, depending on the data.

The Bangko Sentral ng Pilipinas (BSP) expected the consumer price index this month to have settled at between 1.2 and 2 percent, which raises the possibility of faster price hikes than November’s 1.5 percent pace.

Even so, the projection suggested that the data due on Jan. 6 may still fall below the central bank’s 2-to-4 percent target range, or at most edge toward the lower end of the band.

Explaining its forecast, the BSP said this month’s inflation was likely driven by both demand and supply conditions.

“Upward price pressures may come from increased prices of major food items due to the lingering effects of adverse weather and strong holiday demand, as well as higher LPG and gasoline prices,” the BSP said.

“These pressures could be partly offset by lower electricity prices in Meralco-serviced areas and declining kerosene and diesel prices,” it added.

Another month of tame inflation could afford the central bank enough wiggle room to adjust monetary policy and add more support to a slowing economy, if data would justify such moves.

Revisions

President Marcos’ economic team has already signaled that official macroeconomic targets may need to be revised to account for the fallout from an intensifying antigraft drive.

To “compensate” for the effects of the graft fallout, the BSP slashed the policy rate by another quarter point to 4.5 percent at the Monetary Board’s Dec. 11 policy meeting. This brought the cumulative reductions since the easing cycle started in August last year to 2 percentage points.

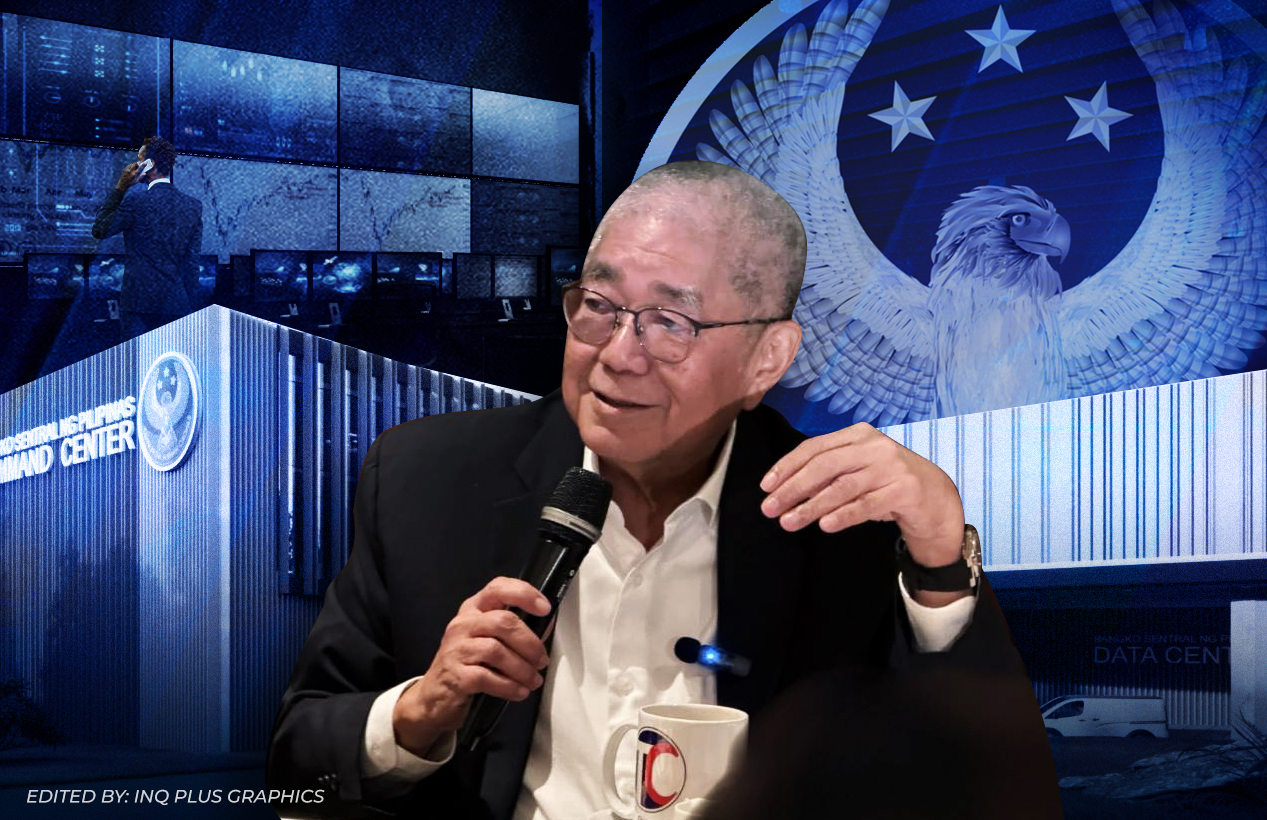

Governor Eli Remolona Jr. had said any further rate easing next year—if it comes at all—is likely to be limited to a single 0.25 percentage point reduction.

The BSP chief also said the central bank would steer clear of outsized cuts and off-cycle decisions that may stir market concerns about the economy.

The BSP expected average price increases this year to settle at 1.6 percent, below the official target band. While its inflation forecasts for 2026 and 2027 have risen slightly to 3.2 percent and 3 percent, respectively, the central bank said the outlook remains “benign.”

“The BSP will continue to monitor domestic and international developments affecting the outlook for inflation and growth in line with its data-dependent approach to monetary policy,” the central bank said.